Unpaid bills in foreign currencies, bank accounts, and balance sheets open invoices are examples of unrealized concerns. Depending on the company’s selections, these currency rates fluctuate regularly after the open amounts in the books must be revalued at the end of the fiscal year.

Determining the potential profit or loss based on the difference in currency rates between the open commodity’s accounting date and the rate following a fiscal quarter is important.

The reporting goal is to provide the most accurate image of a company’s financial position after each period, even if this distinction needs to be clarified.

We could use a manual trigger on particular reports in Odoo 17 to achieve this, but you would have to reverse the entry at the start of the subsequent period.

We must convert the vendor bill from foreign money to our currency as soon as we receive it. As a result, 100 dollars may be worth 95 euros on the invoicing date. However, currency exchange rates fluctuate frequently, and when the payment is made later, $100 is no longer worthwhile.

A subset of the currency gain/loss use case has been used. Unrealized is the polar opposite of realized cash gain or loss. Let’s look at how unrealized gain/loss works in Odoo 17 Accounting.

The balance sheet’s open balances are all displayed in the unrealized currency gain/loss report. Being able to work with multiple currencies and acquire real-time data fast is beneficial for your business.

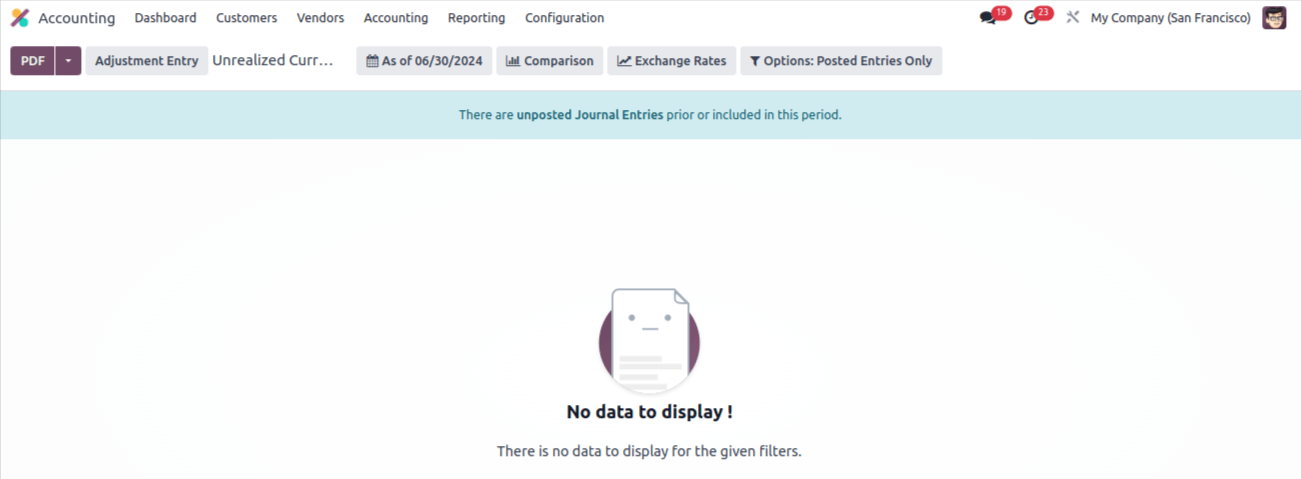

To view the report, go to the reporting tab and select the unrealized currency gain/loss menu. The information on the new screen is organized by currency. As a result, you can collect a variety of currencies from your open items.

As shown in the screenshot below, customers may check each account's balance in foreign currency, as well as the currency rate and operation rate.

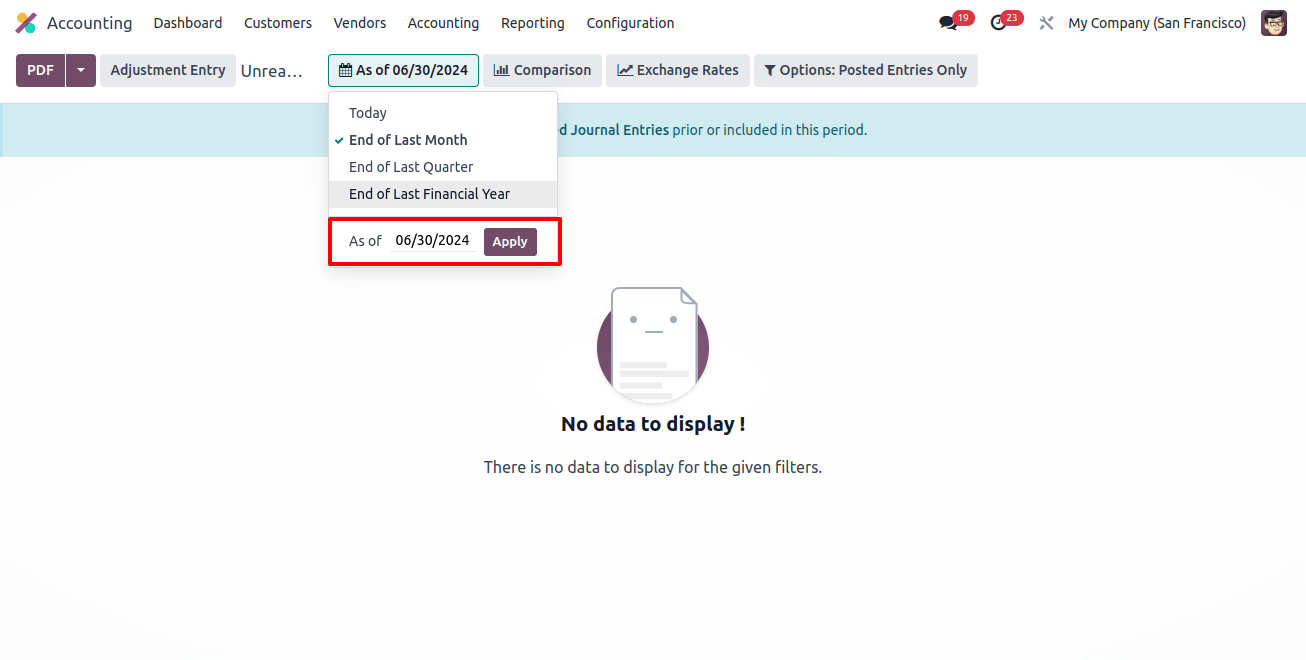

The date filter allows you to sort the data by today, end of the last quarter, end of last fiscal year, custom, and end of last month.

After selecting the Today Filter, the Unrealized currency Gains/Losses window displays individual results. To analyze currency gains/losses for a certain date, select the custom option within the date filter. Enter your date in the end date column and click the APPLY icon, as seen in the image below.

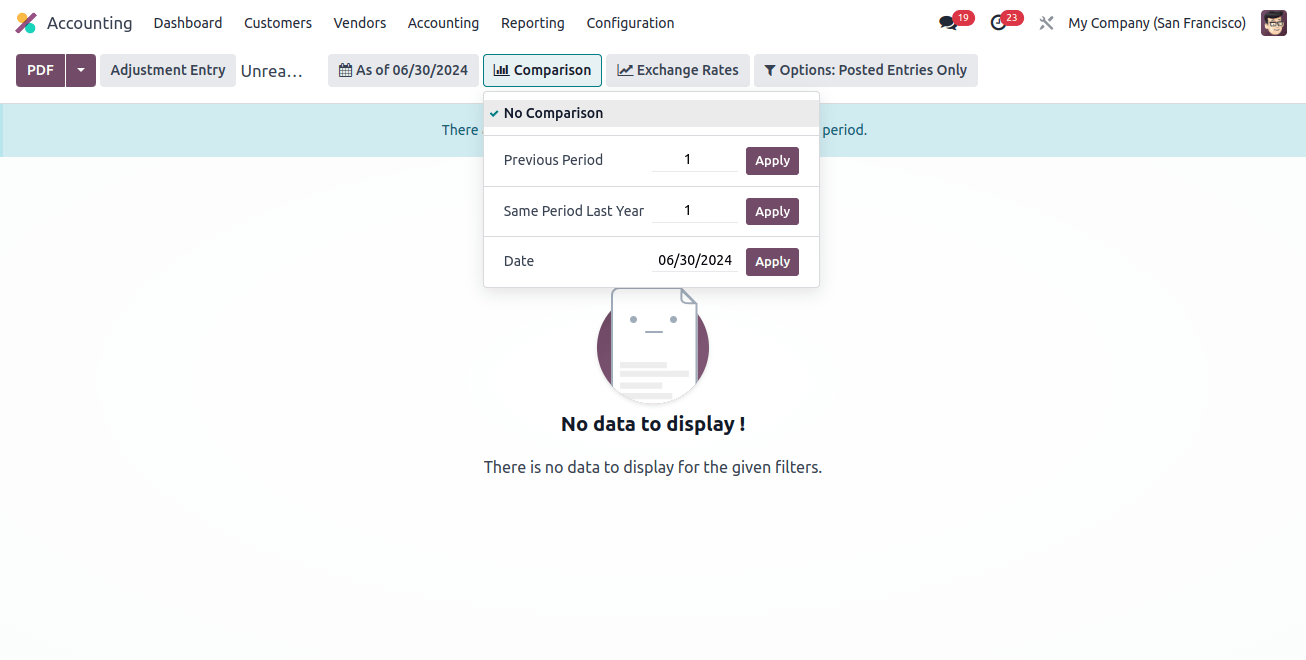

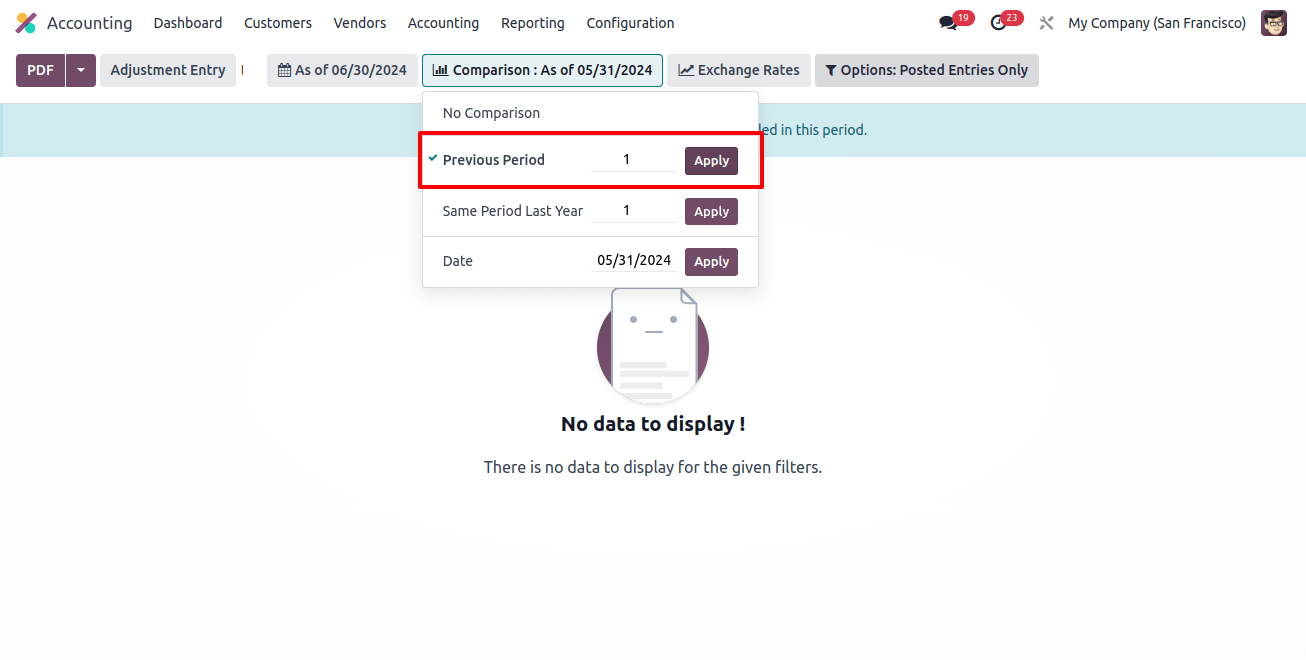

As a result, we can obtain the unrealized currency gain/loss report on the desired date. Users can select the comparison icon to distinguish between currency gains and losses. This comparison can be made using the previous period, custom, and the same period last year.

Let’s ook at each one in the unrealized currency gains/losses pane. To begin, select the previous period option from the comparison menu and enter the number of periods. Click the APPLY icon after applying the period count, as shown in the image below.

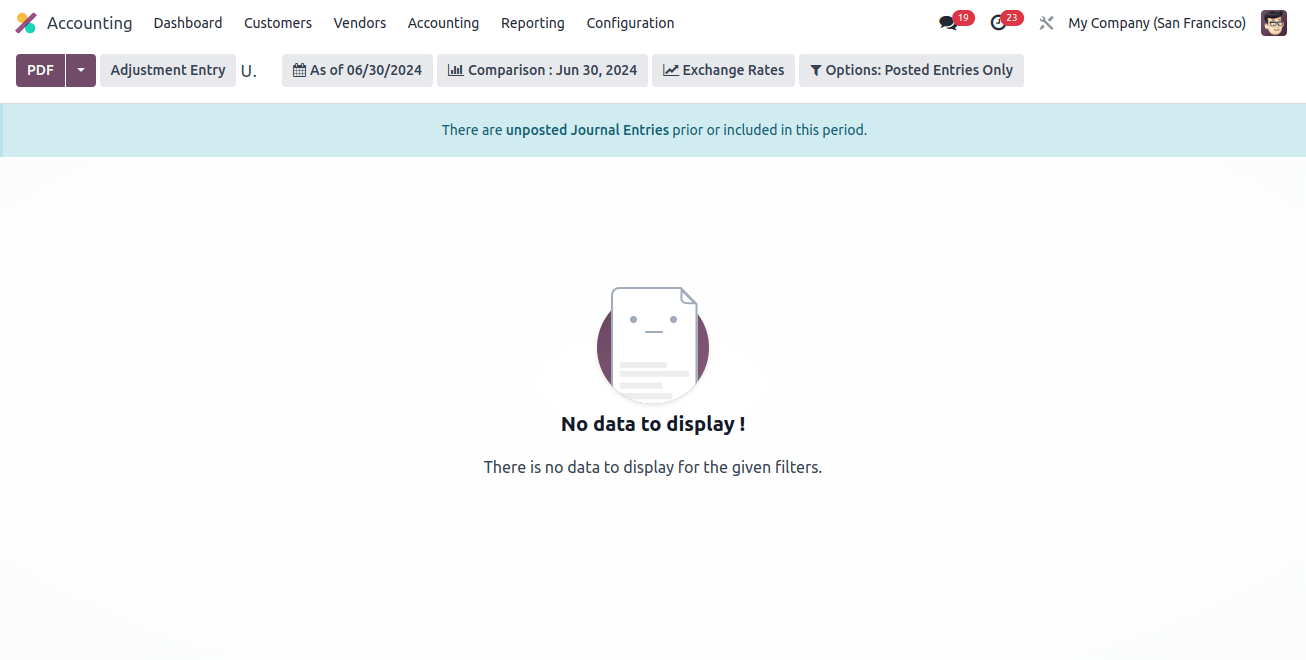

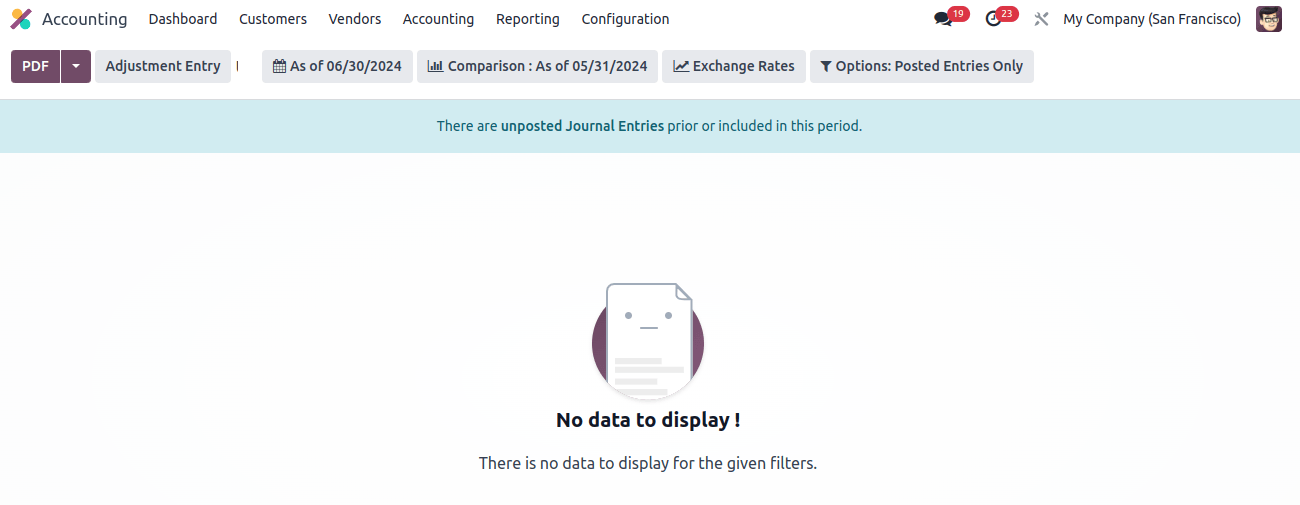

The Unrealized currency gains/loss window gives the user access to the relevant statistics after mentioning the comparison from the previous period.

The results can then be compared to the same period in the previous year. To do this, select the same period last year option from the comparison menu.

After selecting the same period as last year's option, the user is presented with a list of periods. Once the number of periods has been added, click the APPLY icon, as seen in the image below.

We can get the results depending on the corresponding times in the preceding year. The reports present account data for the same year period in separate columns.

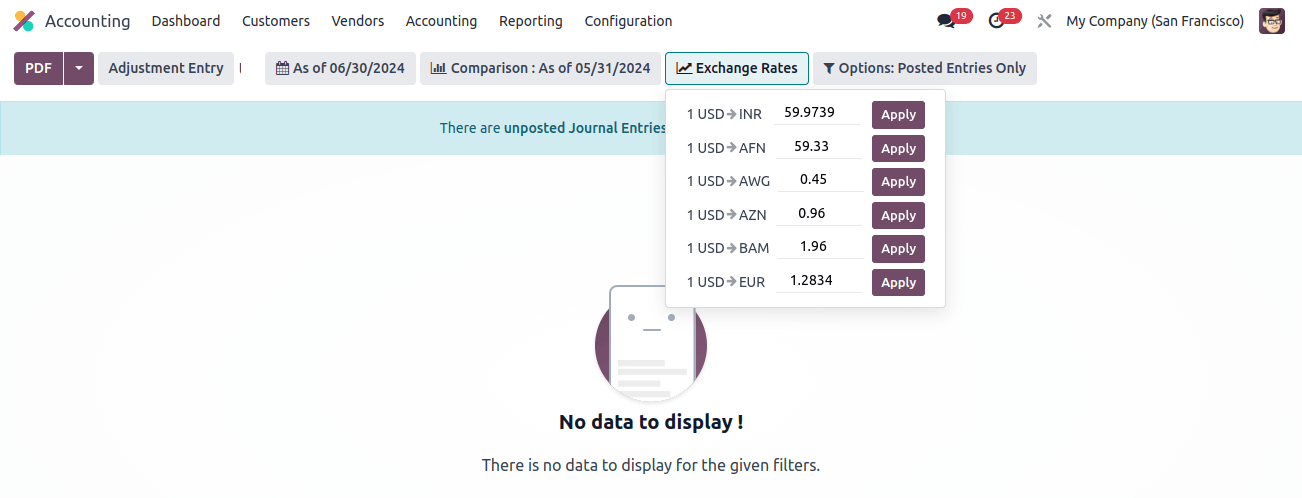

Thus, it is simple to compare a company’s unrealized currency gains or losses at different points in time. Also, we can change the exchange rates in the unrealized currency gain/loss.

The user can add and convert currency values by selecting the exchange rates menu. After entering the currency rate into the unrealized currency gain/loss field, as seen in the image below, click the APPLY icon.

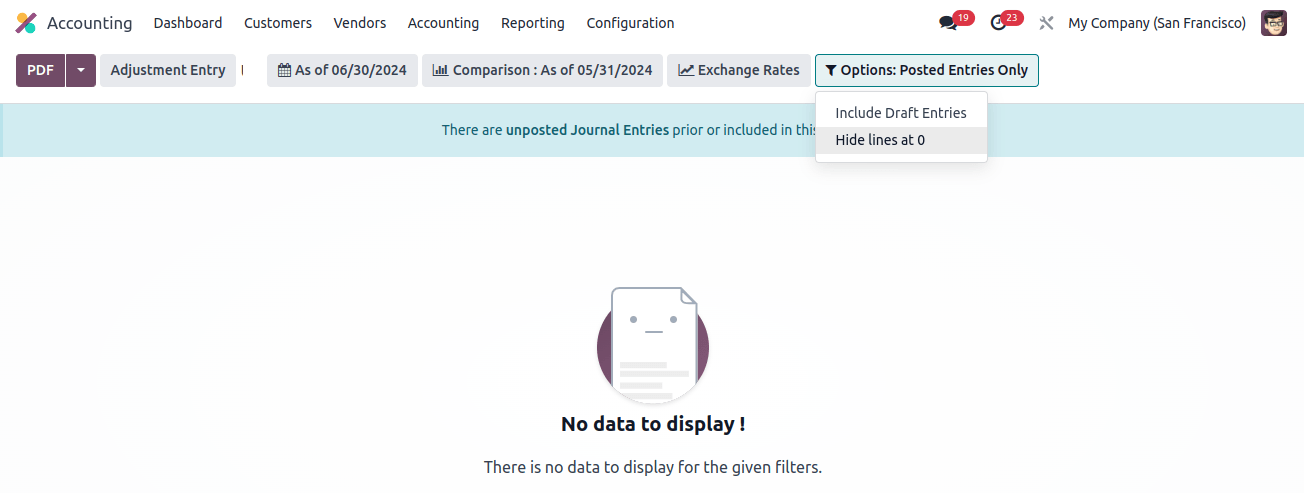

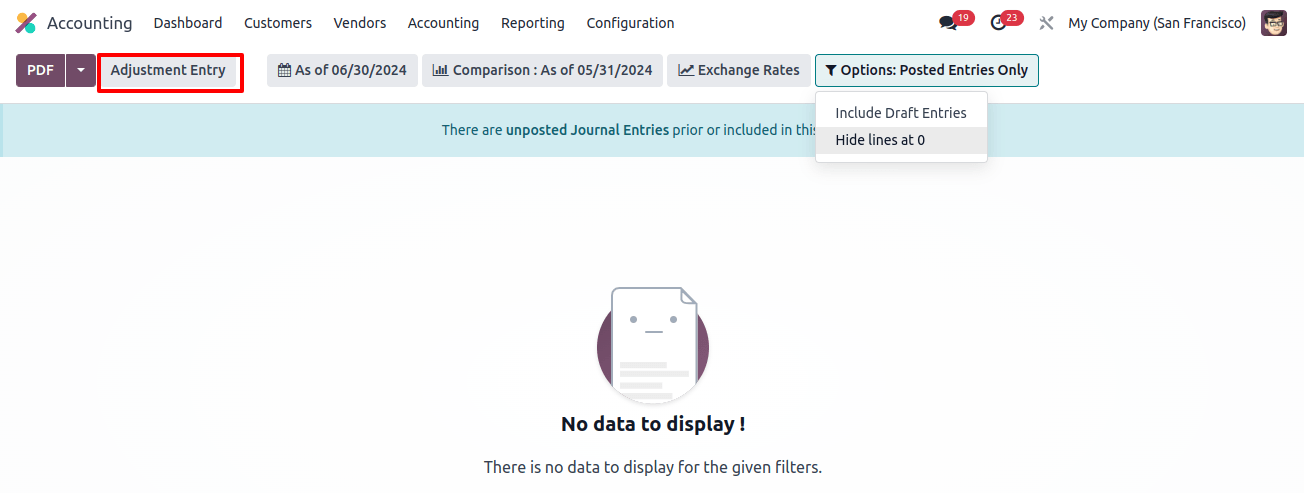

To convert USD to EUR, type the conversion rate into the designated field and click the APPLY button. To add unposted entries, go to the options: Posted Entries only menu and select the include unposted entries option, as shown in the image.

Users can modify their accounts by selecting the ADJUSTMENT ENTRY icon. To view the unrealized currency gain/loss rapport, select the PDF icon in the unrealized currency gain/losses pane, as shown in the image below.

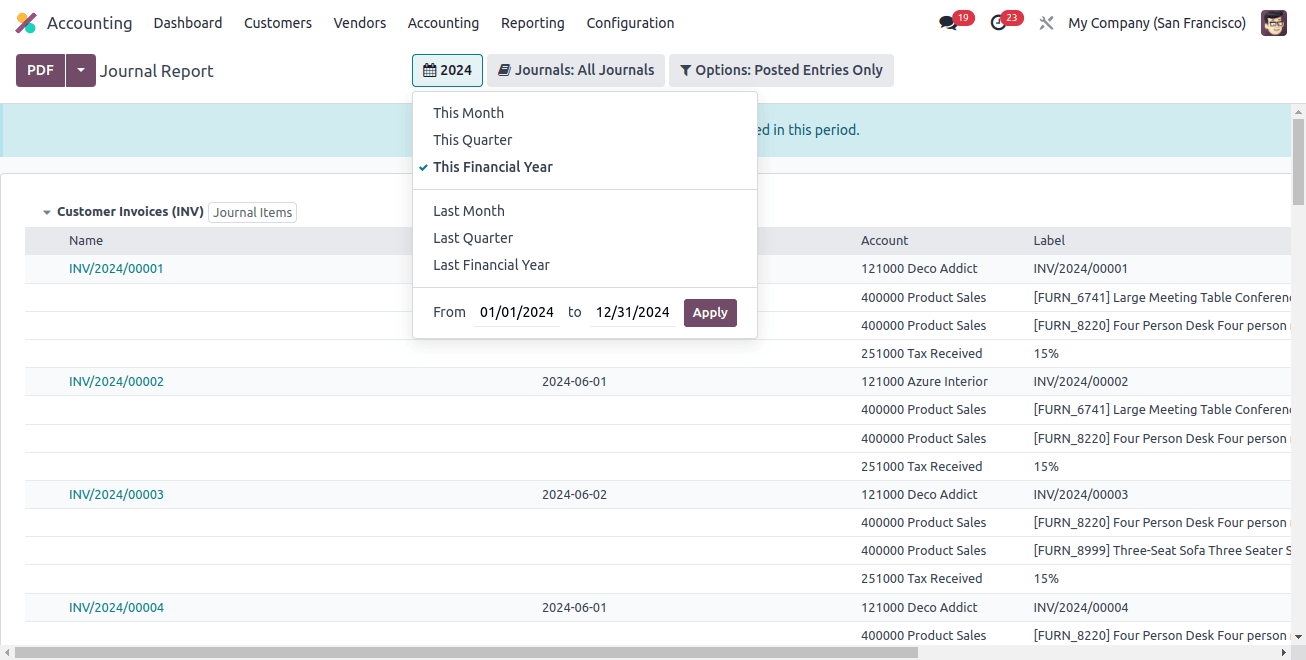

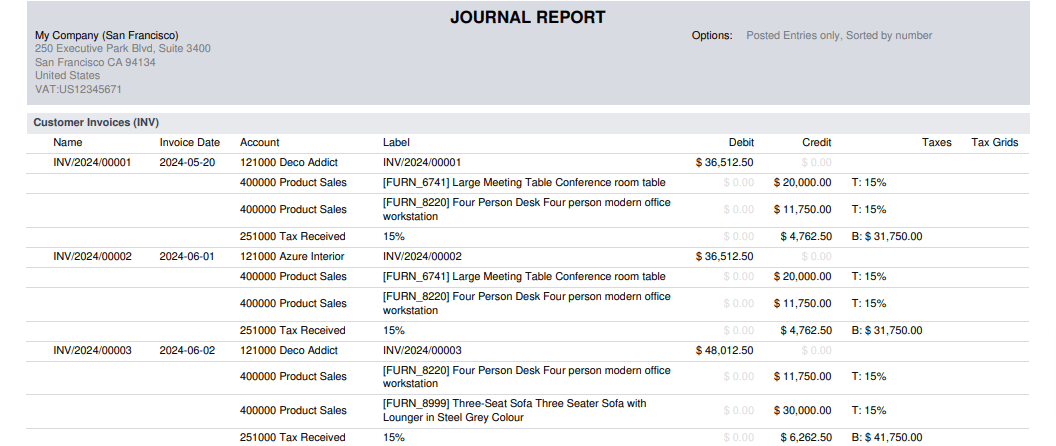

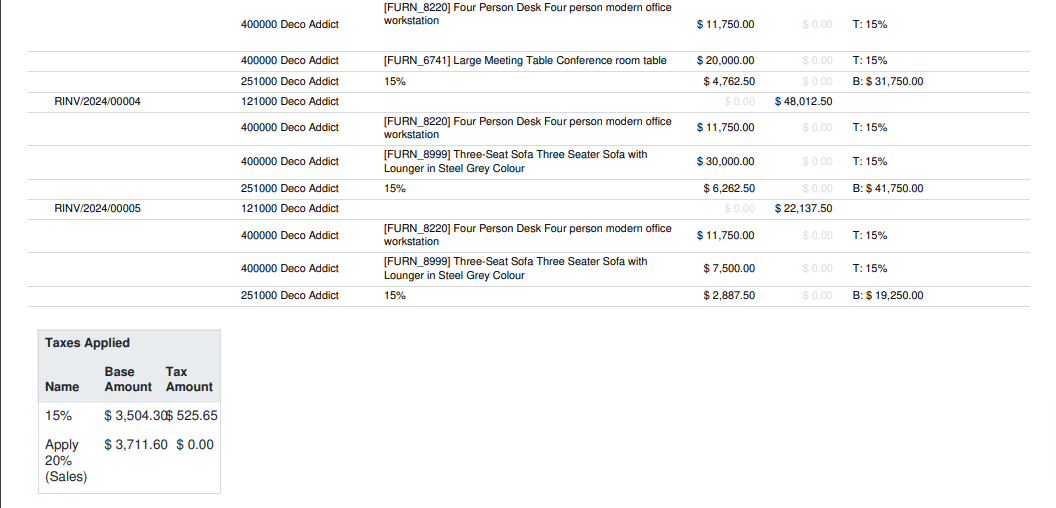

With Odoo 17 Accounting, a company’s journal evaluation is more accessible. Journal reports can be filtered based on date ranges such as current month, last fiscal year, last quarter, custom, and more.

For example, after selecting this financial year option from the 2022 menu, you will be able to examine the journal report for your company’s fiscal year.

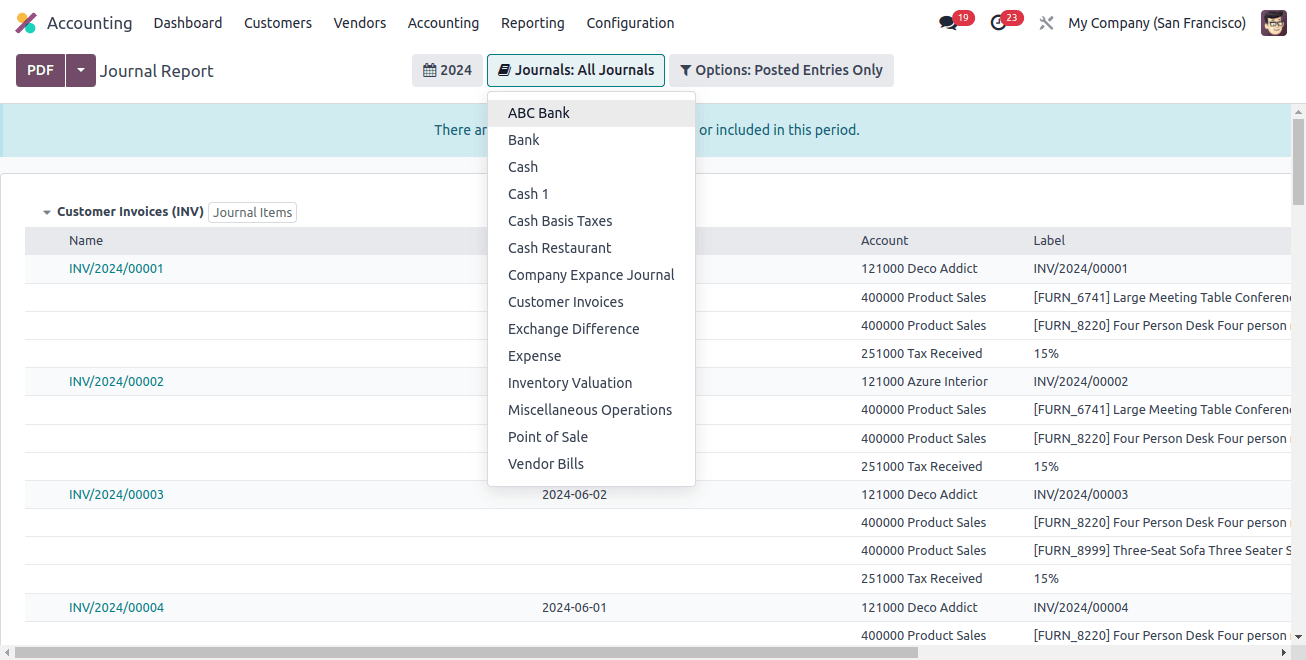

In addition, you can review the details about each account separately in the Journal Report box, such as Label, Name, Account, and more. Selecting the Journals: BNK1 option, as shown in the screenshot below, allows us to interpret the journals based on bank, cash, vendor invoices, point of sale, salary, and other criteria.

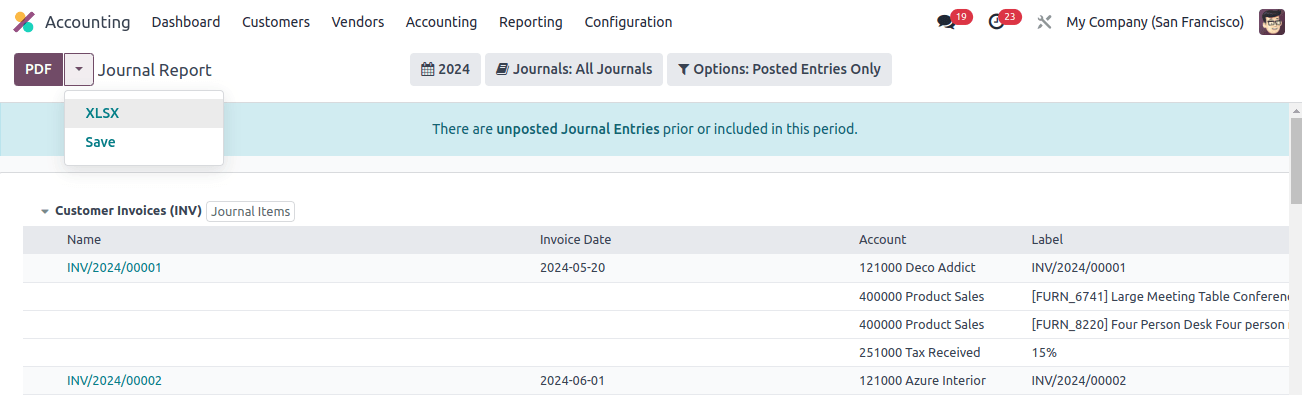

The report can also be sorted by date, payment type, month, unposted items, and other parameters. Choosing to SAVE the report makes it easy to secure. To download the report, click the PDF icon in the Journal Report box, as shown in the image below.

As seen in the image below, the downloaded journal record of business transactions is available.

Using Odoo 17 Accounting simplified evaluating unrealized currency gains and losses, journal reports in a business. The Accounting module in Odoo 17 allows businesses to quickly configure transactions related to accounts. It contributes to improved corporate performance and marketing.