Certain expenses cannot be deducted from a company’s taxable income due to tax restrictions. These charges are referred to as prohibited costs. Understanding these charges is important for accurate tax reporting and compliance with tax laws because they are not considered acceptable deductions.

They can be confused for permitted expenses, such as company entertainment, loan repayment, apparel, asset depreciation, fines, penalties, and charitable contributions.

These expenses, including personal benefits, are taxable and must be taken into account when calculating whether they are eligible for a corporate tax deduction.

Certain expenses may be excluded in business profit and loss computations, making them ineligible for deduction from fiscal results.

However, the Odoo 17 Accounting management system provides a more streamlined approach to disallowed expenses, allowing for real-time financial reporting.

This blog intends to walk you through effectively managing disallowed expenses using Odoo 17 Accounting’s advanced features.

Configuring Disallowed Expenses in Odoo

Make sure you have installed the accounting and expenditure modules in your database before attempting to manage prohibited spending.

Once installed, use the AppStore search box to find modules for disallowed expense management and install them. After completing the installation, go to the main dashboard and pick the Accounting module.

Access the ‘Configuration’ menu and select the ‘Disallowed Expenses Categories’ button. This process will open a new window with pre-configured forbidden spending categories, including their Code, Name, Related Accounts, and Current Rate data, as well as the possibility to set new ones by clicking the ‘New’ button.

When you select the ‘New’ option, a new line is added to the document where you can input the restricted spending category’s name, related account, and current rate. Use the set rates option to further customize rates, including variables like start date, Disallowed %, and company.

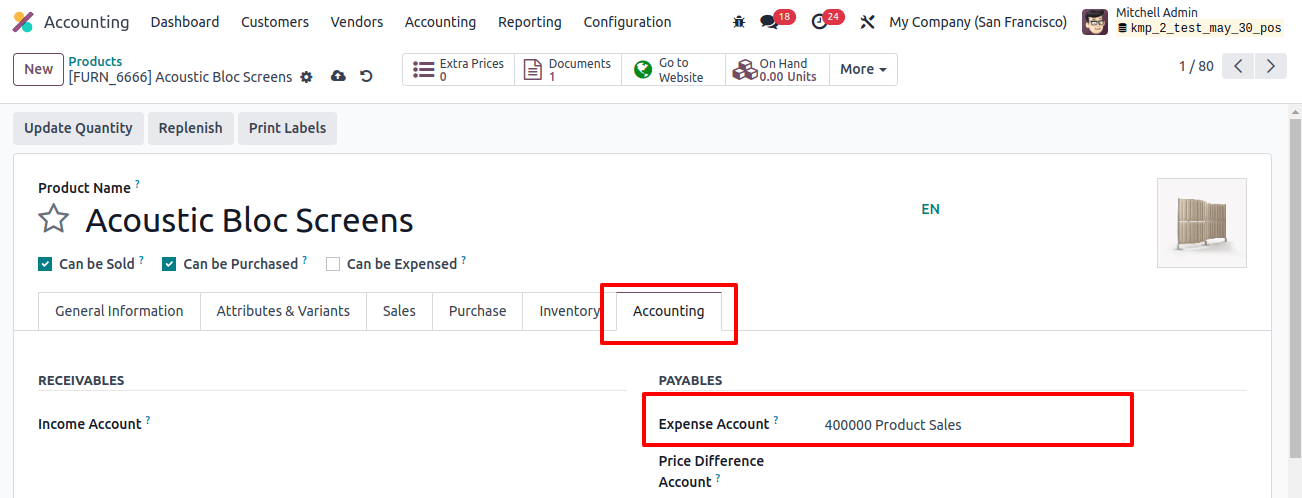

The chart of accounts platform connects the set of accounts. Navigate to the chart of accounts, choose an appropriate expenditure account, and enter the disallowed expenses in the designated field.

This set up a link, ensuring that banned charges are computed using the designated category when adding new expenses.

To set rates for banned spending categories, select the set rates button. To change any category details, simply click on them and proceed to the form page, where you can amend data and set rates.

The form view displays pricing specific such as the code, category, name, company, and related account. The vehicle is necessary for the vendor bill booking in the car category field.

The Rates tab allows you to enter rates one at a time, along with the start date, Disallowed%, and Company data. This specifies the proportion of the amount that will be prohibited for expenses in this category.

In the Chart of Accounts platform, a newly formed forbidden category can be linked to an expense account. This enables the mention of Disallowed Expenses in the specified field.

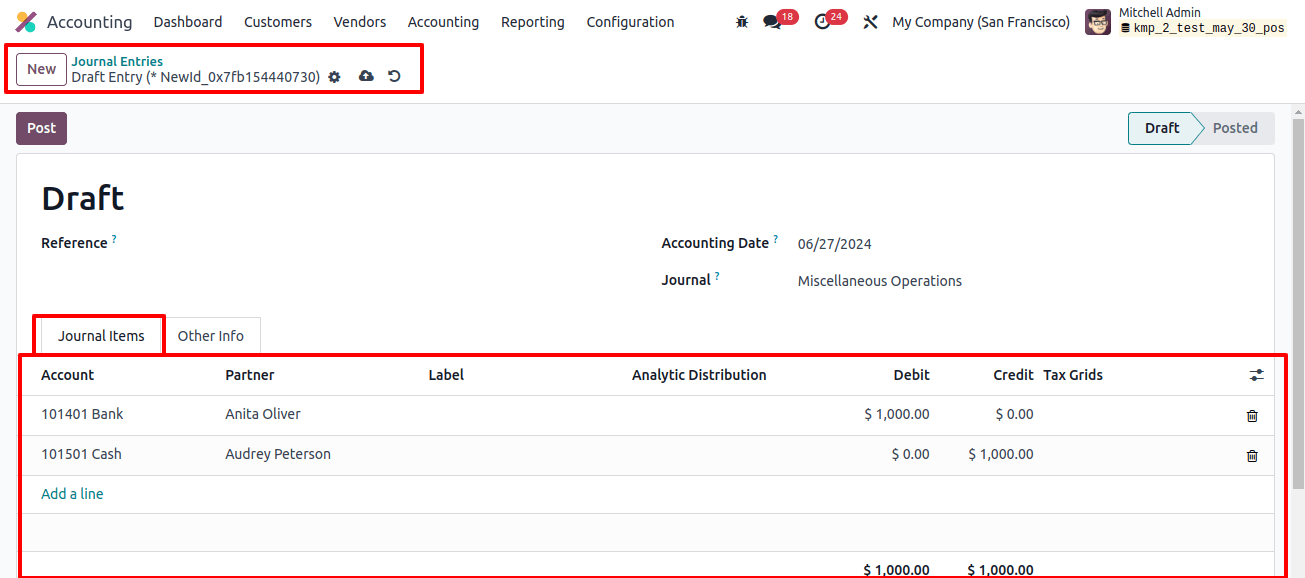

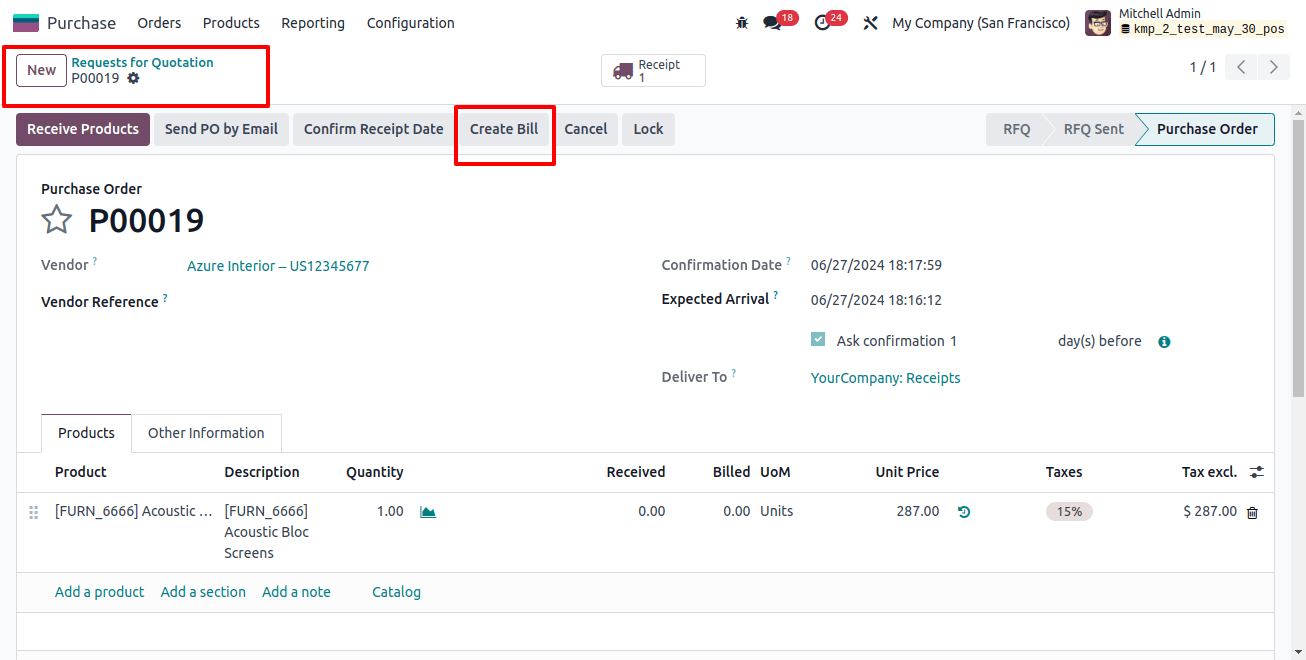

Create a Purchase Order

Consider the following scenario: A product is purchased using an expense account tied to a forbidden category.

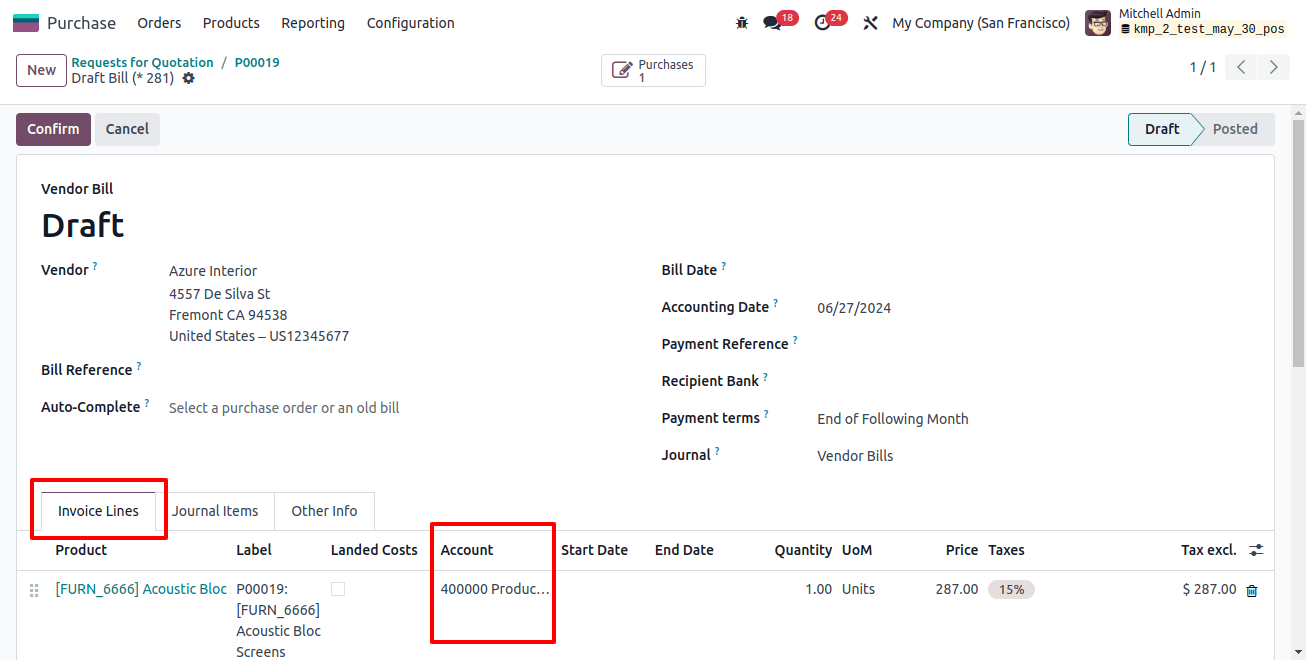

Then, from the Odoo buy module, use the ‘Orders’ menu’s ‘purchase orders’ window to create a buy order. Use the ‘create bill’ button to generate a bill after creating a purchase order to confirm receipt of the merchandise.

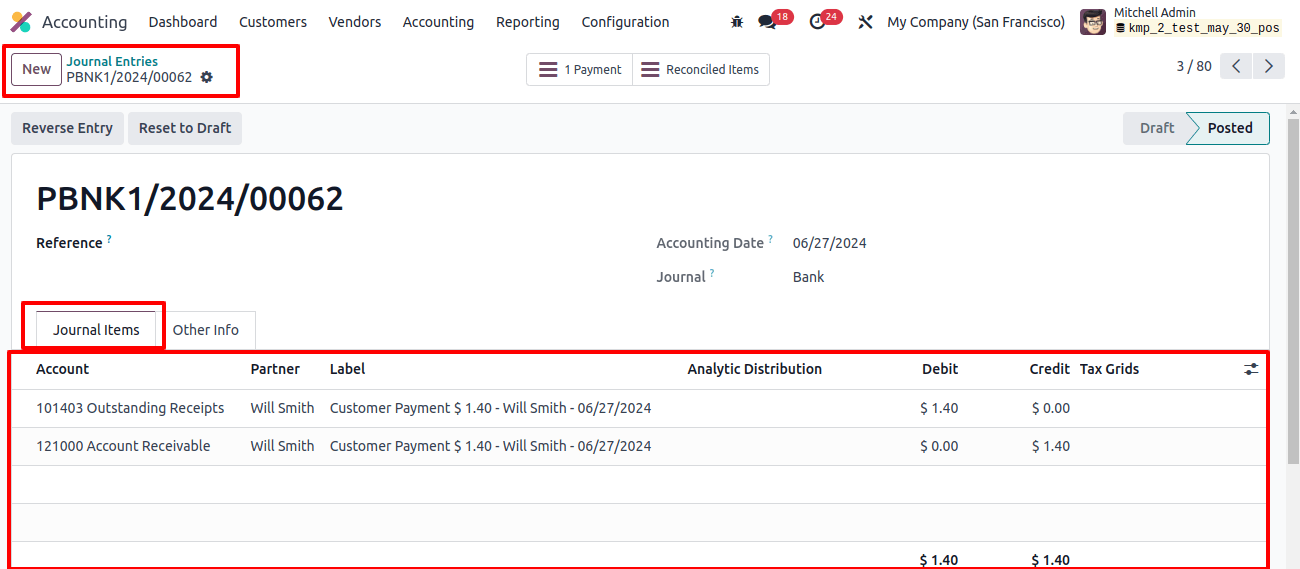

After checking the bill, look for the impacted account under the Invoice line and journal items page, as shown below.

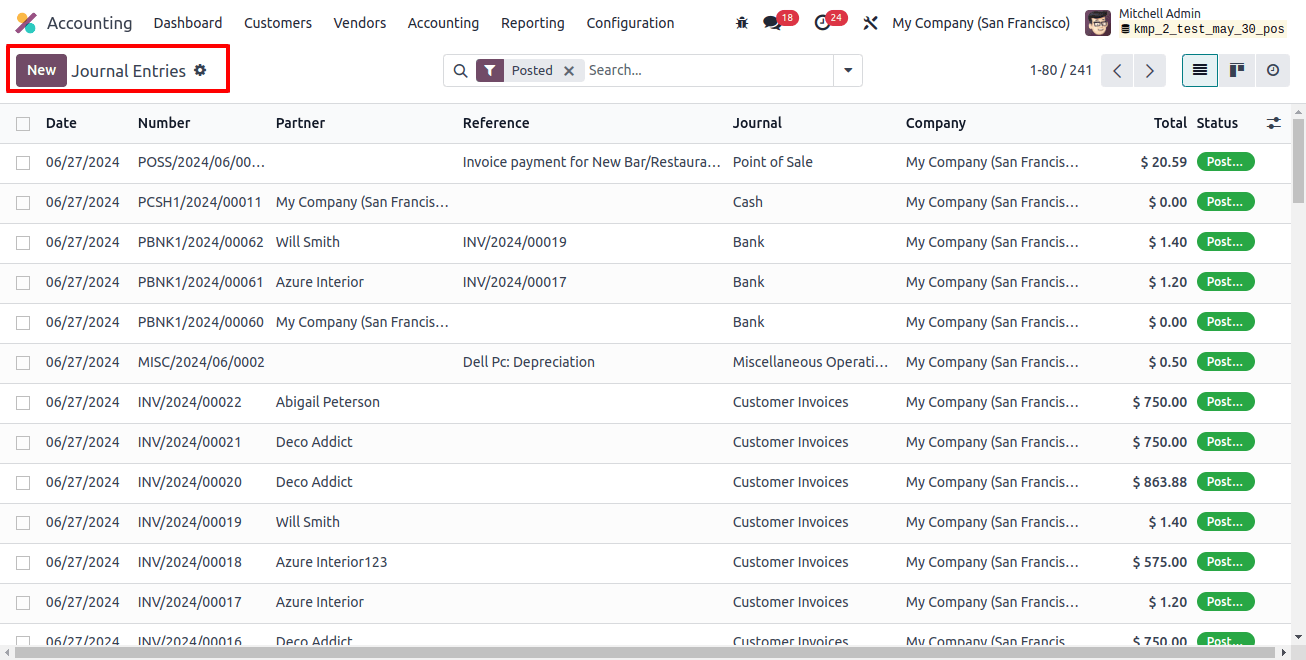

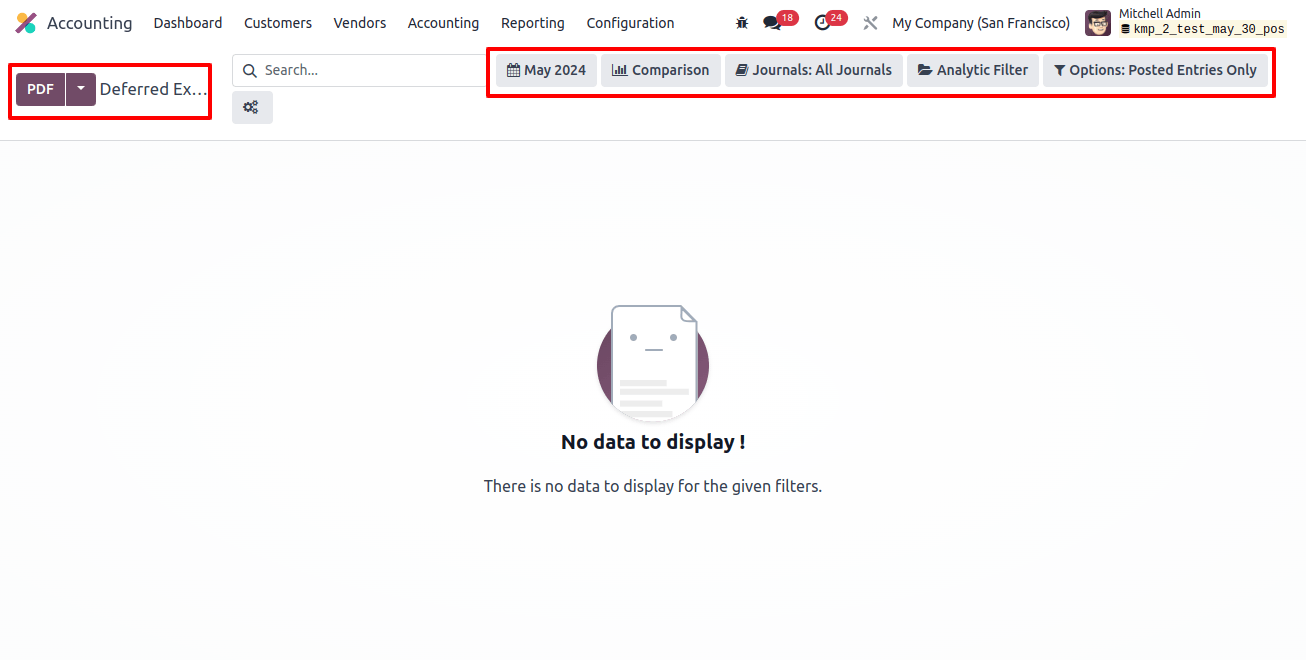

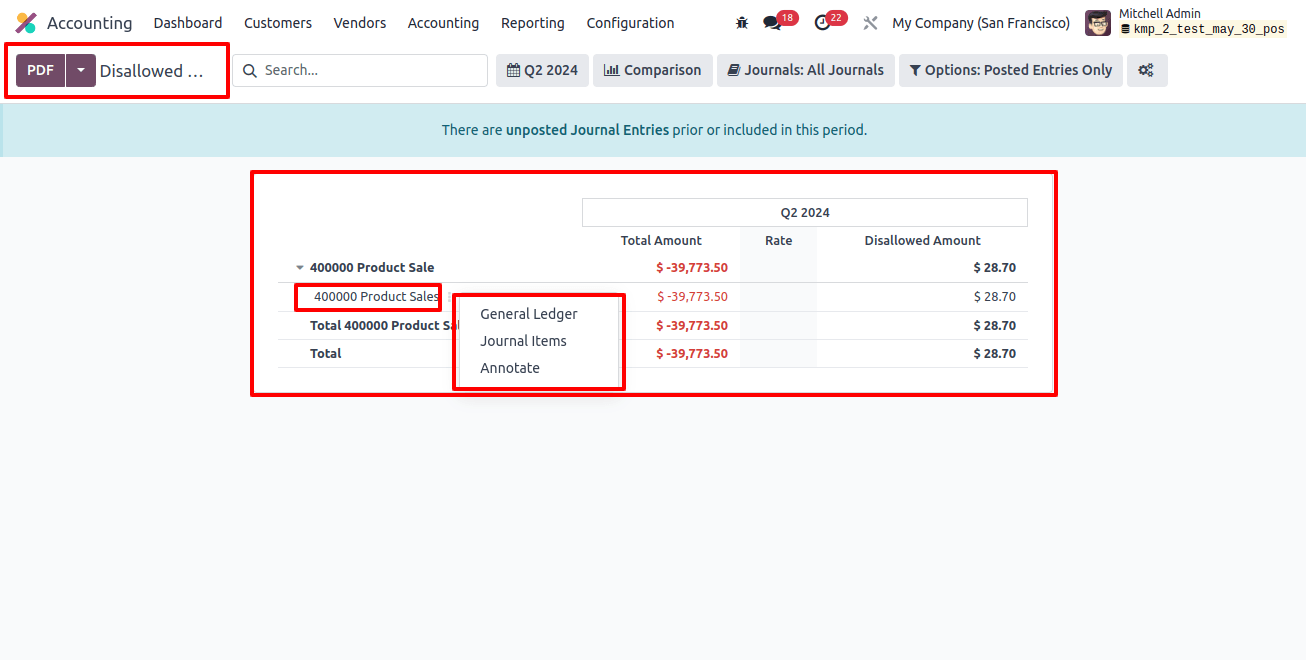

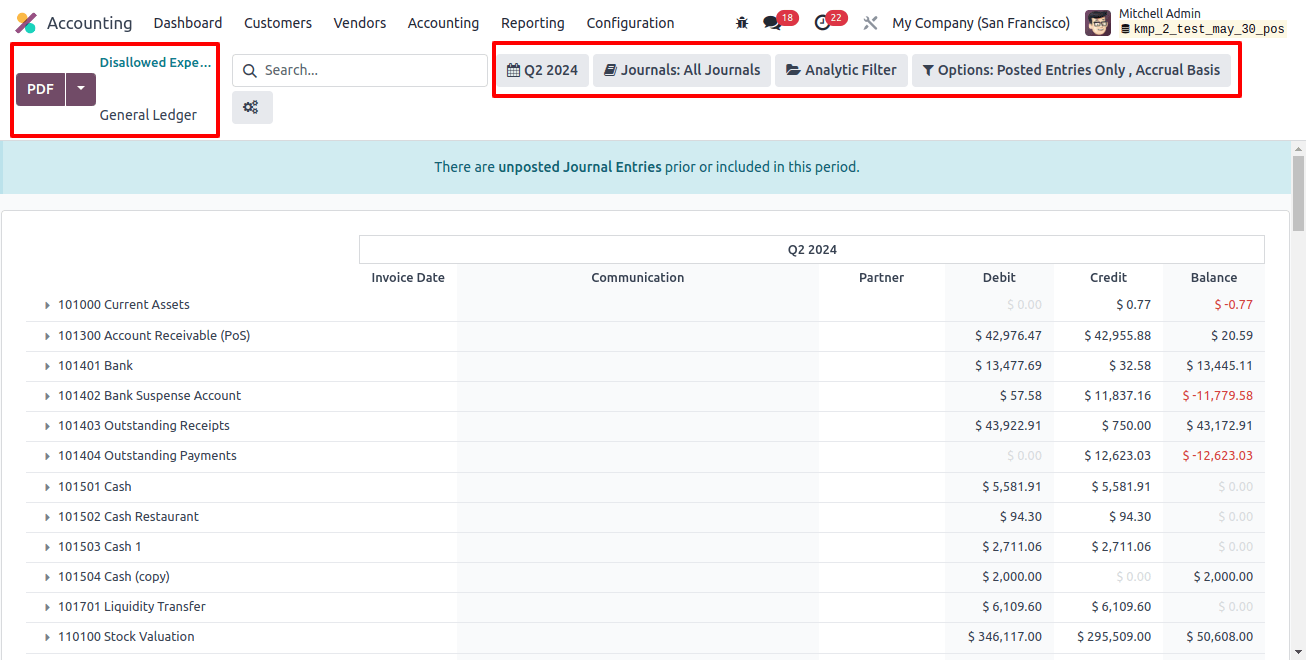

Now, return to the Accounting module. The accounting module displays banned expenses under the reporting menu, allowing you to create detailed reports on forbidden spending categories and associated accounts.

The report contains information about journal items, dates, communication, partners, currencies, debits, and banned expenses.

This report can be converted to PDF and XLSX formats, and the General ledger button allows for further study of the general ledger related to reported disallowed expenses. Also, the Annotate option allows you to add footnotes to your report.

In conclusion, this blog has guided properly managing forbidden expenses in Odoo 17 Accounting, including the installation process and setting of disallowed categories in the system.