Accounting localization in Odoo is a process of adopting Odoo accounting modules to meet the specific financial standards, tax requirements, and reporting standards of different countries.

This localization ensures that the accounting practices within Odoo are compliant with local laws and are customized to the business needs of a particular country.

Businesses can ensure compliance with local financial reporting standards and regulatory requirements by using the Serbian localization module, which is in accordance with the country’s accounting and tax standards.

The module includes financial report templates and formats, including as profit and loss statements and balance sheets, that are specifically customized to meet Serbian accounting standards.

This allows businesses to generate reports that conform with region laws. The Serbian translation of Odoo 17 changes billing operations to meet regional needs, such as generating compliant invoices with the necessary information and formats. It also communicates with surrounding banks and accepts regional payment methods.

Serbian Accounting Localisation

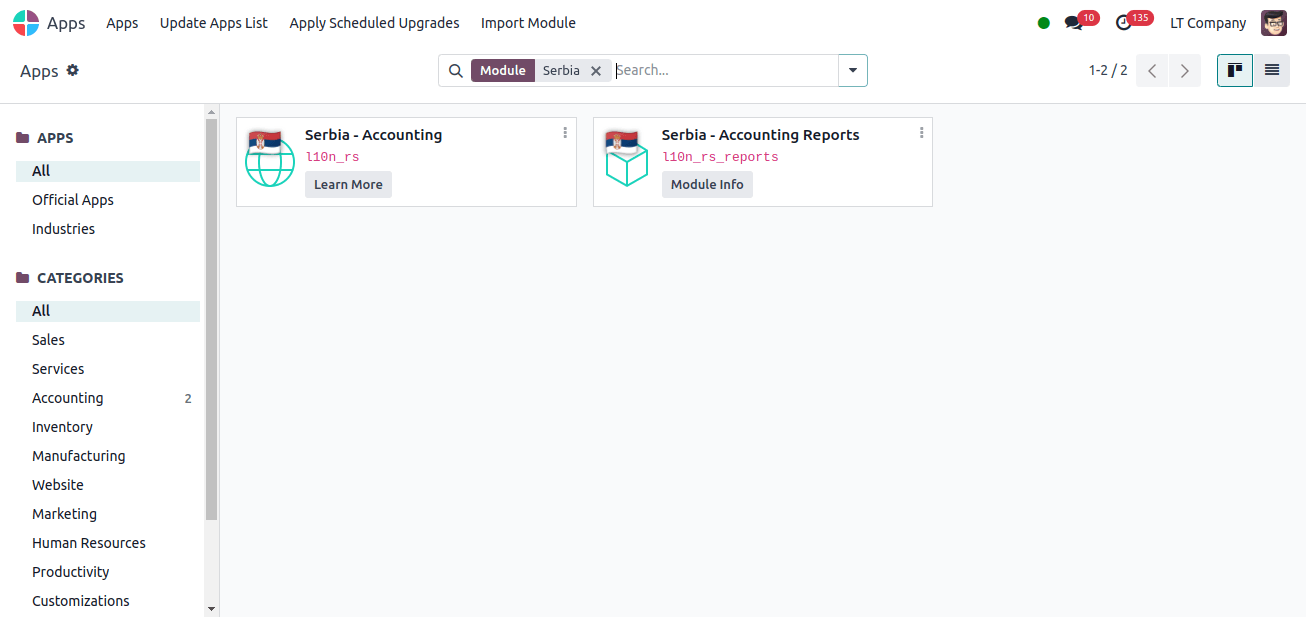

To acquire accounting localization for Serbia in Odoo 17, we have two options: install the accounting localization modules or select Serbia as the Country when creating the database. To install the accounting localization modules, navigate to Apps and search for the modules you need.

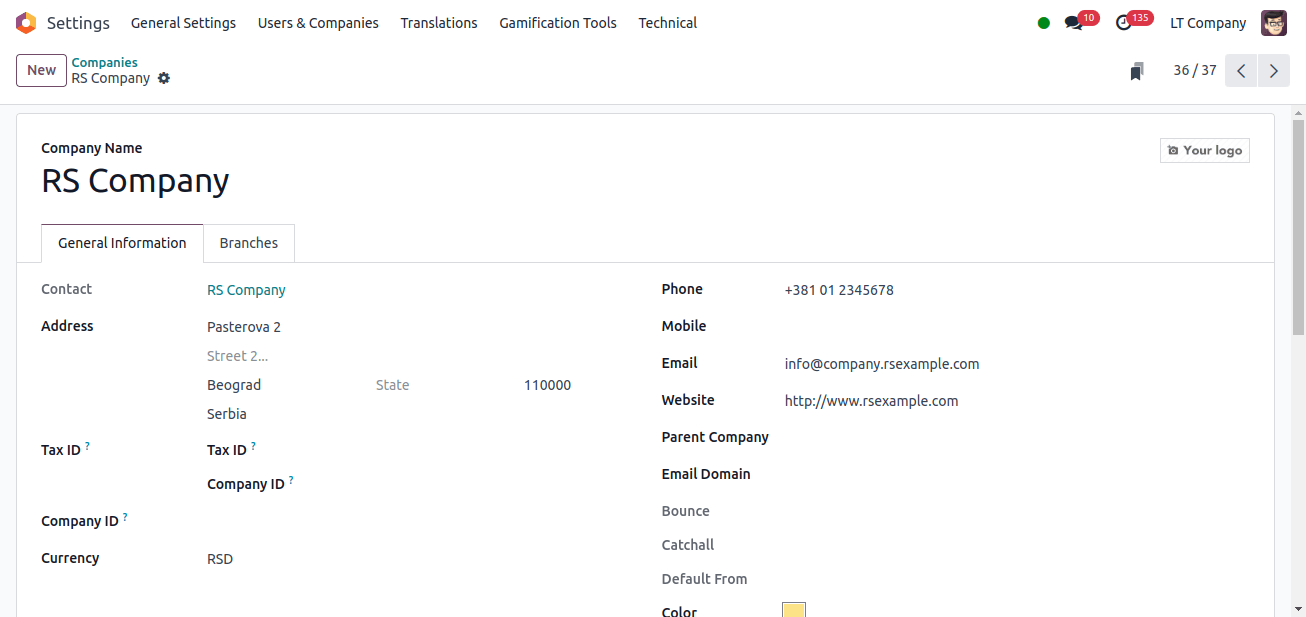

After installing the needed accounting localization modules, we must verify the company's settings. To ensure smooth accounting operations, the organization must be appropriately configured in accordance with the country and other details. To access the companies, Go to Settings > Users and Companies > Companies, select a firm, and review the configuration.

After setting up the correct company details, we may now review the revisions for this localization.

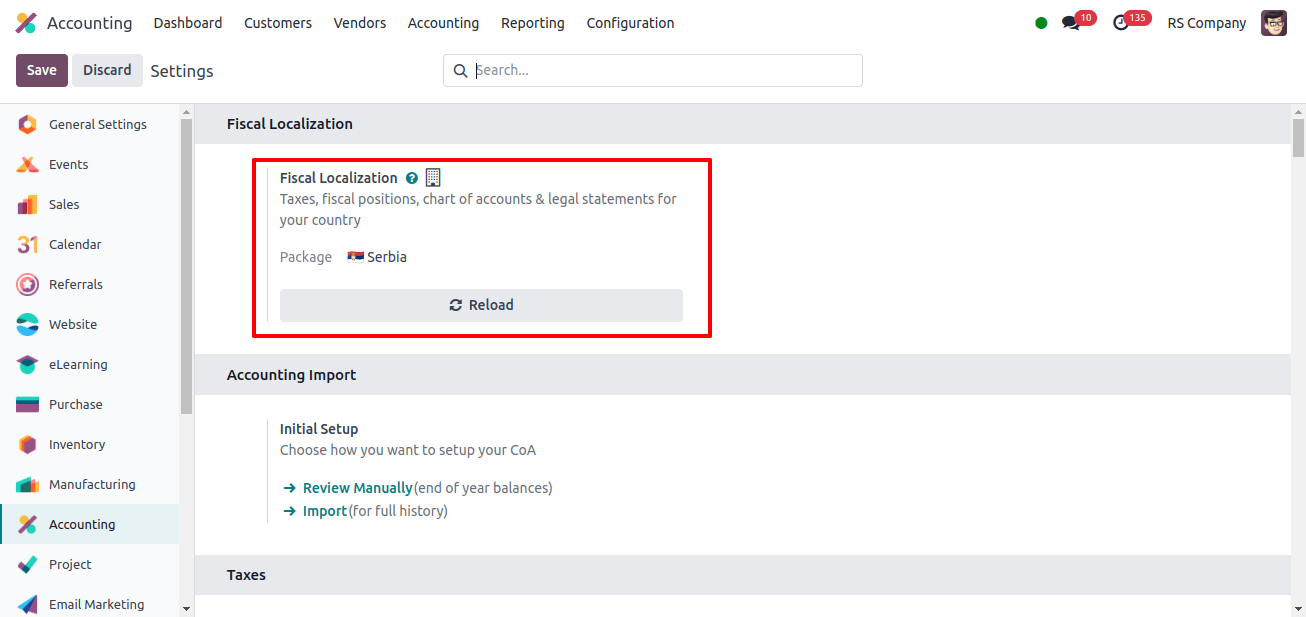

In the Accounting Module’s Configuration Settings, we can see that the Fiscal Localization will be Serbia.

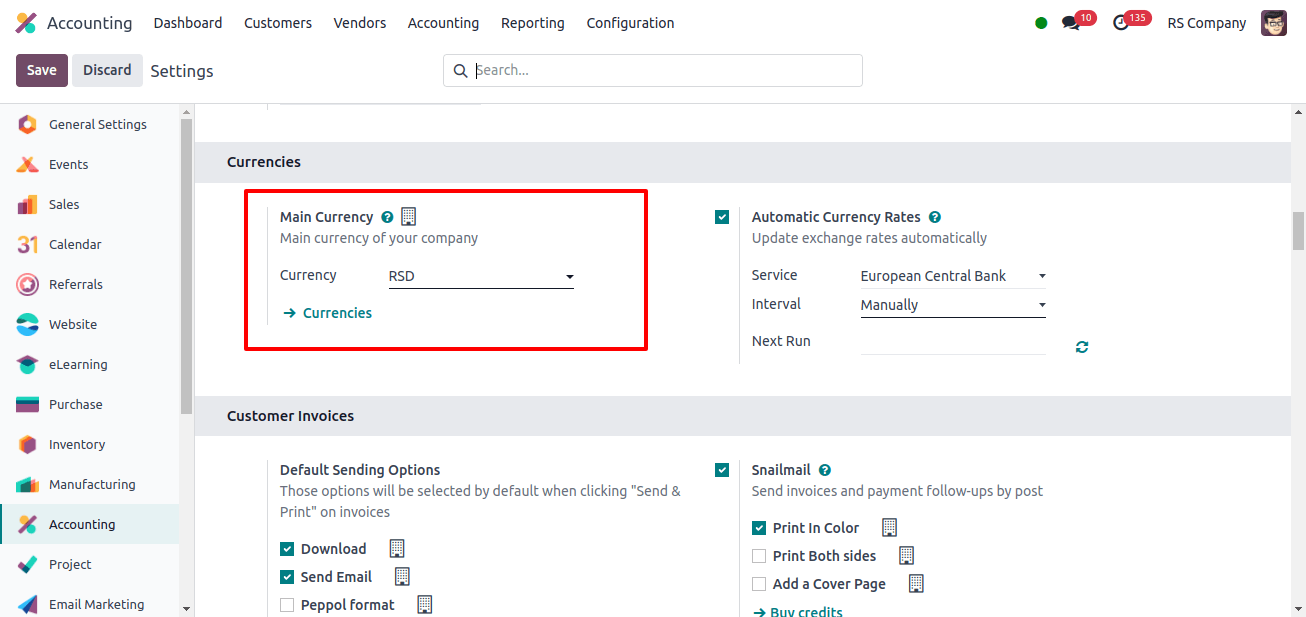

The basic currency used for all transactions will be Serbia’s official currency, the Serbian Dinar (RSD).

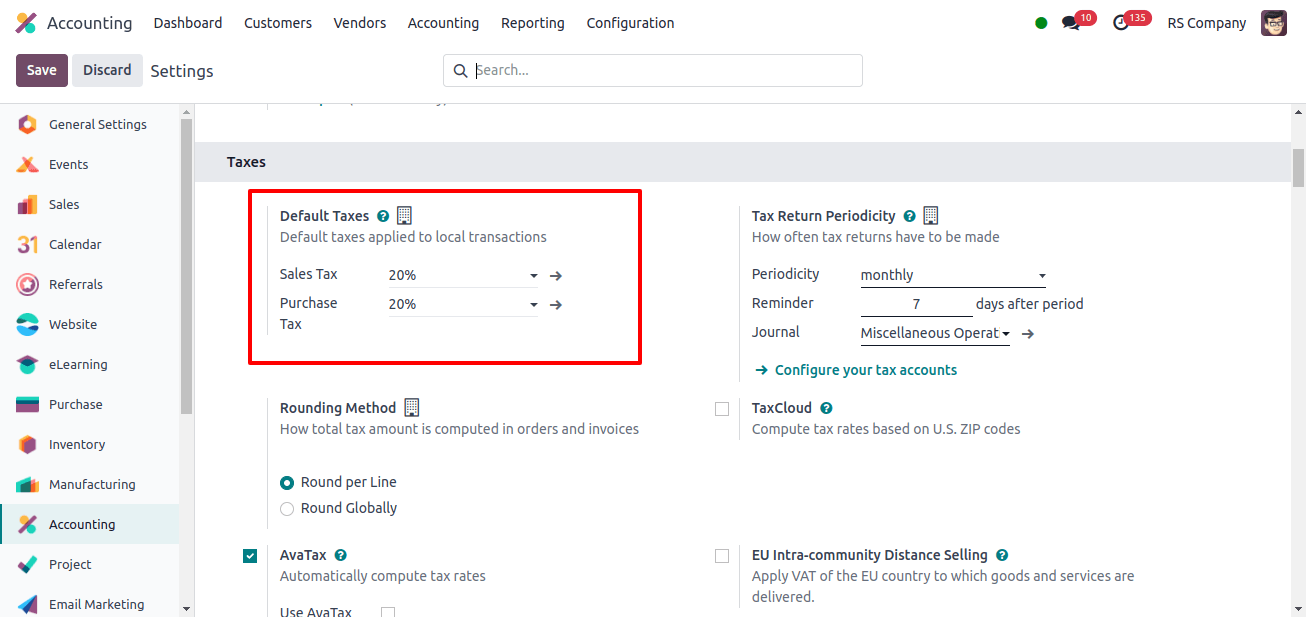

In addition, under the settings, we must select the Default Taxes so that all sales and purchase transactions are taxed automatically. Since we installed the Serbian Localization, we can see that the default tax will be set to Serbia’s 20% tax for both sales and purchases.

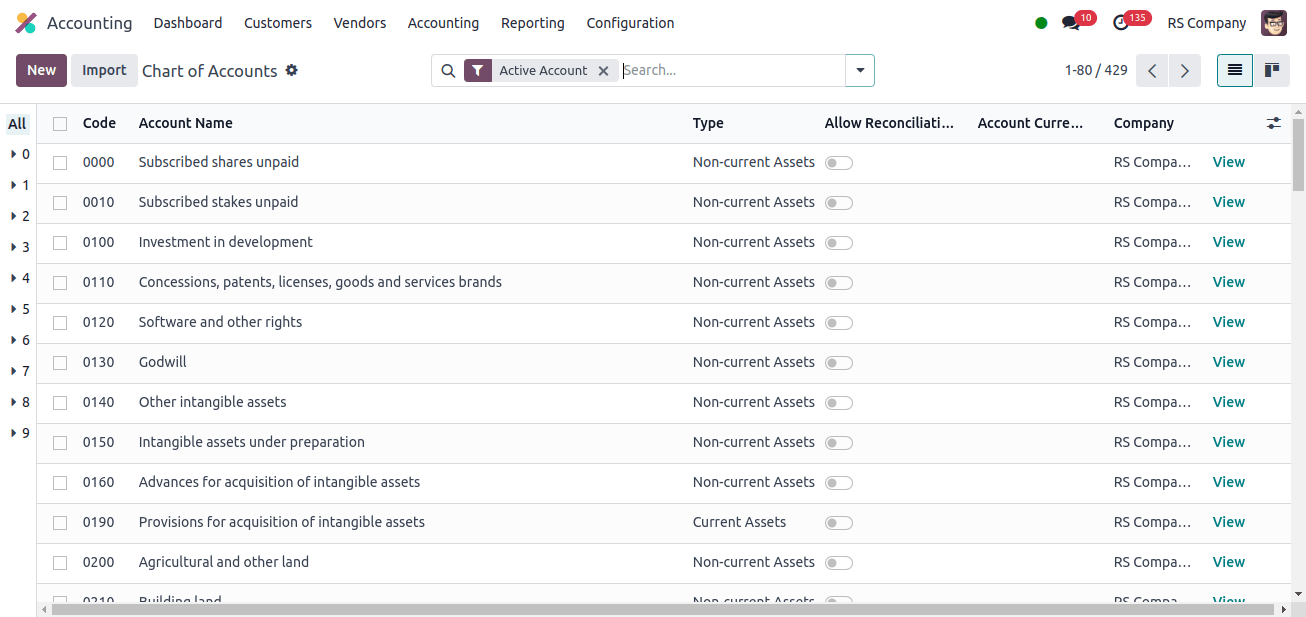

When we install a localization, we also receive the preconfigured Chart of Accounts for that translation. The Chart of Accounts, with its well-structured and organized framework for categorizing transactions, is a key component for managing a company’s financial data.

It simplifies financial reporting by categorizing transactions into several categories such as assets, liabilities, income, and spending. This institution creates detailed financial statements, such as balance sheets and profit and loss reports, which are important for evaluating business performance.

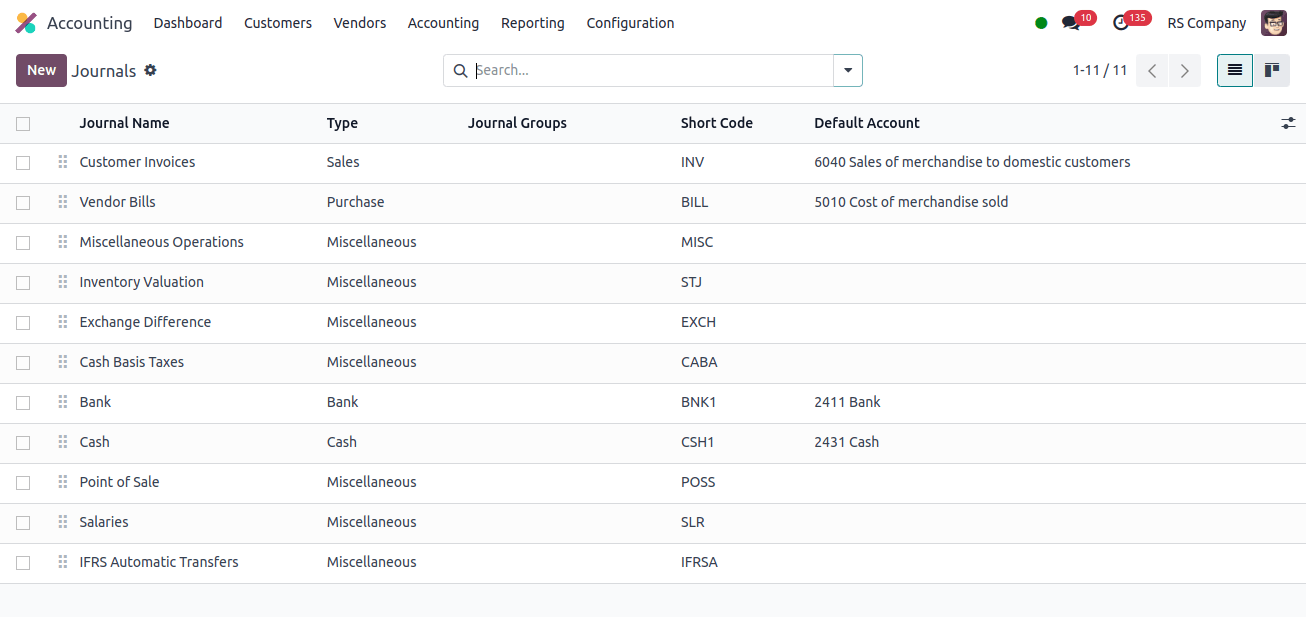

Journals capture all types of financial activities, including purchases, sales, and bank operations. They serve as the primary source of input into the accounting system for these transactions. The localization into Serbian ensures that journal entries correspond with Serbian accounting principles and regulatory standards.

This includes managing regional recording standards and formats. The localization into Serbian ensures that journal entries correspond with Serbian accounting standards and regulatory requirements. This includes holding to regional recording traditions and formats.

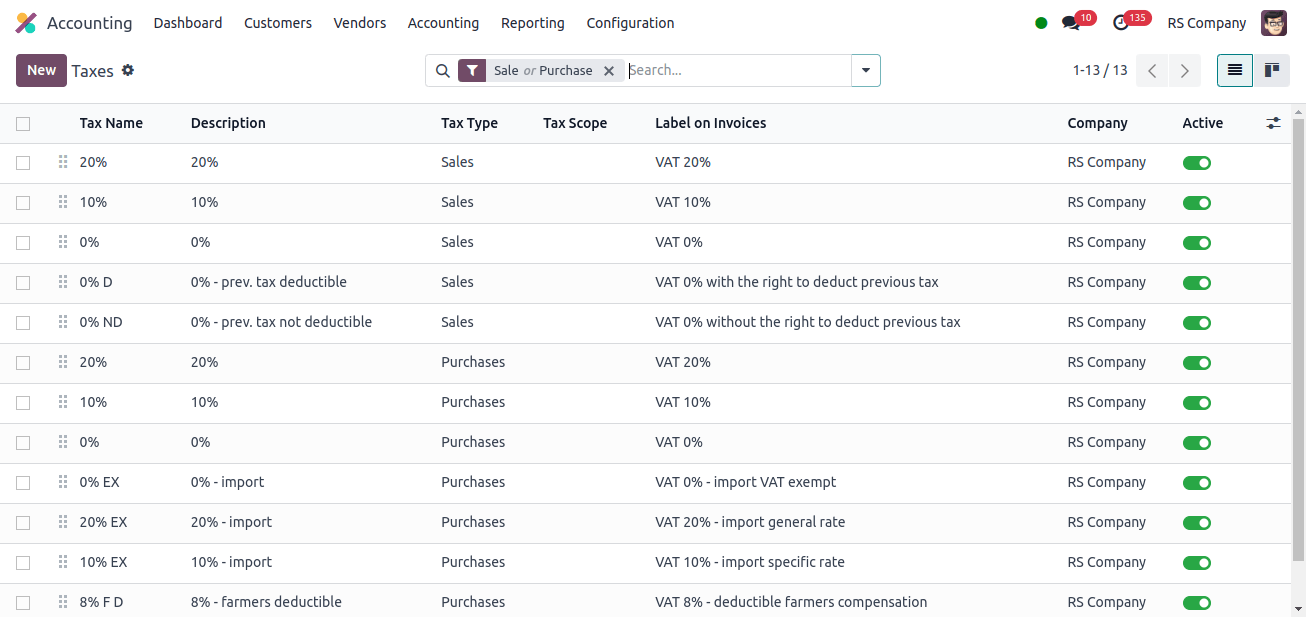

To ensure compliance with Serbian tax legislation, the tax management system in Odoo's Serbian accounting localization was precisely designed. The process of preparing and filing tax returns is made easier by automating the calculation and reporting of VAT and other municipal taxes.

Companies can establish multiple tax rates in accordance with Serbian legislation, and these can be readily integrated with accounting and invoicing software to ensure accurate tax management.

This localization also includes in-depth analysis tools, which help businesses track their tax requirements and credits more accurately.

Odoo’s Serbian localization enhances tax accounting, reduces management effort, and enables accurate financial reporting by aligning with local tax rules and automating required tasks.

Fiscal Position

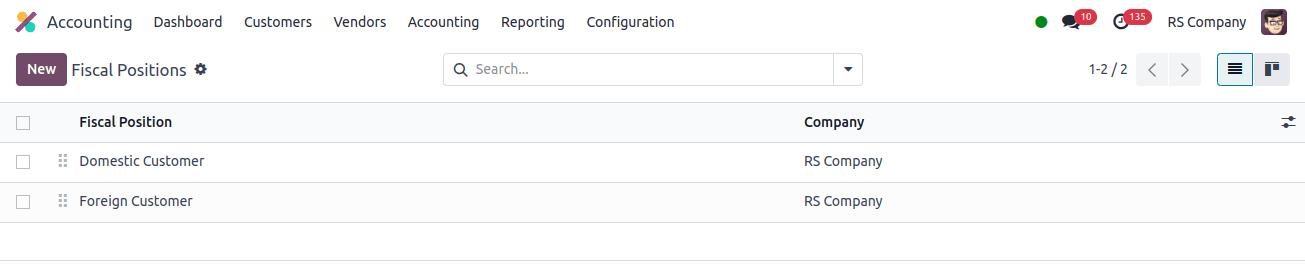

Fiscal Positions of Local and Foreign Customers in Odoo with Serbian Accounting Localization. In Odoo’s Serbia accounting localization, fiscal positions are important for applying proper tax management for domestic and international customers, as well as ensuring compliance with local legislation.

Fiscal Position of Domestic Customer

Odoo allows you to configure fiscal positions so that right VAT rates and tax standards are applied to transactions with Serbian clients.

This ensures that all sales and purchases follow the regular, reduced, or exempt VAT rates specified in Serbian VAT legislation.

Businesses can automate the application of VAT rates to invoices and other financial documents, making compliance and reporting easier by generating fiscal positions specifically for domestic consumers.

Position for Foreign Customers

Fiscal positions in Odoo help manage transactions in accordance with Serbian export standards and international tax norms while dealing with international customers.

For example, in some cases, sales to abroad buyers may be subject to zero percent VAT under Serbian export limitations.

Odoo’s fiscal position setup allows businesses to manage the paperwork required for export transactions and automatically alter VAT rates, ensuring that export transactions are properly reported and in accordance with both domestic and international tax requirements.

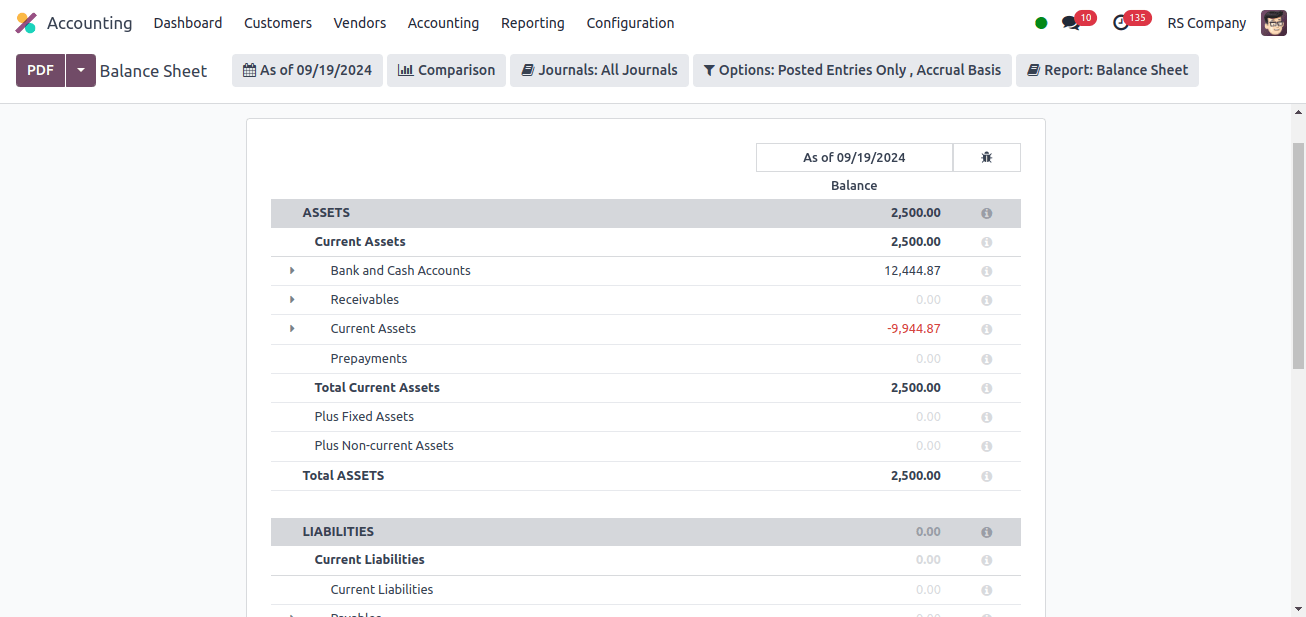

Balance Sheet

The balance sheet feature in Odoo’s accounting localization for Serbia provides a complete view of a company’s financial state and has been designed to comply with Serbian financial reporting regulations.

It follows local laws and accounting standards & accurately reflects assets, liabilities, and equity. Odoo automatically integrates accounting entries, ensuring that the balance sheet compiles with Serbian reporting requirements and reflects current financial reporting facts.

The system’s customized templates and formats that meet Serbian standards simplify precise and accurate financial reporting.

Companies can use this feature to keep track of accurate financial records, prepare for audits, and make financial decisions based on a clear and complete financial picture.

Permanent assets, also known as non-current assets in Odoo’s Serbian accounting localization, are key components of the balance sheet. They are long-term investments required for business operations and are not intended to be sold in the normal course of business.

Intangible assets: Companies that keep detailed records of their intangible assets can ensure that the balance sheet gives an accurate picture of these long-term investments.

Immovables, plants, and equipment: Plants, machinery, and other immovable assets are precisely maintained and documented on the balance sheet in compliance with Serbian accounting standards.

To ensure accurate assessment and reporting, these tangible fixed assets which include office equipment, machinery, and real estate are precisely classified.

To account for the progressive fall in asset value, Odoo automates the tracking of acquisition expenses and depreciation in accordance with Serbian standards. This connection allows businesses to keep track record of their physical assets, providing a clear and compliant view of their long-term investments on the balance sheet.

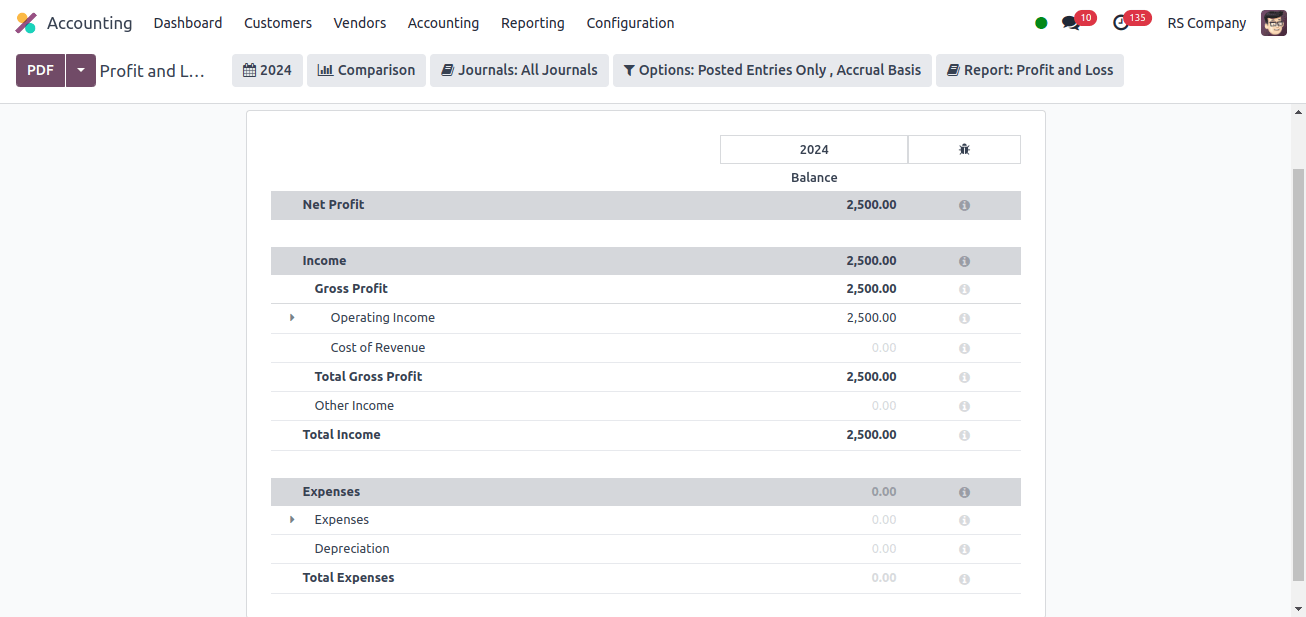

Profit and Loss Report

The profit and loss report provides a complete valuation of a company’s financial position by summarizing sales, costs, and profit or losses during a specific time period.

The format of the report’s income and expenses presentation complies with local legal requirements and is intended to meet Serbian accounting standards. Odoo automated financial gathering ensures that all transactions are accurately recorded and classified in compliance with Serbian accounting rules.

This connection promotes effective financial analysis and decision-making, allowing businesses to publish complete and compliant profit and loss statements.

Operating profit/loss (A - B): Operational profit or loss is calculated as the difference between a company's operating income and expenses, denoted as A-B. This indicator is important for determining the core profitability of a company’s operations, that is, before non-operating revenue and expenses.

Odoo automates the calculation of operational profit or loss by merging extensive financial data from several sources, including as sales, cost of products sold, and running expenses, into the financial reporting system.

Profit from Financing (C-D): The ‘Profit from Financing’ indicator, calculated as C-D, evaluates the profit derived from financial activities by quantifying the difference between financial income and expenses. This includes loan and investment interest.

Profit from other regular operations and irregular operations (E - F + G - H + I - J): Using the formula for profit from other regular and irregular operations (E-F+G-H+I-J), one can gain a complete knowledge of a company’s profitability from a variety of operational and non-operational activities.

This statistic includes profits or losses from both routine activities outside of the primary business operations (such as earnings from asset sales) and irregular operations (such as one-time costs or extraordinary gains). Odoo streamlines statistics collection and computation by integrating data from multiple financial transactions and operational operations into the accounting system.

Profit before tax (Operating + Financing + Other regular and Irregular operations): ‘Profit Before Tax,’ which combines finance results, operating profit, and profits from other regular and irregular operations, provides a full view of a company’s pre-tax financial success.

To give a complete overview of financial health, this indicator integrates profitability from core business operations, financial activities, and other regular and irregular transactions.

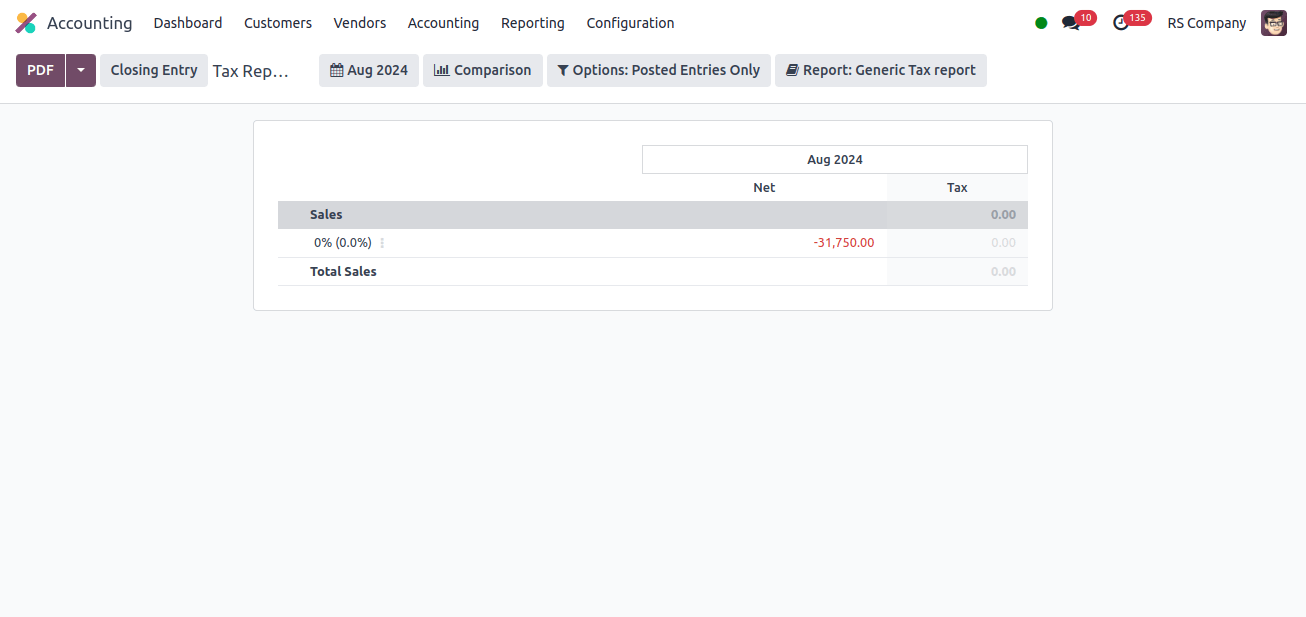

Tax Report

In compliance with the Serbian Tax standards, the text report is precisely created to manage VAT and fee computations. The report presents an easy-to understand analysis of the taxable and nontaxable components of transactions by differentiating between charge amounts without and with VAT.

This segmentation simplifies accurate VAT reporting and compliance by ensuring that VAT is properly computed on taxable fees and non-VAT payments are properly reported.

Odoo automates data extraction and companies from financial transactions, streamlining the princess of creating tax paperwork, including VAT reports.

Odoo ensures that companies doing business in Serbia may keep precise and legal account records by providing customized features such as accurate tax reporting, complete balance sheet management, and effective management of both routine and occasional financial transactions.

The system’s integration features help effective decision-making while also improving financial visibility and running processes.

Odoo optimizes financial management processes for companies while streamlining compliance due to its attachment with Serbian accounting standards.

Overall, Odoo’s localization for Serbia stands out for its extensive attention to navigating the complexities of Serbian taxation and accountancy.