Odoo Accounting is a business management software that provides apps, including accounting modules, to assist businesses with financial procedures. Odoo features delayed income as receiving payments in advance. Odoo defines delayed income as receiving payments in advance for things or services that have not yet been given or earned.

Because of the outstanding accurate financial reporting to supply the specified products or services, this prepayment creates a liability on the business’s balance sheet.

This creates a liability on the balance sheet, indicating that the business has failed to meet its accurate financial reporting to supply the specified products or services.

In the world of accounting, controlling deferred revenue is an important issue that businesses must manage to ensure proper financial reporting.

Odoo 17, a comprehensive business management software, has powerful accounting functions, including tools for dealing with deferred revenue.

In this blog post, we will look at how to compute deferred income in Odoo 17 accounting, giving businesses a clear grasp of the process.

How to Deferred Income in Odoo 17 Accounting?

Understanding Deferred Income

The Odoo accounting module is designed to manage delayed income, commonly known as unearned or prepaid revenue. Begin by creating a separate account for deferred income in Odoo. This account will track monies received in advance until the appropriate goods or services are provided.

It systematically addresses this issue because of its diverse accounting features. Instead of recognizing income immediately, businesses must delay it until the goods or services are delivered. For correct financial reporting, revenue must be recognized at the time it is earned.

Configuring and Managing Deferred Revenues

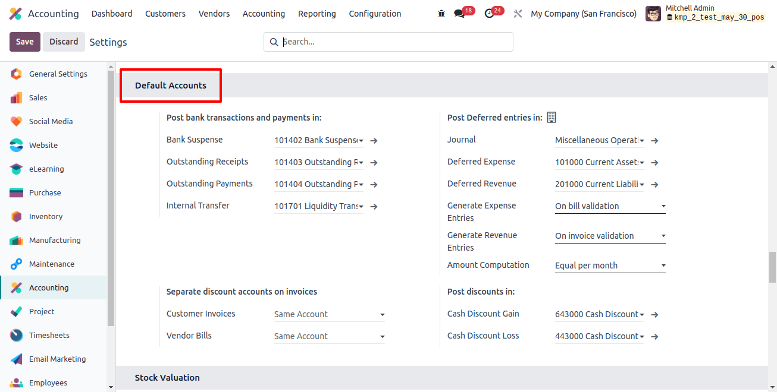

Setting or updating Deferred Entries and Accounts is a simple process in the Odoo 17 Accounting module. So, go to the ‘configuration’ menu and select the ‘settings’ page to configure your company’s accounting settings.

This box allows you to specify various default accounts for each journal. The three options are Deferred Expense Account, Deferred Revenue Account, and Journal.

Journal: Keep a journal to record deferral entries.

Deferred Expense Account: Expenses on Current Assets are delayed until recognized.

Deferred Revenue Account: Revenues are deferred on current liability until acknowledged.

Generate Entries: When submitting a client invoice, Odoo produces deferral entries automatically; however, users can generate them manually by selecting the Manually & Grouped option.

Amount Computation: You can compute the invoice using several computing methods and postpone over specific duration, such as the ‘Equal per-month’ and ‘dependent on days’ computations, which account for differing amounts dependent on the number of days.

If the Generate Entries field is set to On invoice/bill validation, Odoo will generate deferral entries during invoice validation. After entering the relevant information, save the settings and go to the next stage.

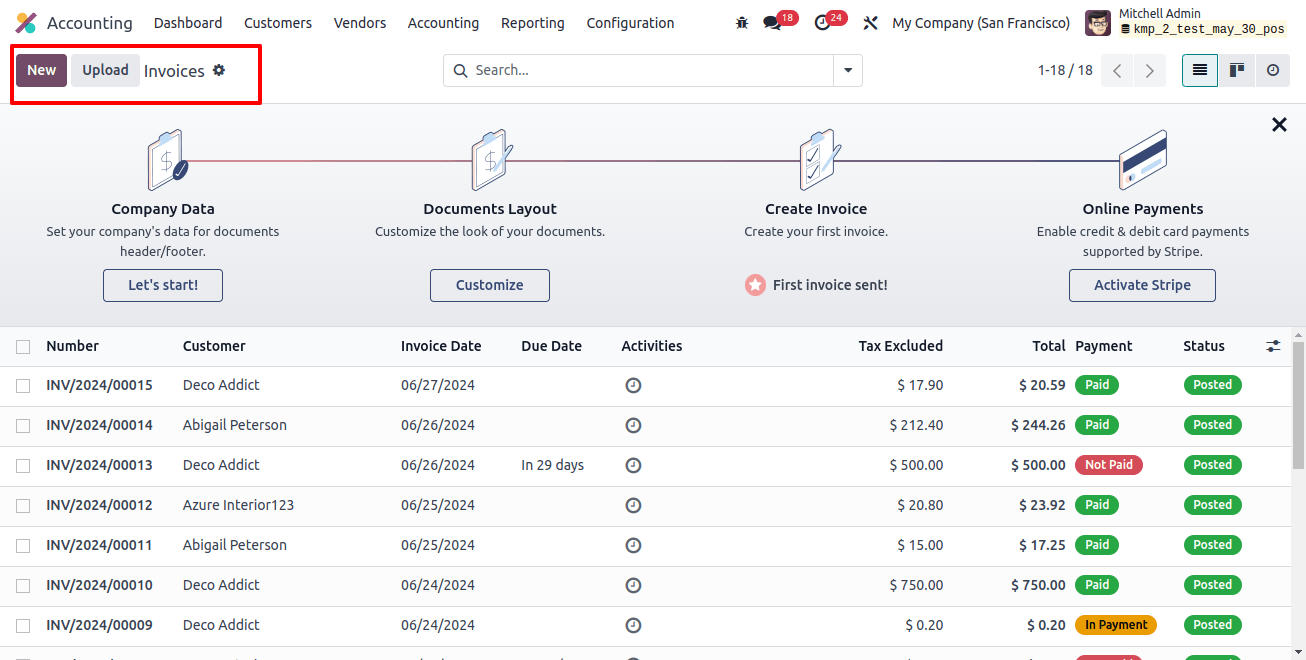

Create a New Invoice

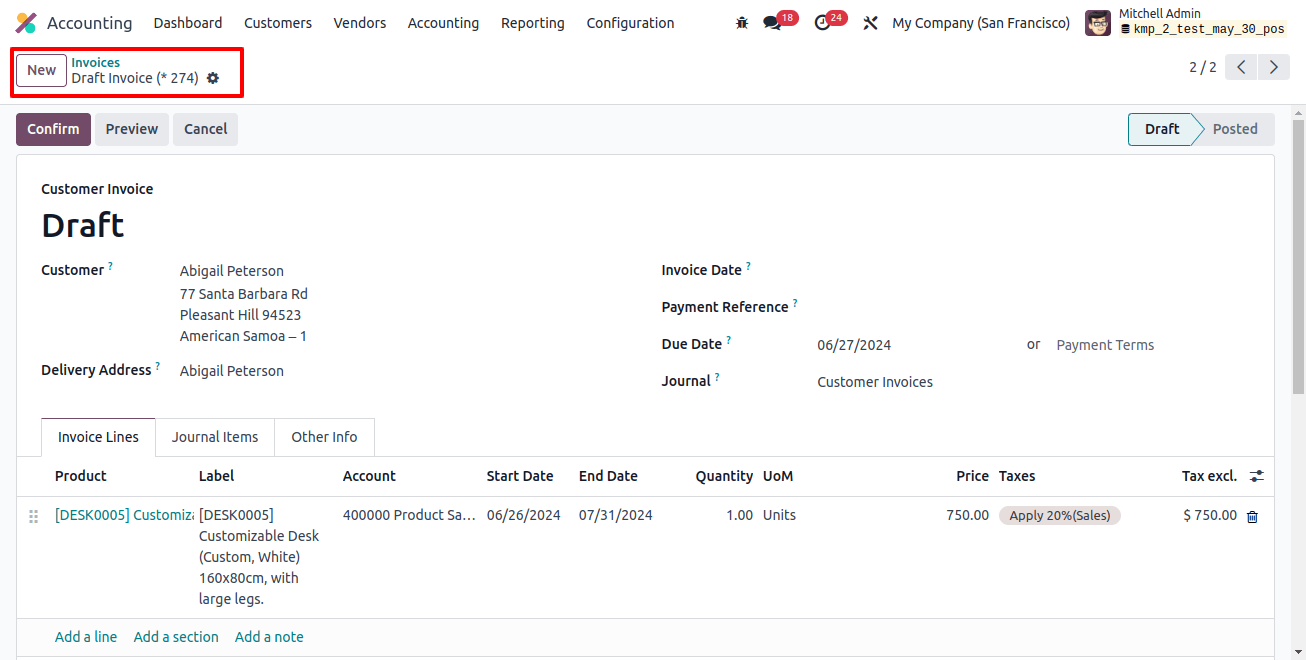

To test the capabilities of computing delayed income computations, we can create a new customer invoice using the ‘Invoice’ window in the ‘Customers’ menu.

From the invoices dashboard, create a new invoice configuration form and begin modifying the form fields such as customer name and invoice date.

The remaining elements, such as Delivery Address, due date, journal, and so on, will be filled out automatically based on the customer’s information and the invoice date, as shown below.

Next, check that the ‘Start date’ and ‘End Date’ fields are visible in the ‘invoice lines’ tab, usually in the same month as the invoice date.

Then, pick the ‘Add a line’ option to include the invoice goods in the ‘invoice lines’ tab. Adding invoice products will display the journal items on the ‘Journal items’ page, and you can also enter any other invoice information in the ‘other info’ tab. Finally, save the form data and finalize the invoice by clicking the ‘finalize’ option.

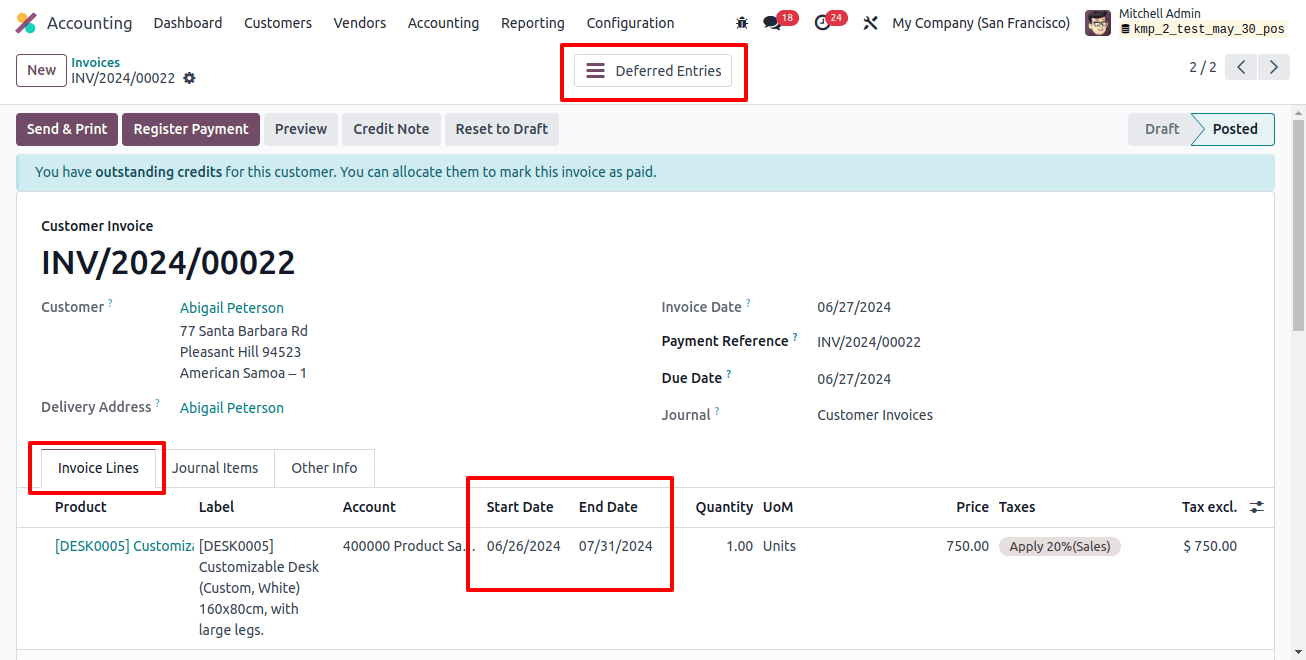

The invoice amounts are transferred from the Deferred Account to the Income Account on the same day as the invoice, with future deferral entries moving the invoice amounts monthly to recognize revenue.

The Odoo Generate Entries field is set to On invoice/bill validation by default in the configuration settings, which activates the smart button at the top of the form to generate deferral entries. To view these entries, press the ‘Deferred Entries’ smart button.

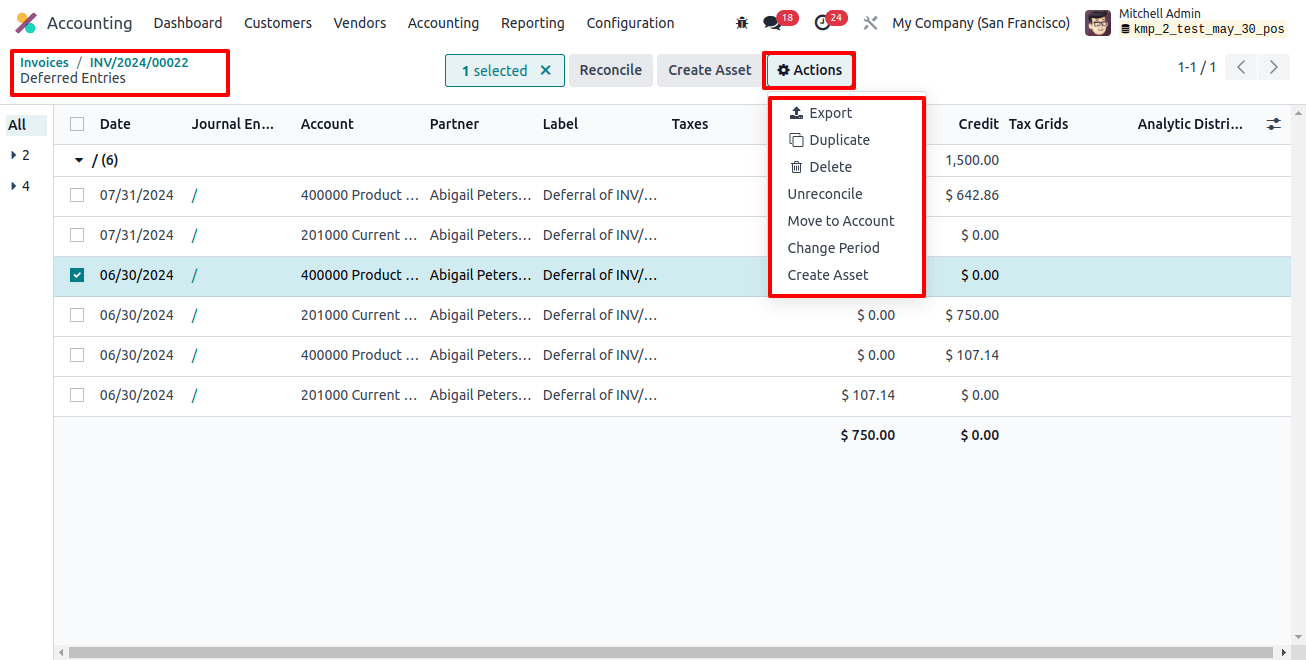

This deferred entries window displays a detailed dashboard of all deferred journal entries, including the date, journal entry, partner, label, taxes, debit, credit, and so on, as shown below.

The Reconcile and Create Asset buttons allow you to select deferred journal entries, reconcile them, and create assets. The ‘Action’ menu allows you to export, duplicate, remove, unreconcile, and change the period, among other options.

Deferred Revenue Reports

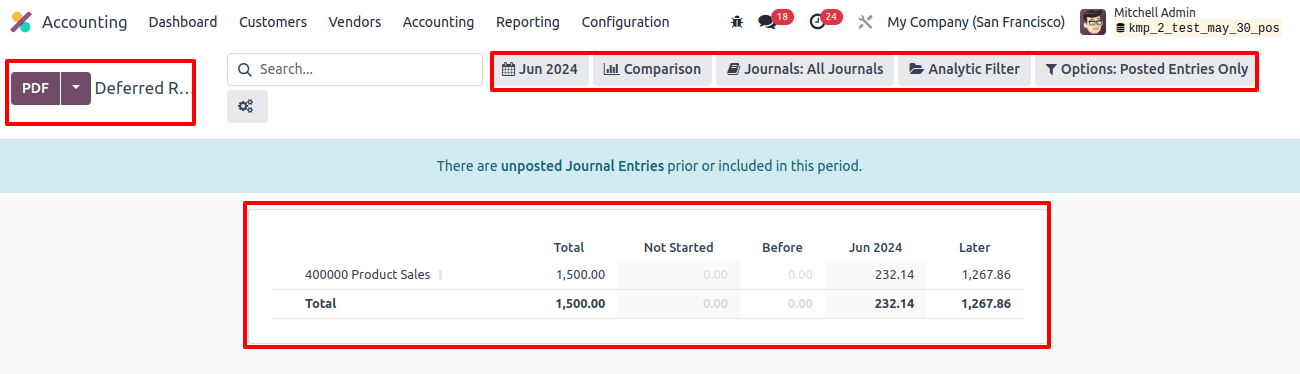

Odoo includes a variety of reporting capabilities in its ‘Reporting’ menu. Using the ‘postponed revenue’ reporting window, we may access or generate reports such as profit and loss statements or balance sheets to see how postponed revenue affects your finances.

We can generate deferred revenue based on the last month, last quarter, last fiscal year, this month, this quarter, and this fiscal year. Regularly examine deferred income revenue entries to ensure correct financial reporting.

We can also make changes as needed, particularly if the projected delivery date of goods or services changes, using the various filtering options at the top of the page.

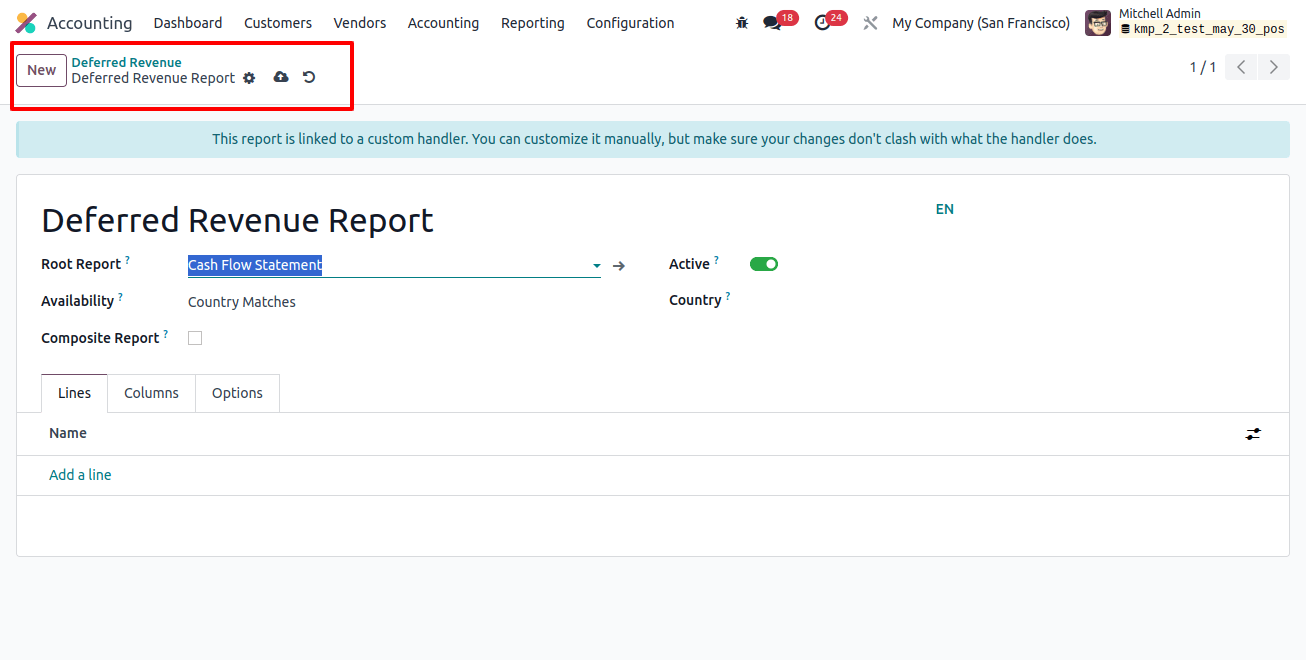

Clicking the ‘Settings’ icon on the right side of the screen allows you to configure or produce new reports using the Deferred Revenue Reports configuration form, as shown below.

The right administration of delayed revenue is important for accounting regulations and maintaining accurate financial records.

Odoo 17’s accounting module simplifies this process, providing businesses with the tools to manage delayed income seamlessly.

By following the methods provided in this guidance, businesses can ensure that their financial reports accurately reflect their income, resulting in better decision-making and financial management.

Related Post: