Accounting localization is a feature set in Odoo that adjusts accounting functions to comply with a country’s specific tax laws, chart of accounts, and financial statements.

Odoo 17 accounting localization ensures that your accounting methods adhere to applicable tax legislation, financial reporting standards, and country-specific charts of accounts.

By doing so, the likelihood of issues, charges, and legal issues is reduced. Odoo 17 calculated taxes automatically based on your country’s tax rates, codes, and laws. This reduces repeating calculations and any errors.

In this blog, we will explore the accounting localization for a French company using Odoo 17. To do so, we must first set up a French company.

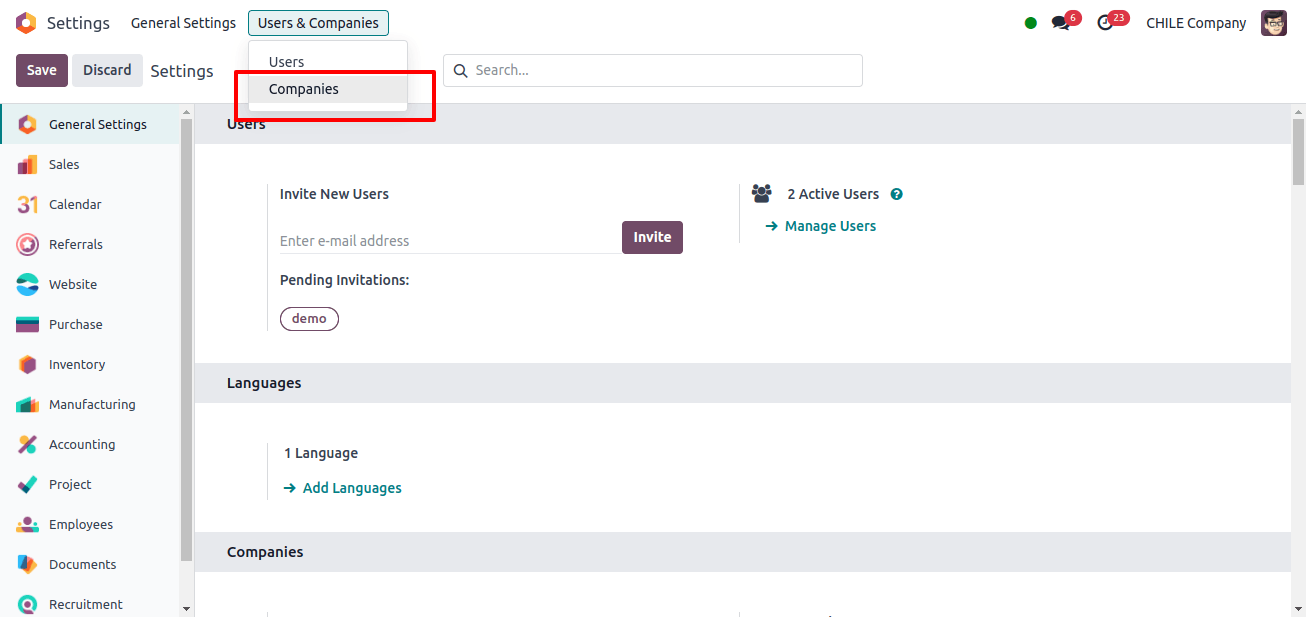

To set up that company, go to Odoo 17’s General settings. Under the users and companies menu, select the companies sub-menu.

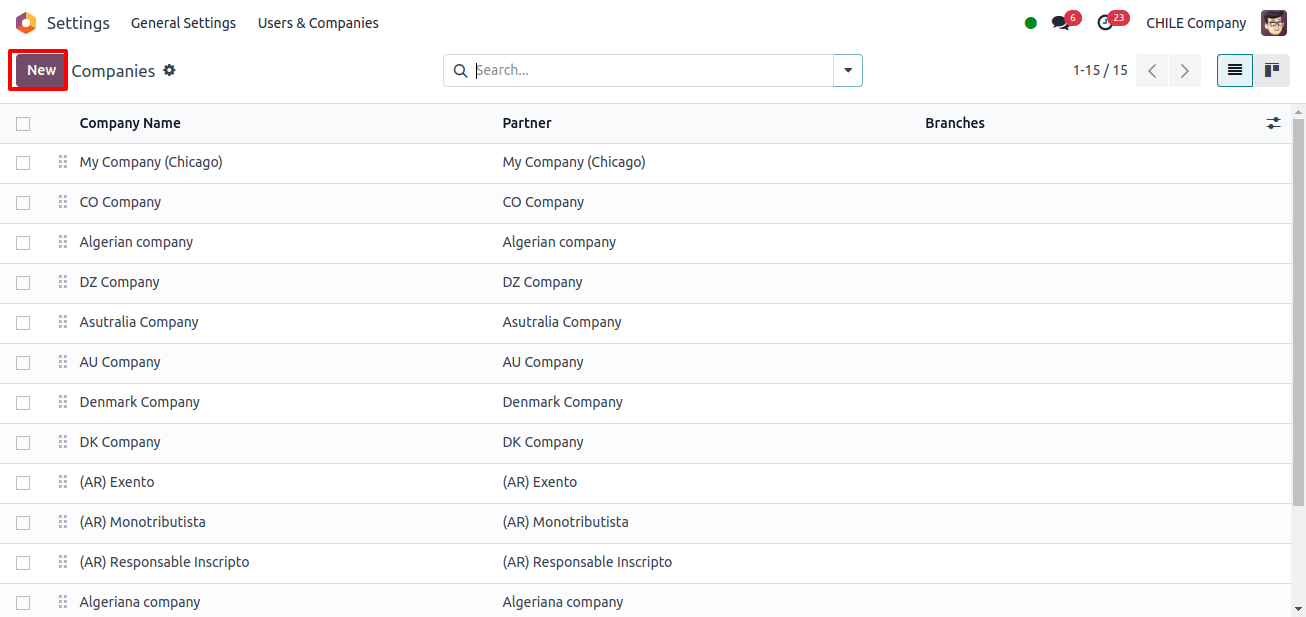

There is a list of already-created companies. From there, we may start a new company by clicking the New button.

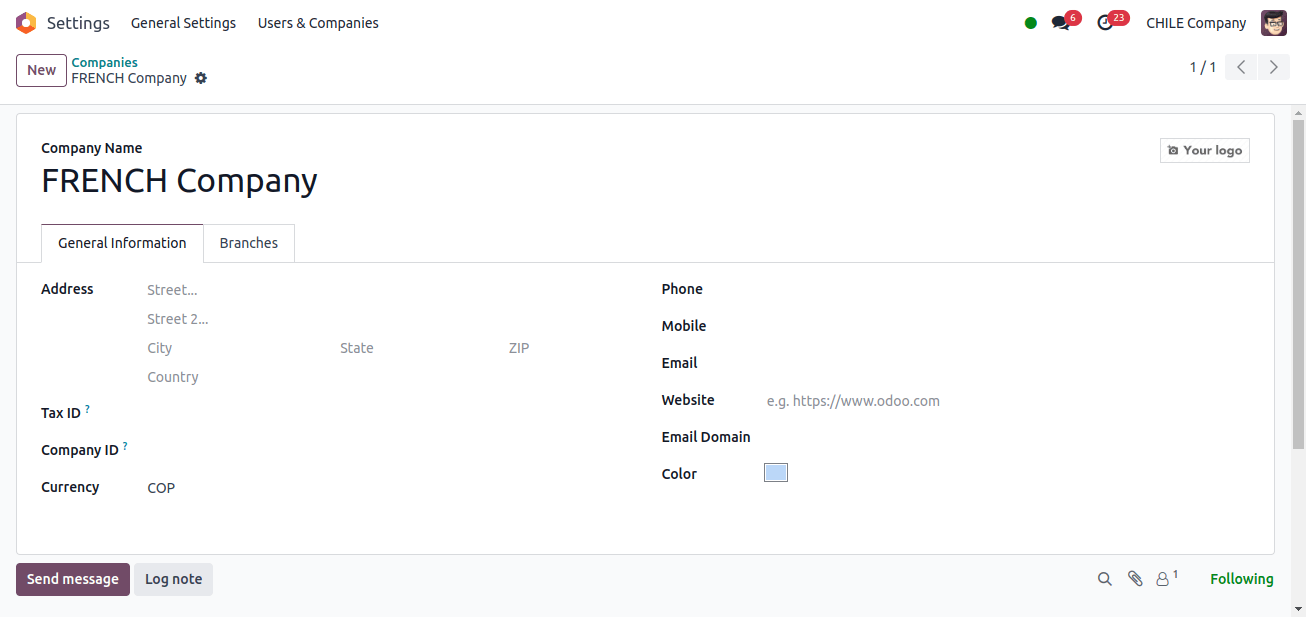

Then we'll be taken to a new form where we can enter the details of the company we’re intending to start.

In the form, provide the company details like name, address, country of incorporation, tax ID, SIRET, APE, and other details.

* SIRET is a unique 14-digit identifier businesses use to identify themselves. It is important for French company operations and administration. The SIRET number is widely used in Odoo 17 for partner management, specifically when dealing with French companies.

* APE is a designation used in France to indicate a company's major business activity. It is based on France’s official classification of economic activity.

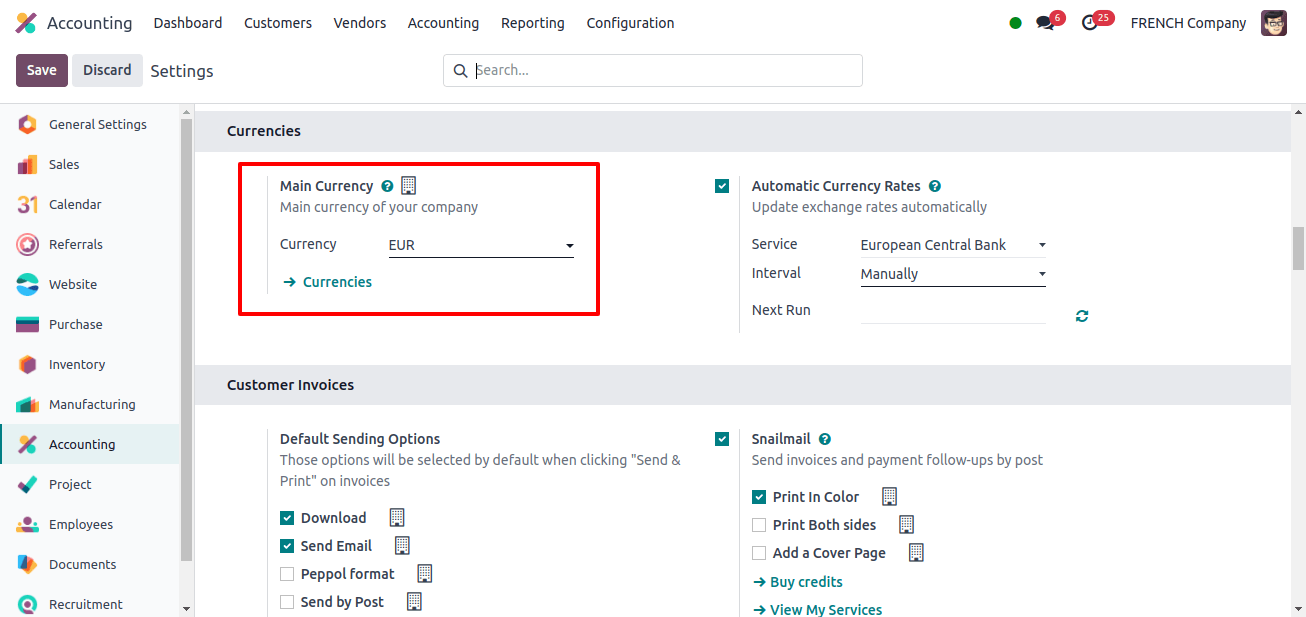

We know that the currency used in France is the Euro (EUR), and the image above shows that Odoo 17 immediately updates the currency for the company to the Euro. The next stage is to create the company’s localization package. To set up the package, go to Odoo 17’s Accounting module.

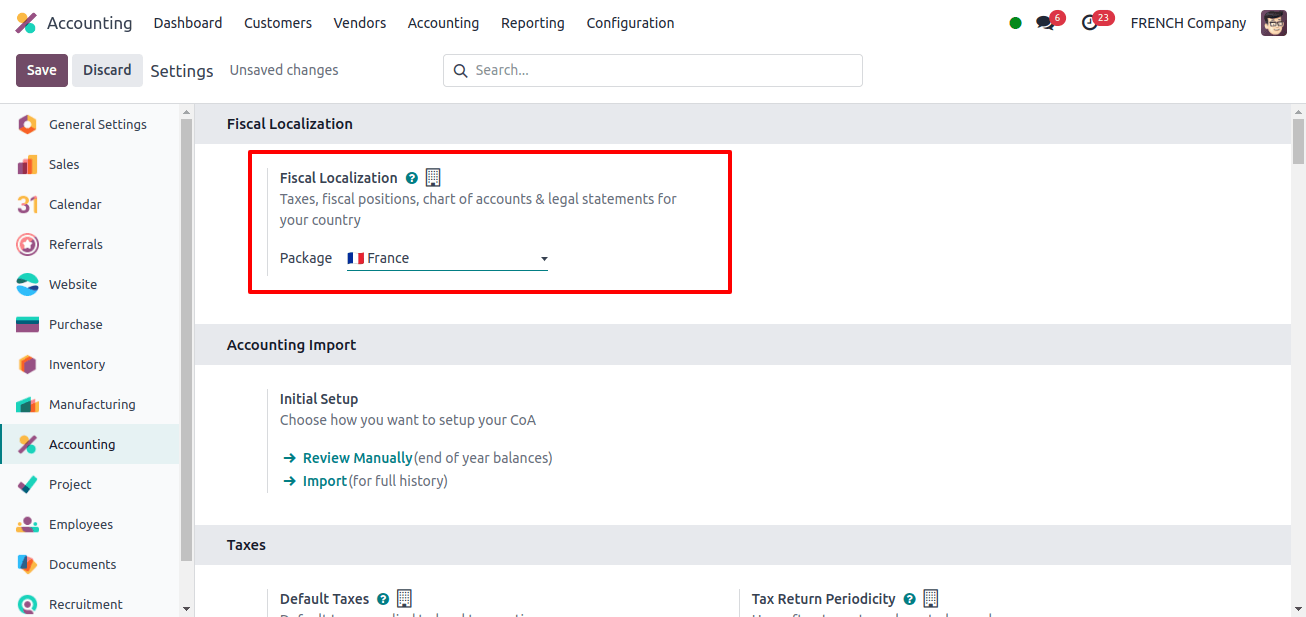

In Odoo 17, under the Fiscal localization field, we can specify the package as France and click the Save button.

Changes made when setting up the France localization package in Odoo 17.

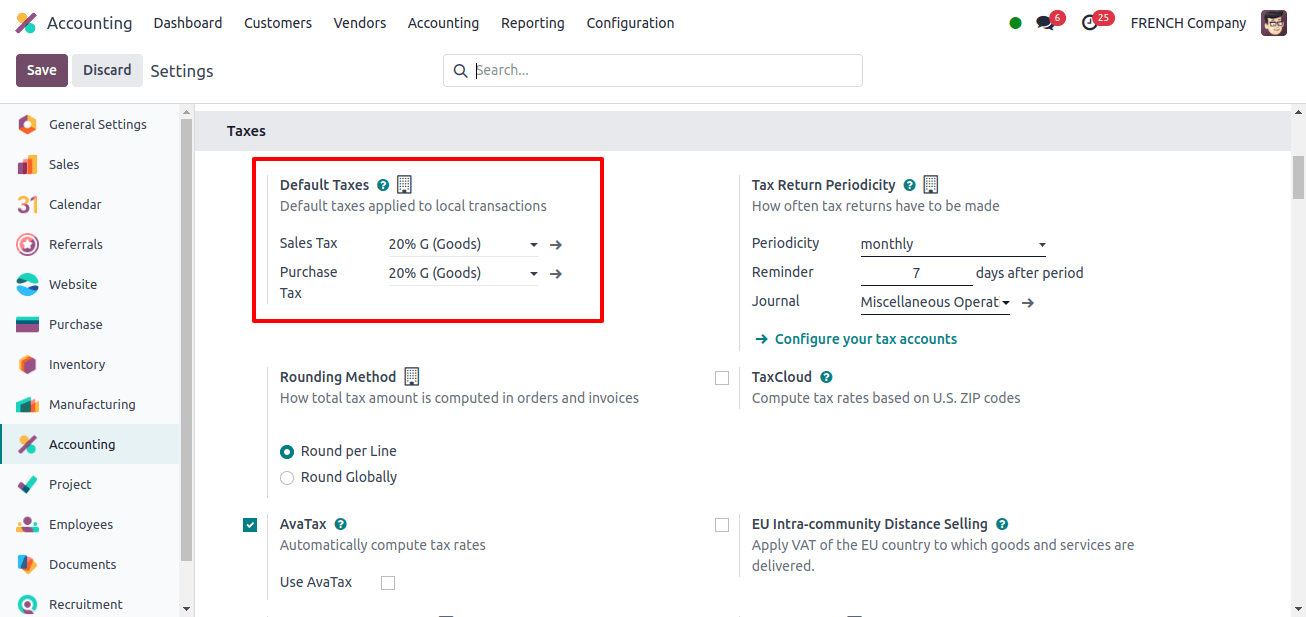

Move to the Taxes section of the Configuration settings, where we may find a default taxes field. Default sales tax and default purchase taxes are offered.

The default sales and purchase taxes used by all enterprises in France are 20% Goods.

The accompanying image shows that the sales and purchase taxes are set at 20% Goods, which Odoo 17 configures automatically when the localization package is saved as France.

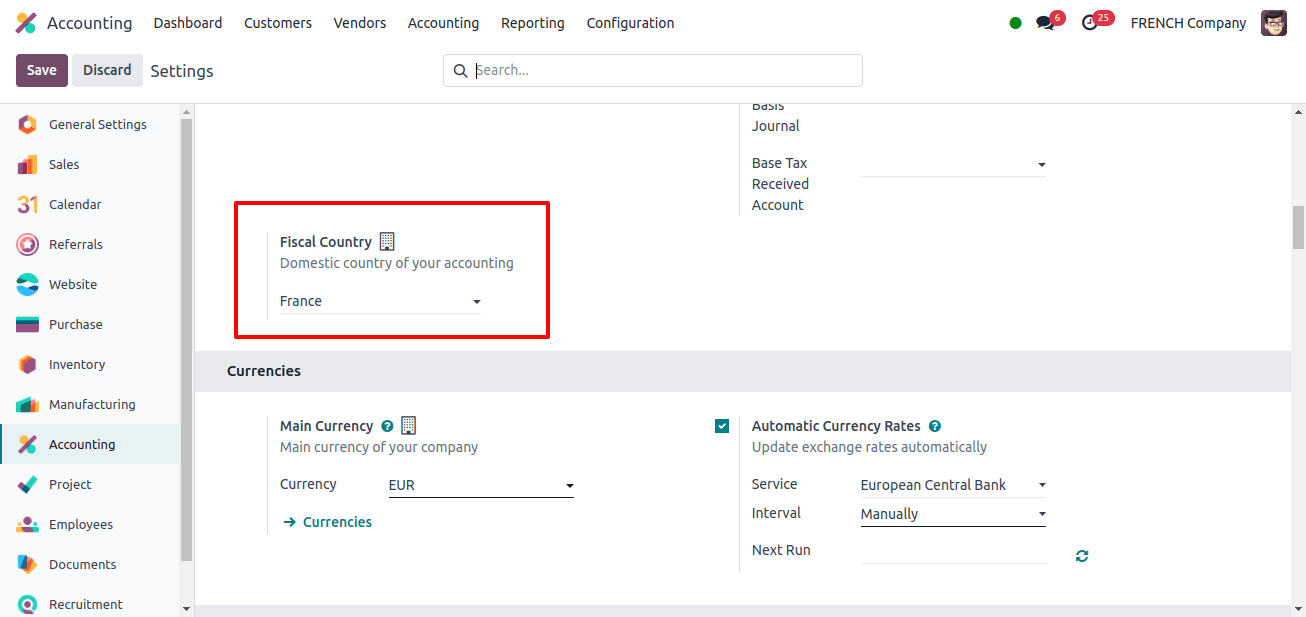

A Fiscal Country field is available in the Configuration settings under the taxes section. The fiscal country is the country in which a business is registered for taxes.

Odoo 17 automatically sets the Fiscal country to France when the company’s package is set to France. Then go to the currency section of the configuration settings.

When we save the France localization package, Odoo 17 automatically sets the company’s principal currency to the Euro.

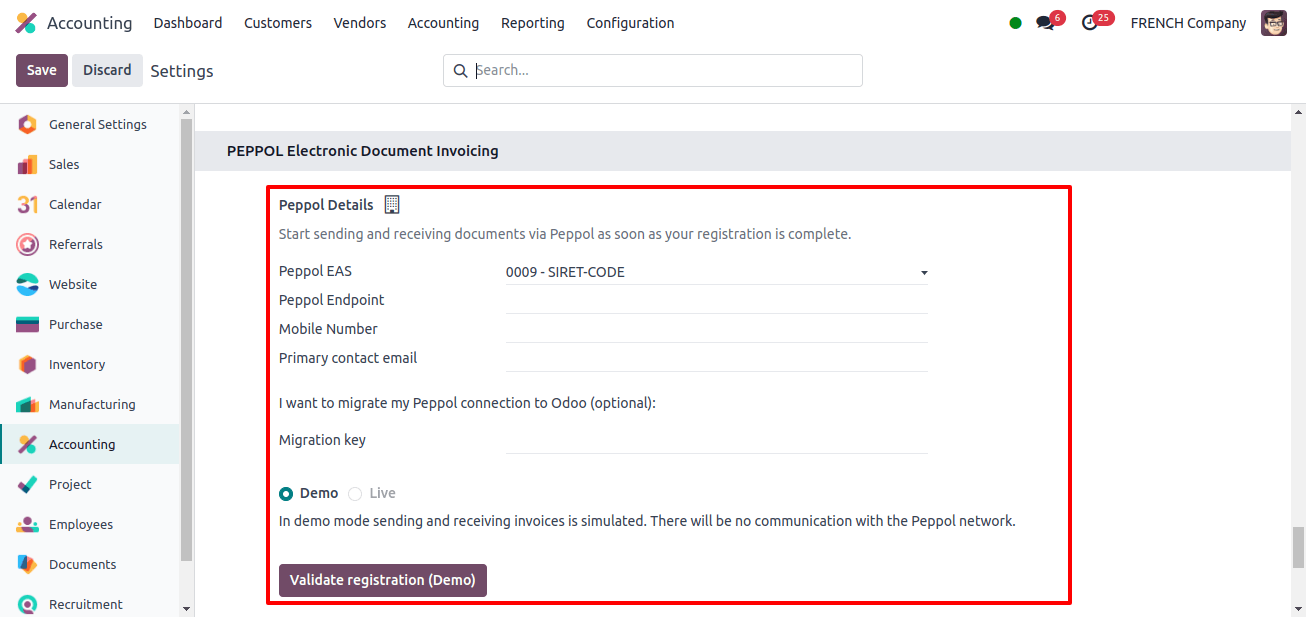

PEPPOL Electronic Document Invoicing is an additional field added to the configuration settings. PEPPOL is an international system and protocol that provides the secure and uniform transmission and receipt of electronic business documents between countries.

PEPPOL, originally developed as an EU standard, has grown to encompass a larger number of countries, making it an essential resource for businesses of all sizes looking to speed up electronic invoicing.

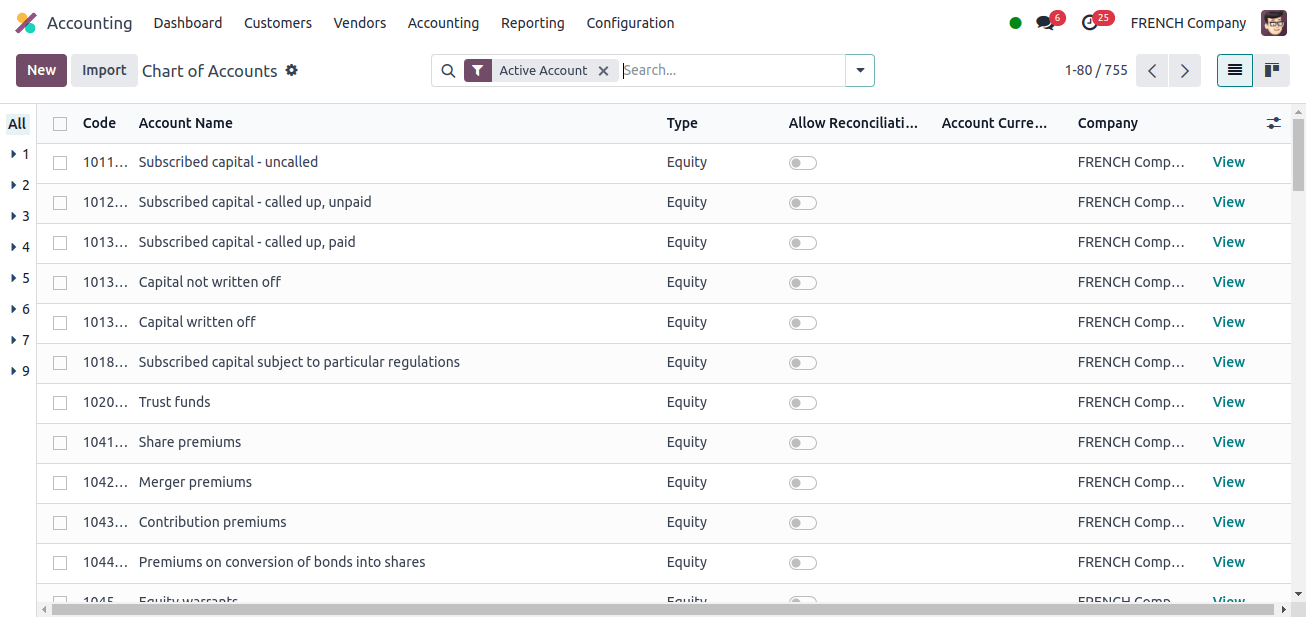

The following is a chart of accounts for French corporations. Each country has specialized accounts for its different business demands, which may differ from country to country. The image below shows the many accounts used by corporations in France.

* Subscribed capital - uncalled refers to the portion of a company's capital that has been authorized by its shareholders but is not yet subject to payment demands.

* Capital not written off refers to accounts that, after losses or payments, represent a company’s equity or shareholders’ cash that has not been reduced.

* Share premiums are the difference between a share’s par value and its issue price.

* Revaluation reserve accounts are used to record the difference between an asset's current value and its carrying amount.

These are some of the accounts that companies use and how they are used. The next section discusses the taxes that French companies can use to fit their needs.

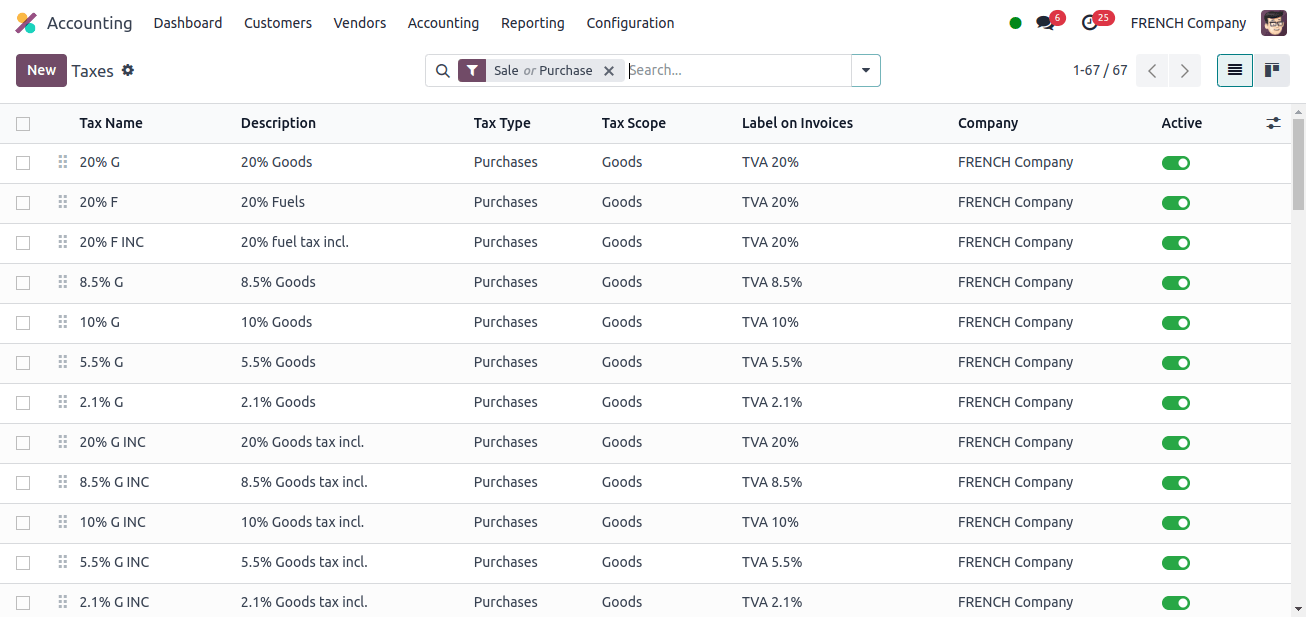

The list will include various sales and purchase taxes, which companies can use for different purposes.

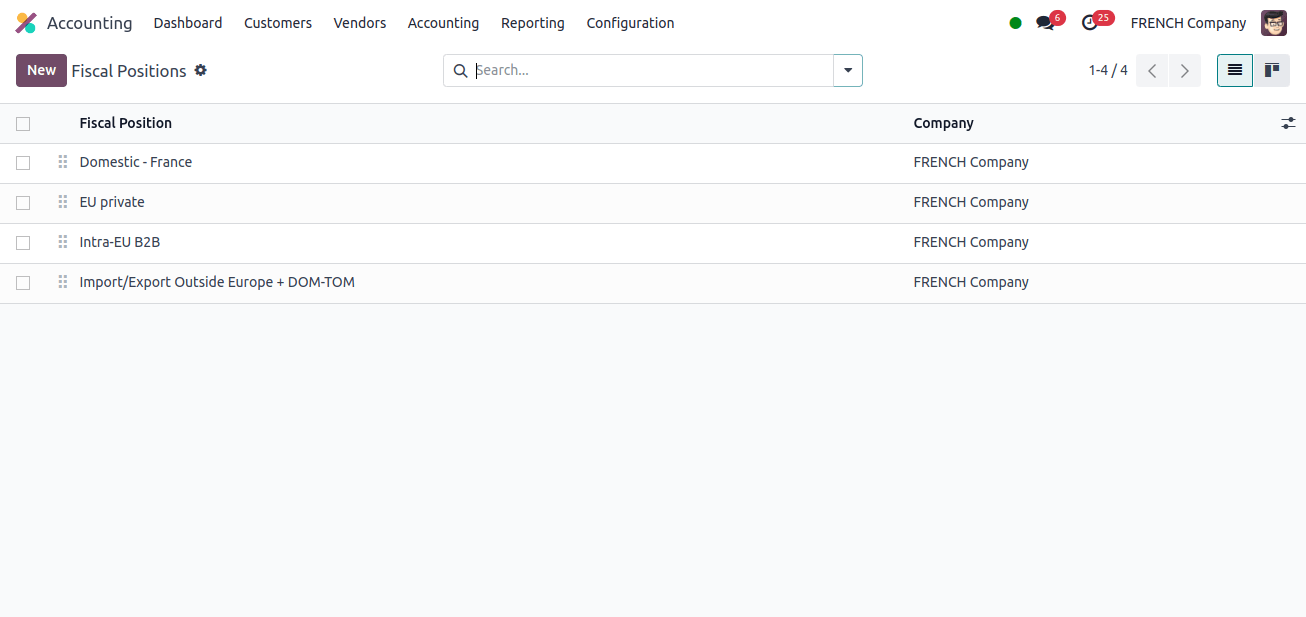

These are the fiscal positions that French enterprises use to map their taxes or accounts from one to another.

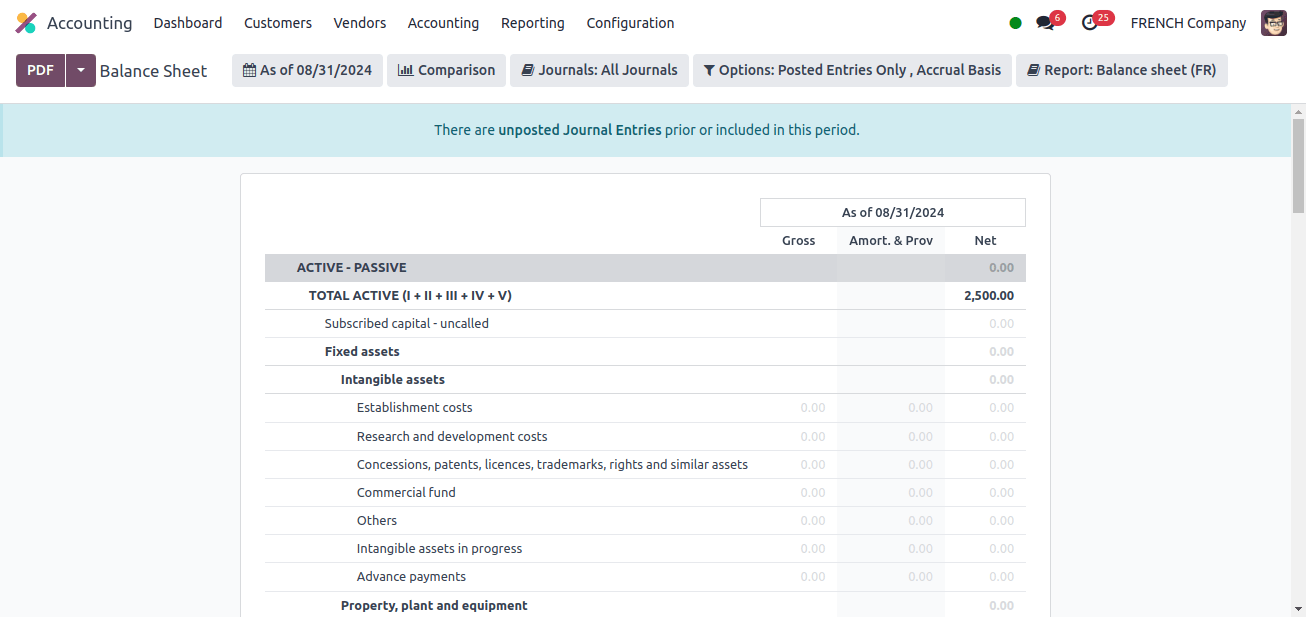

A balance sheet in Odoo is a financial statement that depicts the state of your company’s finances as of a specific date.

It summarizes your company’s assets, liabilities, and equity, emphasizing what it owns (assets), owes (liabilities), and the difference that represents the owners’ claim (equity).

Companies in France have balance sheets that include intangible assets, property, plant and equipment, financial assets, marketable securities, and so on.

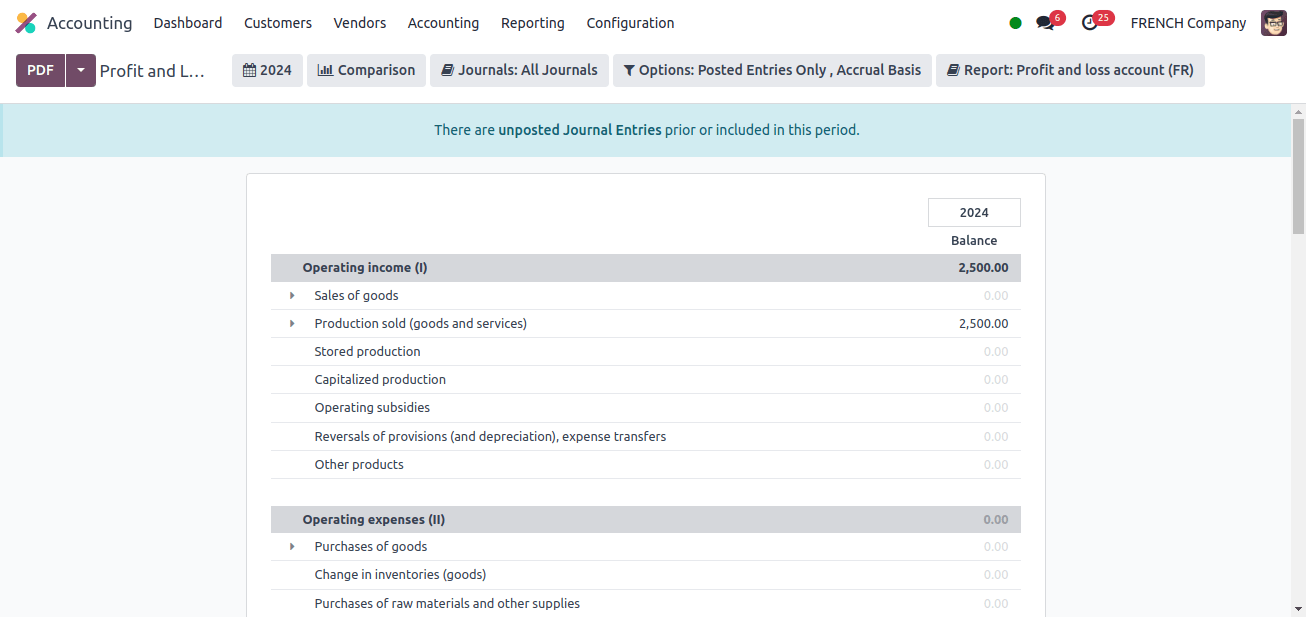

Odoo’s profit and loss report displays the total profits and losses earned by the company over a specified period. This report mostly covers the fiscal year.

Companies in France’s profit and loss account contain operating income, operating expenses, share of profit from joint ventures, financial income, financial charges, and so on.

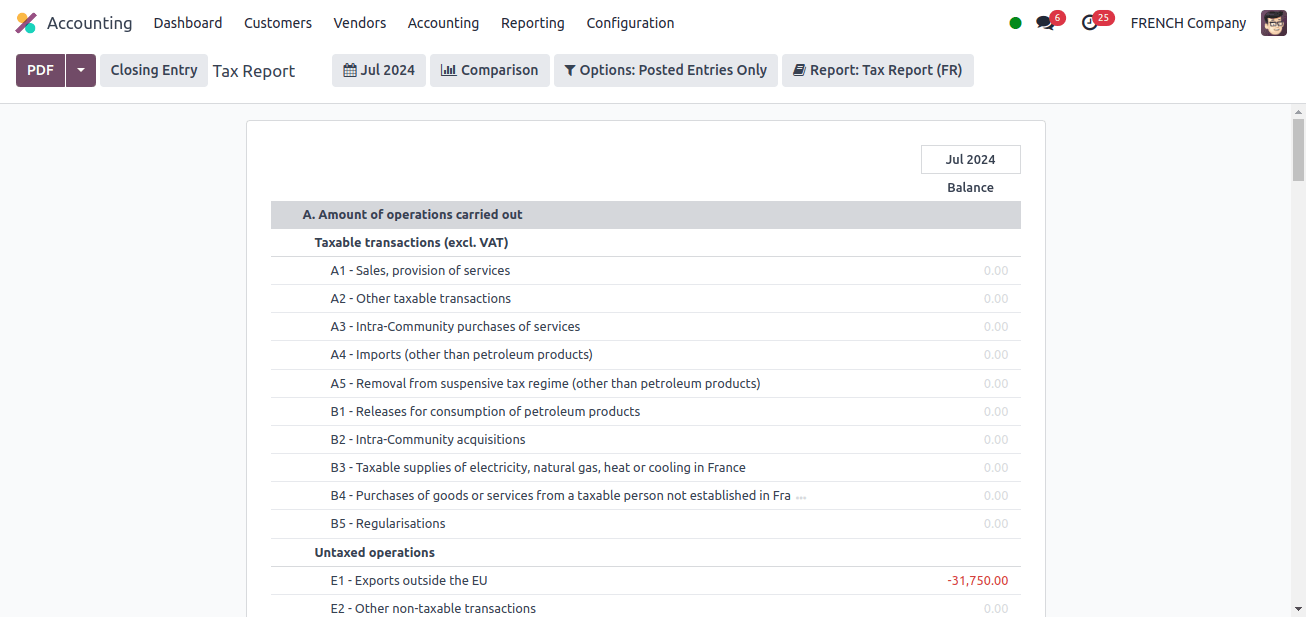

The Odoo tax report is a recorded account of your company’s tax data for a specific period. It helps you schedule payments, calculate your liabilities, and possibly file for a tax return.

Taxes recorded by corporations in different nations may differ. The tax report used to describe the data by the French companies comprises Taxable Transactions (without VAT), Untaxed Operations, VAT Settlement, and so on.

EDI (Electronic data interchange) Export is an optional feature for French accounting localization. It refers to the standard formatted electronic exchange of business documents between an organization and its suppliers or customers.

It’s a standard strategy for increasing productivity and streamlining company processes, and EDI tax reports can be found under the Accounting application’s Reporting option.

To review, the addition of Accounting Localization to Odoo 17 provides businesses with a comprehensive approach to managing money across several markets and regions.

Businesses may quickly alter their accounting systems to comply with local laws, currencies, and reporting requirements owing to Odoo’s versatile and customizable platform.

Businesses may streamline their financial processes and ensure compliance with local legislation by exploring Odoo’s robust features, which include tax customization, multi-currency support, and localized reporting templates.

Finally, Odoo assists companies in managing the complexities of global accounting efficiently and accurately, paving the way for long-term international expansion and success.