Offering loans to customers is important for boosting a company’s competitiveness. Every business must have proper policies that describe the payment terms that a client will receive and the number of credits they wish to be awarded.

The credit limit function will be extremely beneficial in encouraging clients to make greater purchases and faster payments to stay under their credit limit.

Companies can impose a credit hold policy on late or non-paying customers, as well as those who have exceeded their credit limit without offering sufficient grounds, by implementing these advanced feature-credit limits.

The credit limit function helps the organization monitor and enforce credit limits, track invoice payments, and follow the collection plan’s operations. This credit limit will help to minimize the amount of bad debt that a business can incur.

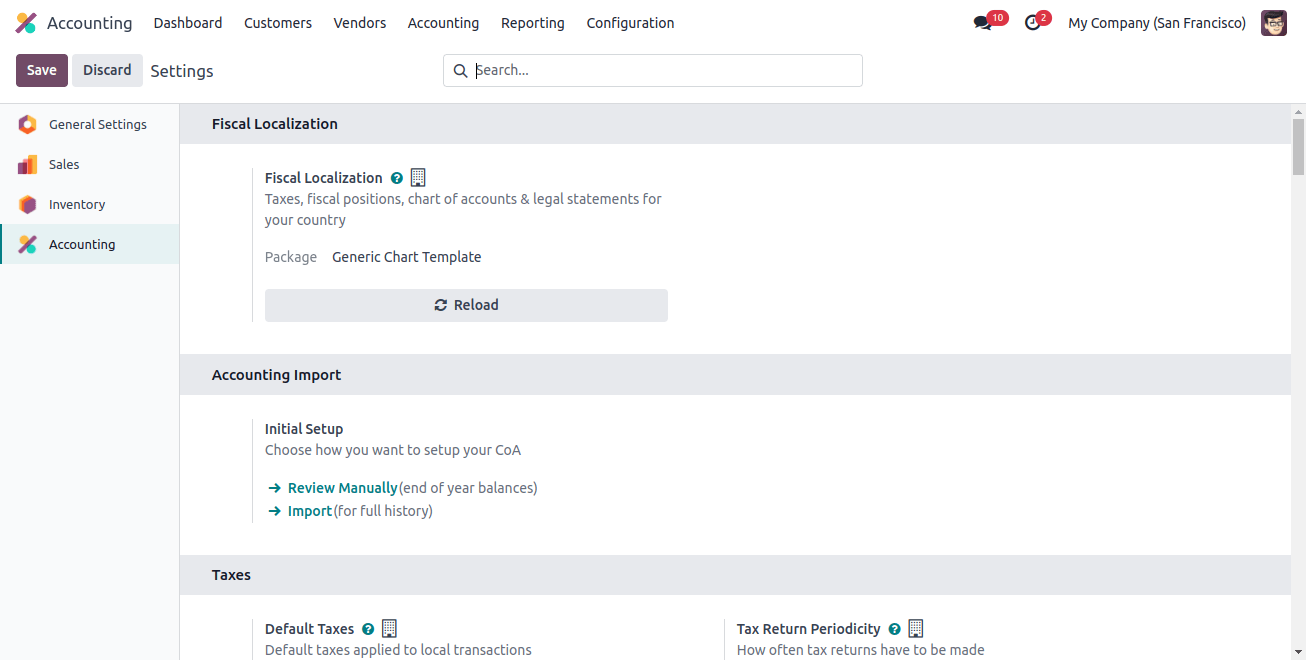

The most recent addition to Odoo 17 is the sales credit limit. The new feature may be found in the configuration settings for the Odoo 17 Accounting module.

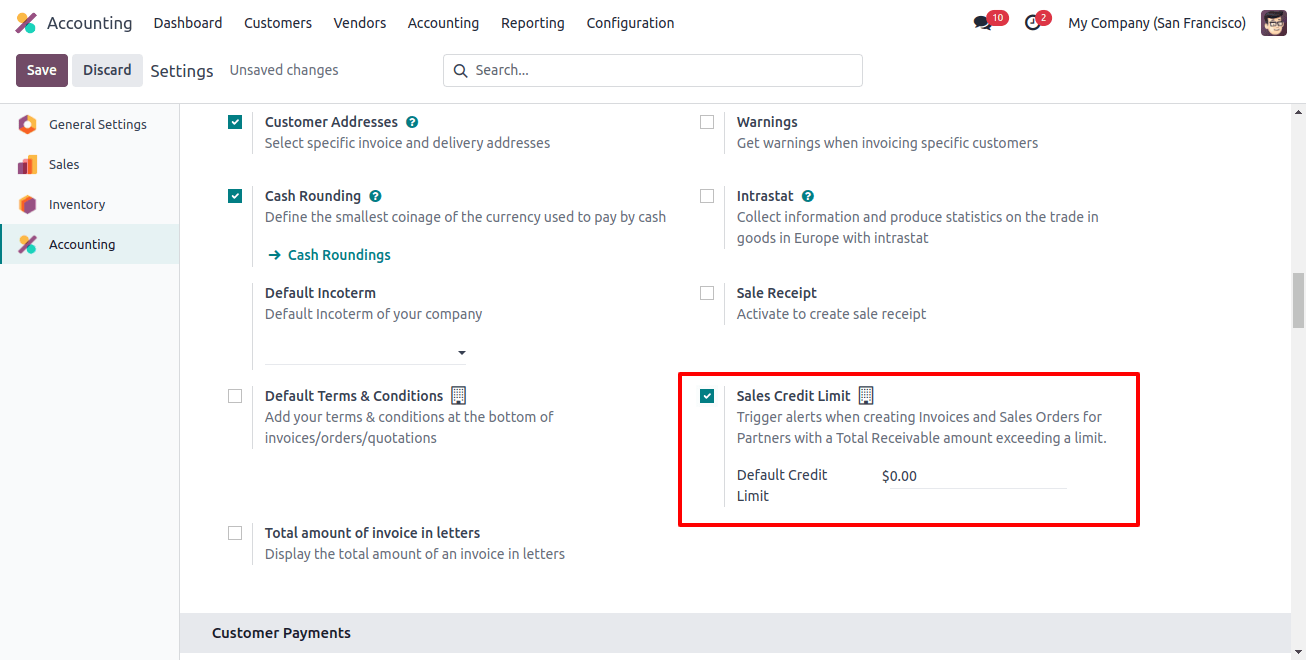

In the customer invoices field of the settings window, you can access the sales credit limit feature. Check out the image below.

When creating sales orders and invoices for partners whose total amount receivable exceeds a given threshold, the sales credit limit tool is handy for triggering warnings.

Also, the system allows you to create a default credit limit, which you can customize to meet your business needs. Similarly, the customer contact form includes an option to set a credit limit.

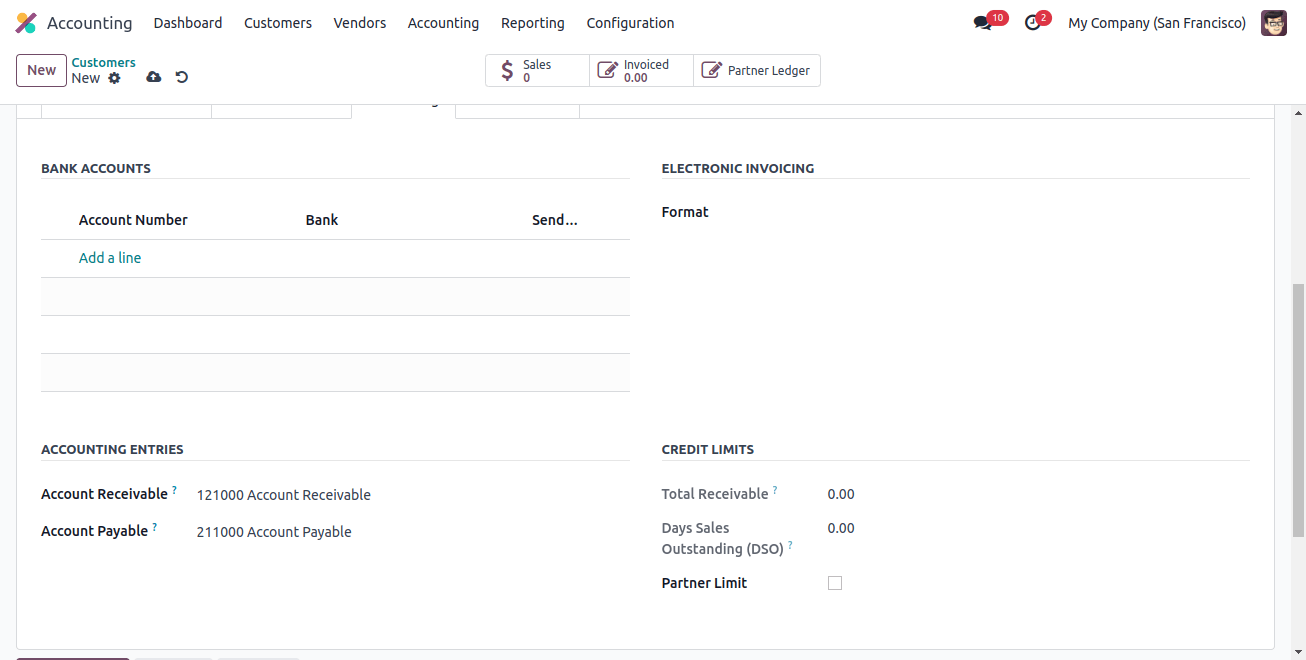

To view the CREDIT LIMITS on the customer creation form. Now let us open the window for customers. You can set credit limits in the customer creation form by selecting the Accounting tab.

The total amount owed by this individual consumer can be placed in the total receivable field of the CREDIT LIMIT section. Activating the partner limit also allows you to specify a partner limit.

When you select the partner limit option, you will see the default partner limit defined in the settings panel. In this example, we have 120 sets as the default credit limit in settings.

As a result, when the partner limit option is selected in the Accounting tab of the customer's window, the sum of 120 is presented immediately, as seen in the image below.

From this page, you can also change the partner limit. This will be quite helpful in identifying partner constraints for diverse clients.

Let us now look at how it will function.

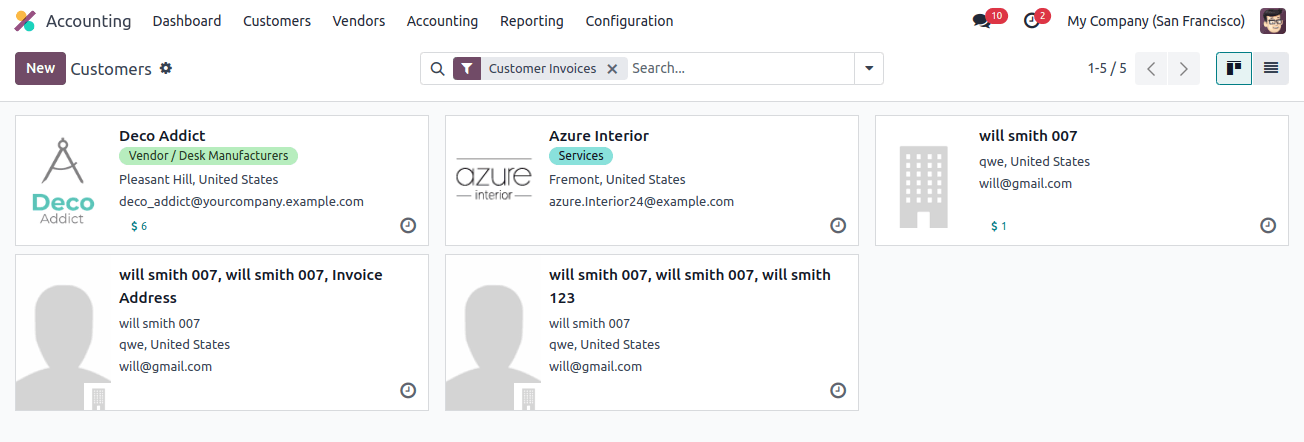

Let’s select a customer for that. To open the customer's window, click on the customer’s menu icon, which appears under the customer's tab.

We can choose any of the clients here. We can set a credit limit for the consumer if we use Deco Addict. To set a credit limit, first click the Accounting option from the window.

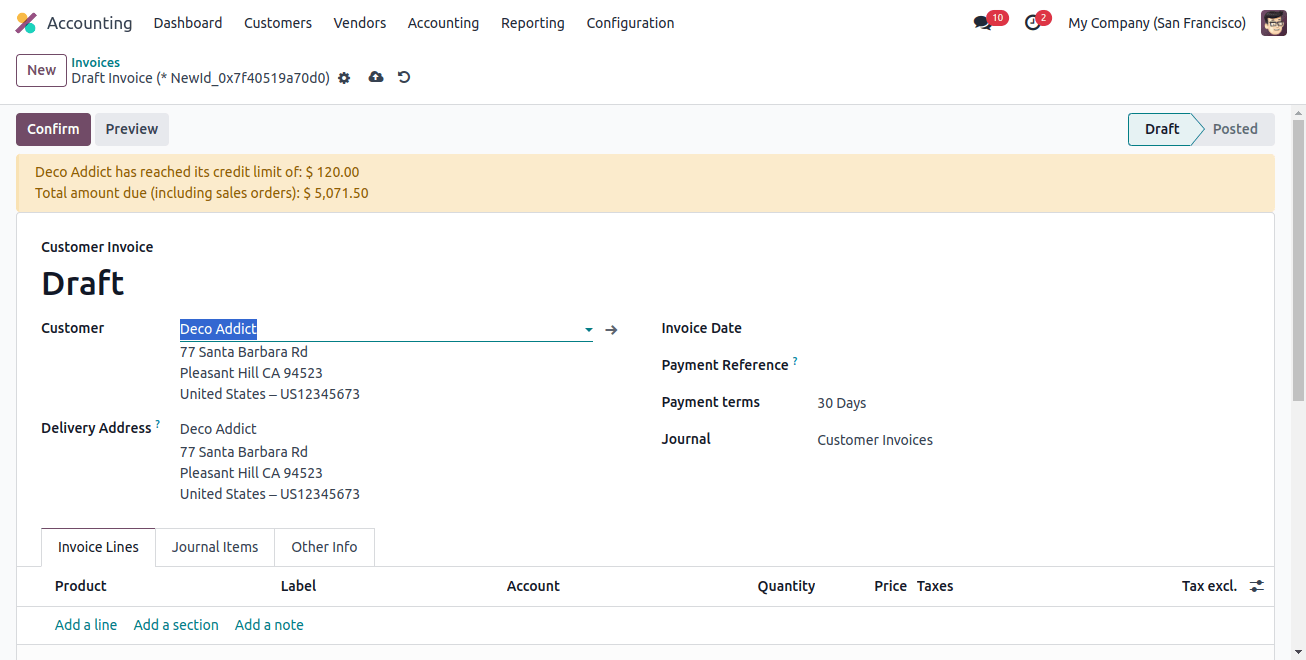

The Partner Limit is now set to 120.00. Let us now create an invoice for the client. To open the Invoices window, select the Invoices menu icon.

To generate a new invoice for the Deco Addict, click the NEW icon. Deco Addict can now be designated as a customer.

The image below shows what happens when you select the Deco Addict: a message that the customer has reached their credit limit will display.

When setting sales orders and invoices for customers whose total receivable exceeds a certain level, the Odoo system generates alerts.