Every day, a company will process several transactions. Payment is made for the amount received from the client via invoice. However, the business’s accounting staff may be unable to record all transaction information and amounts in the bank account at the moment of the transaction.

Account statements are normally analyzed and approved at the end of each week. Reconciliation is reconciling data from a cash transaction with a bank account.

This approach makes it easier for the accounting team to track entry errors. Reconciliation ensures transparency in transactions. This ensures that transactions are executed properly.

Odoo Accounting includes special tools that make reconciliation simple. As a result, the system immediately commences the reconciliation process after the procedure is completed and any changes are discovered.

To speed up the process, the Odoo 17 Accounting module allows for the creation of reconciliation models. We will be able to integrate customer invoices and bank data with this accounting module.

When is an account reconciled?

After each bank account has been reconciled, it ensures that all of your journal entries are appropriately put into the bank statement. We use a reconciliation technique to speed up the completion of this work.

We can create and implement reconciliation models to speed up the process because we must deal with recurring reconciliation processes.

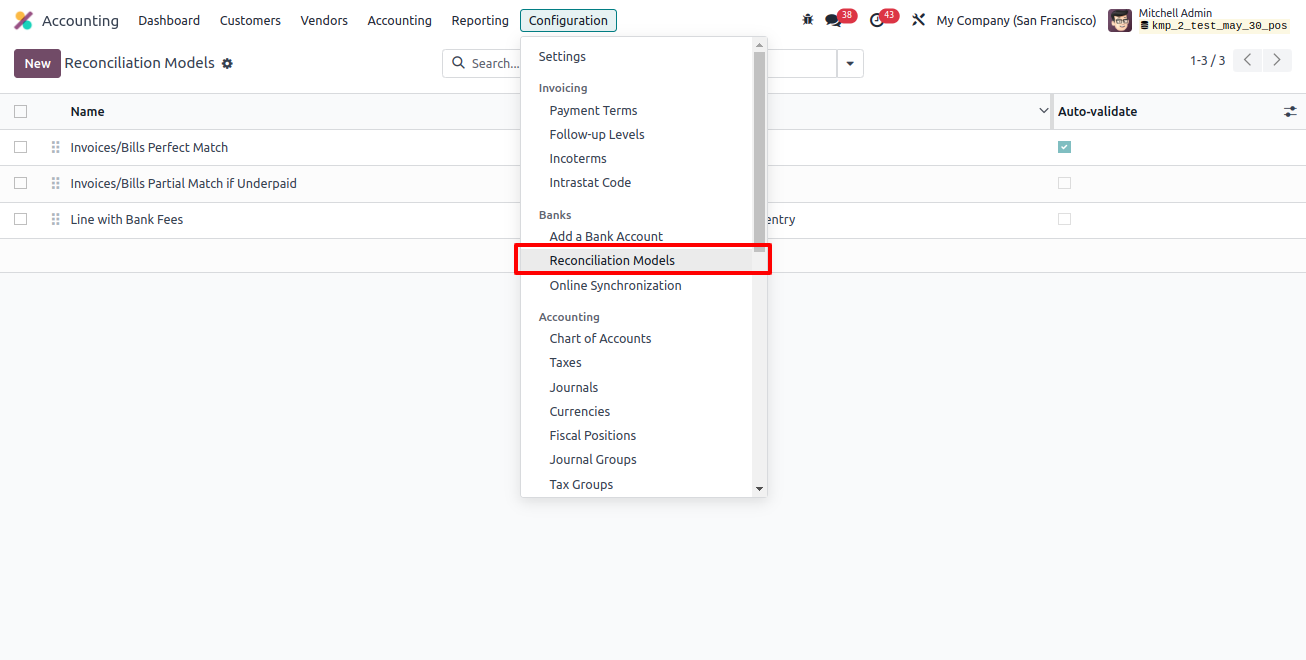

We may create a reconciliation model using the Odoo 17 Accounting Configuration menu. A reconciliation model is available under the Bank field.

Models of Reconciliation

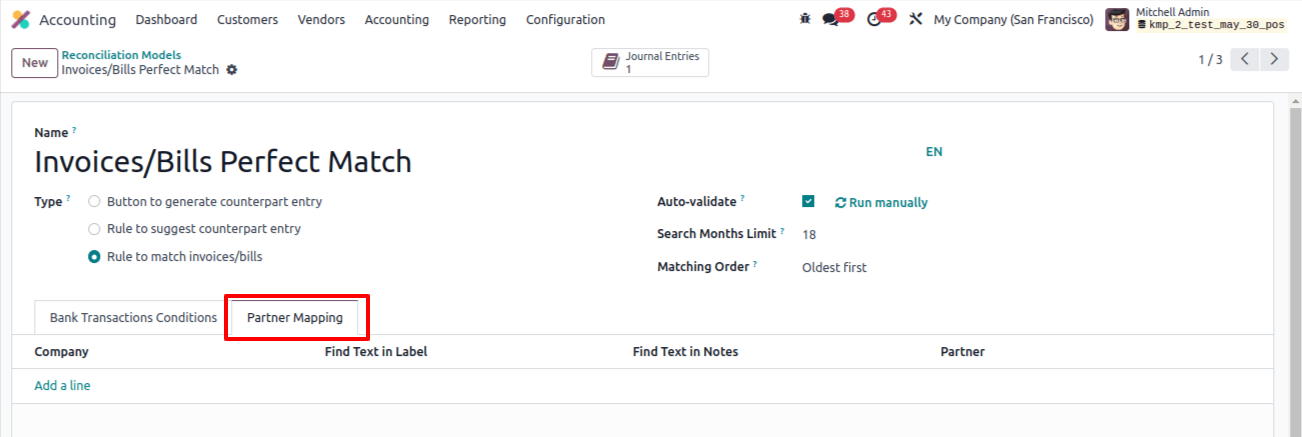

A complete reconciliation model is accessible here. Let’s open it to see what’s inside.

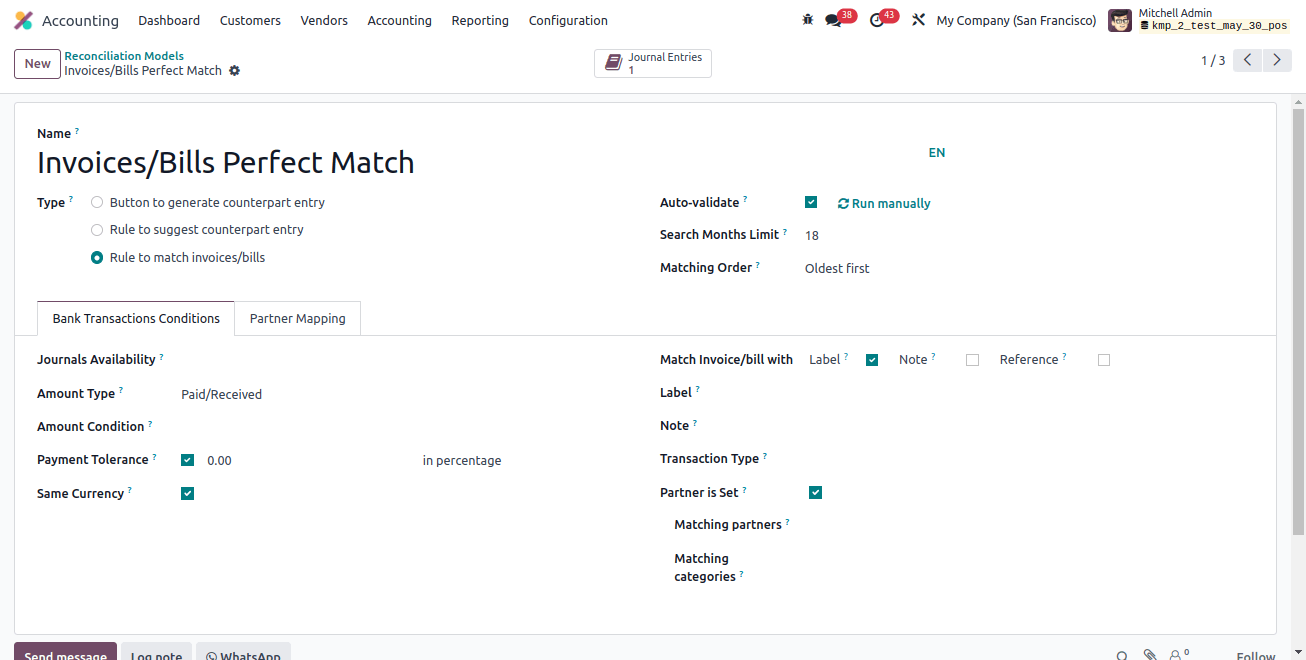

Odoo allows users to name reconciliation models. Another option is to create a reconciliation model. This form allows users to create three different models. They are

- Compare the current bills and invoices.

- When a button is clicked, manually create a write-off.

Propose equivalent values. We created a model with rules to match invoices. The Auto-validate feature is another option. Once you allow the Auto Validation option, the reconciliation will be automated.

The criteria listed on the bank statement lines are what we currently have. In this situation, we must select the journal, type of balance, quantity, and so on. The same options for balance and currency matching are available.

Partner mapping is one additional feature we have. We can confine this reconciliation to only one partner. Partner restriction: This feature allows you to select only one partner, such as vendors and consultants.

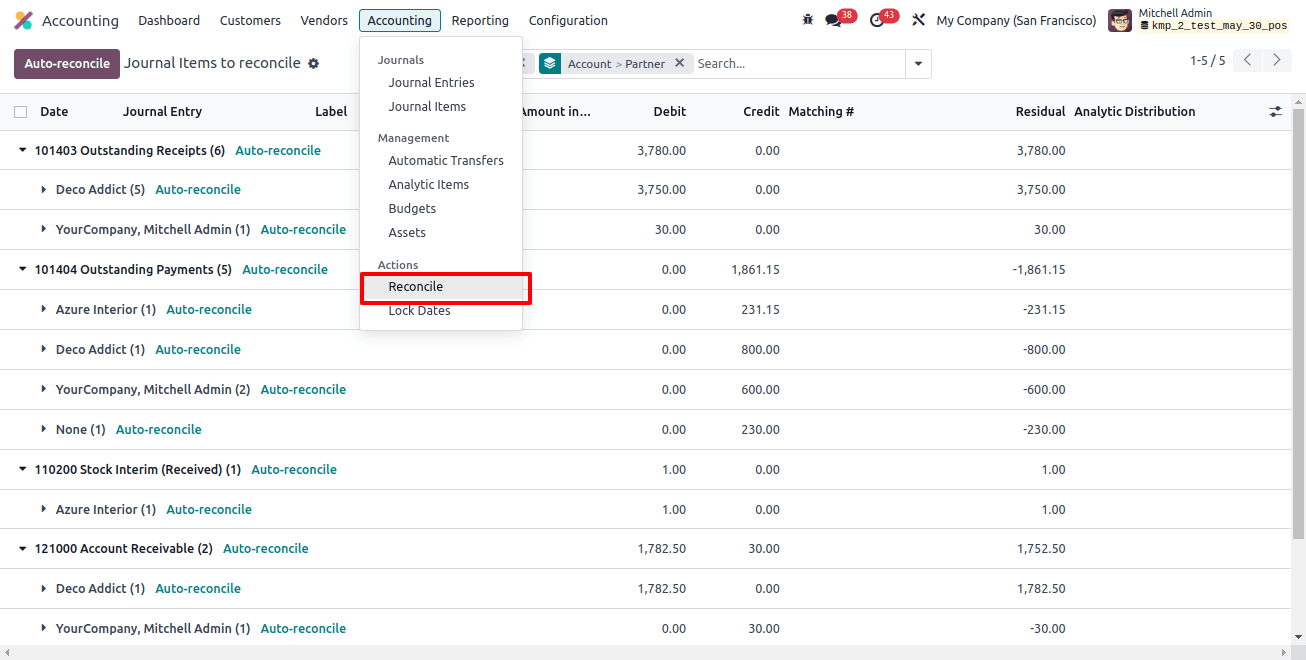

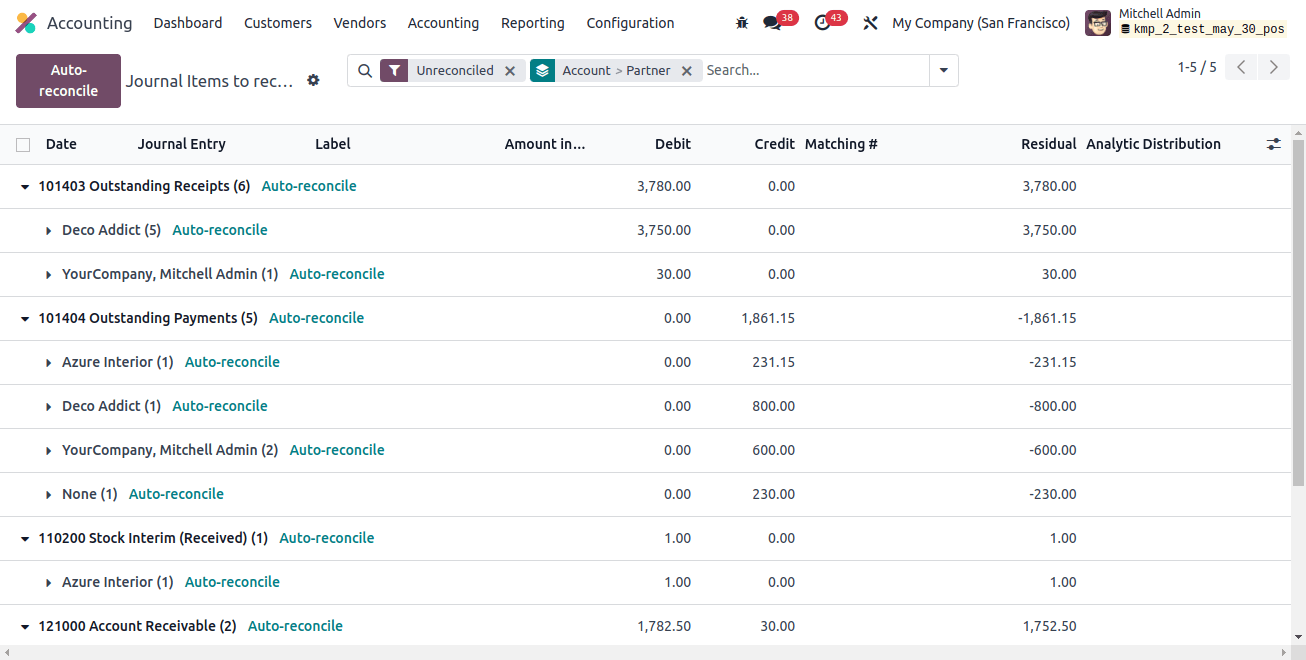

We can begin the reconciliation process once the reconciliation models are configured to our satisfaction. To accomplish this, go to the Accounting menu and select the reconciliation option. You can find it under actions.

When we click reconciliation, we see a list of accounts that need to be reconciled.

This location makes it easy to receive the invoice and payment information. The button is also within our grasp. This button will help users in finalizing the reconciliation process.

This method will allow us to reconcile the invoice or payment with the account. It will ensure that the information presented in the bank statement corresponds to that found in the journal, which includes the general ledger.

There are two ways we can complete the reconciliation process.

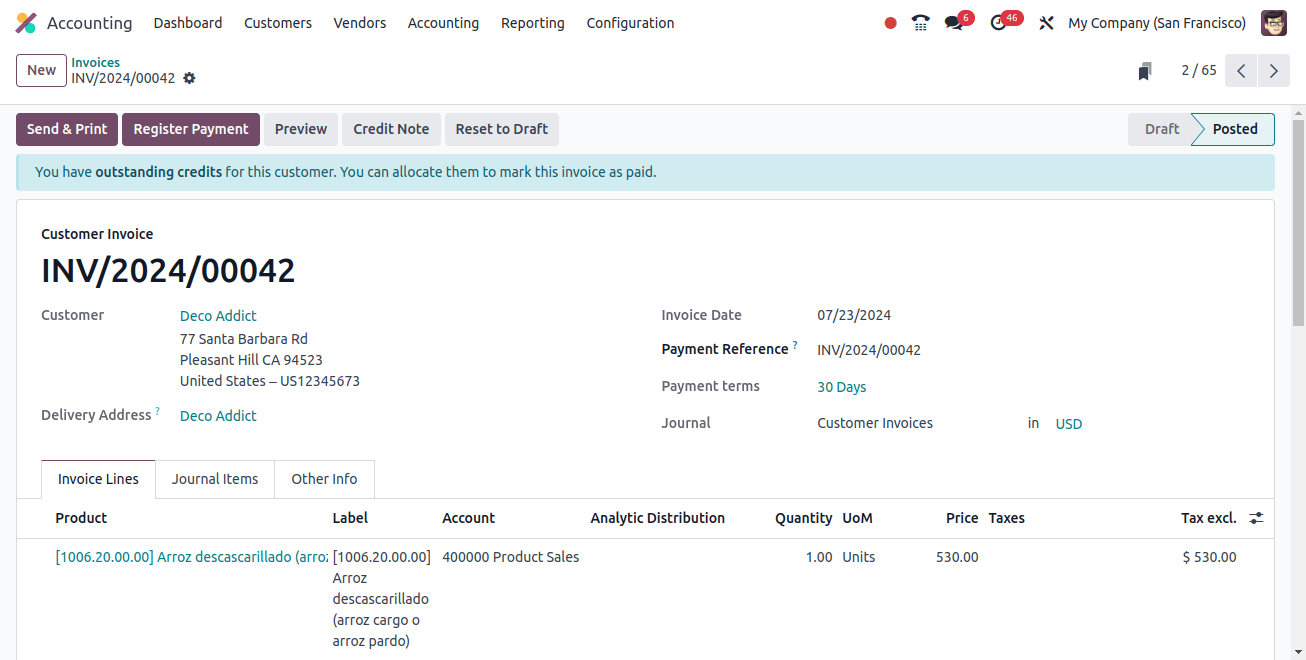

To reconcile from an invoice, we must first create an invoice.

You can enter the invoice date, due date, and customer's name here. It could be written in the journal as well. We also need to fill up the invoice lines with the important information.

A product, product label, account number, and analytical account must all be included in this case. We can also provide the product’s price, quantity, unit of measurement, and tax details.

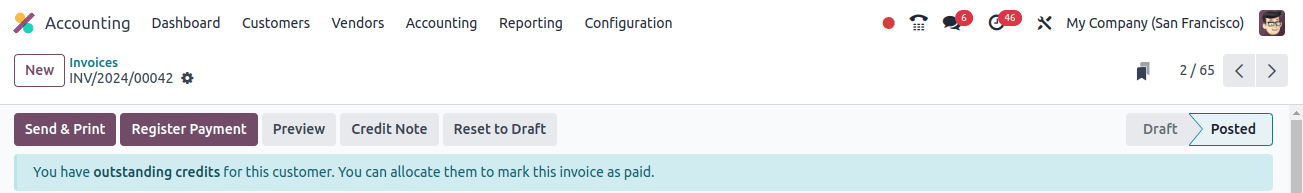

After an invoice is generated, it must be confirmed. Following that, we must register payment.

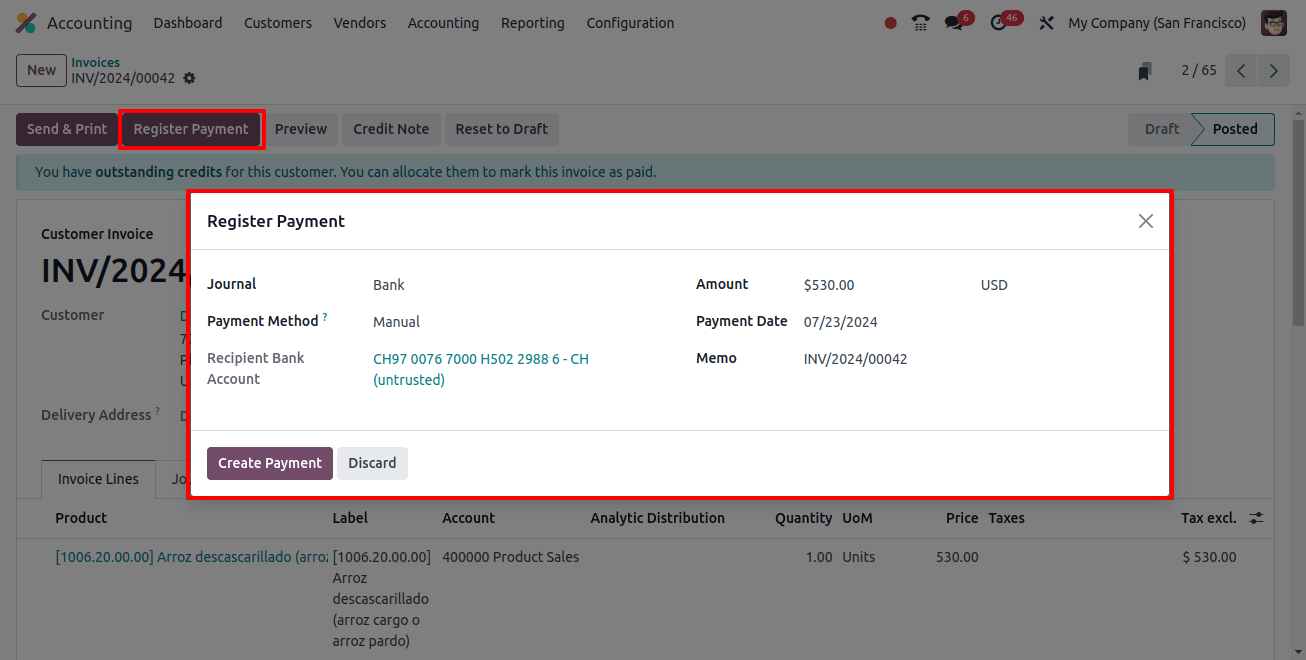

When we register a payment, we are directed to a new page, as shown below.

The journal’s name can be entered. Choose one payment method and include others. Here we can also put the payment date and amount. After that, make the payment, and we will know the process is complete.

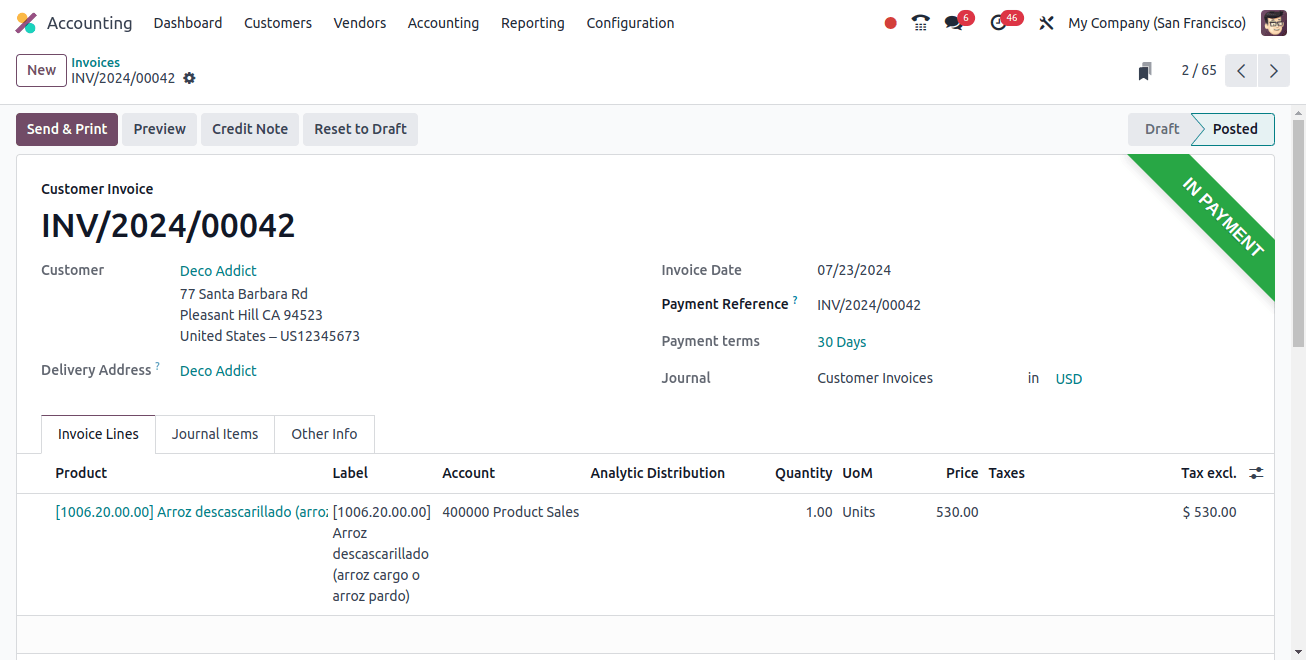

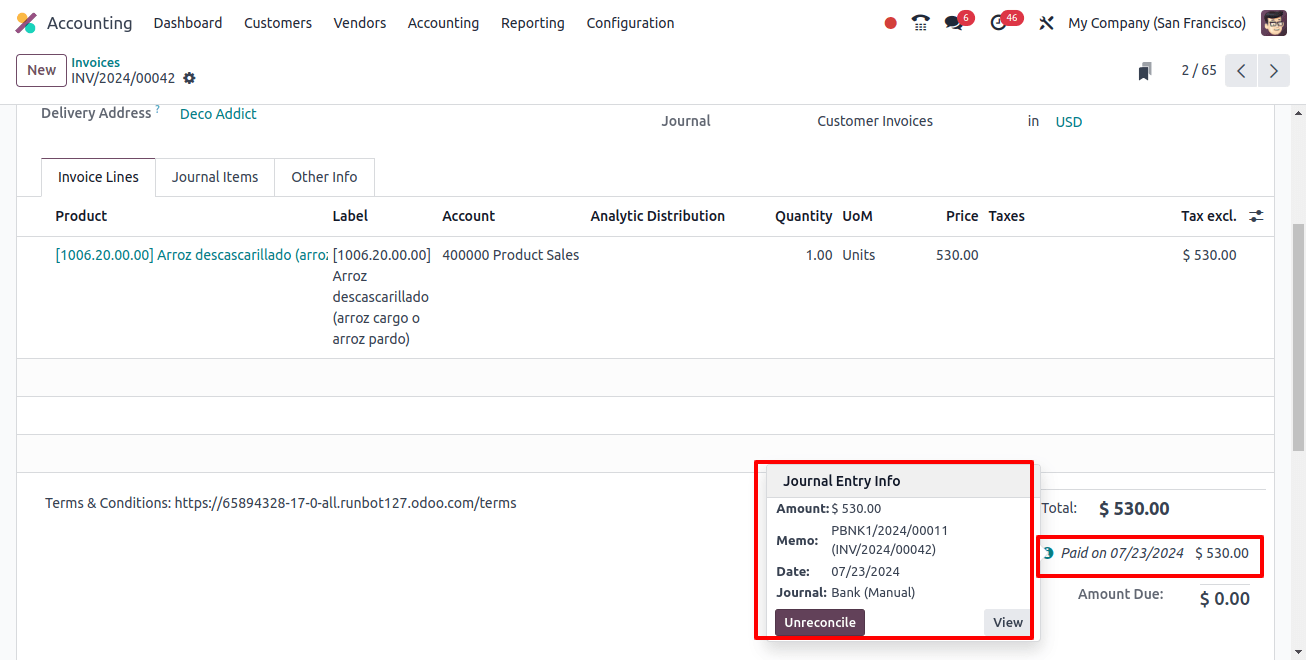

This is the page that appears when a payment is made. There's a ribbon on this invoice.

This is the page that appears when a payment is made. There's a ribbon on this invoice.

The invoice page lists the amount owed as well as the payment date.

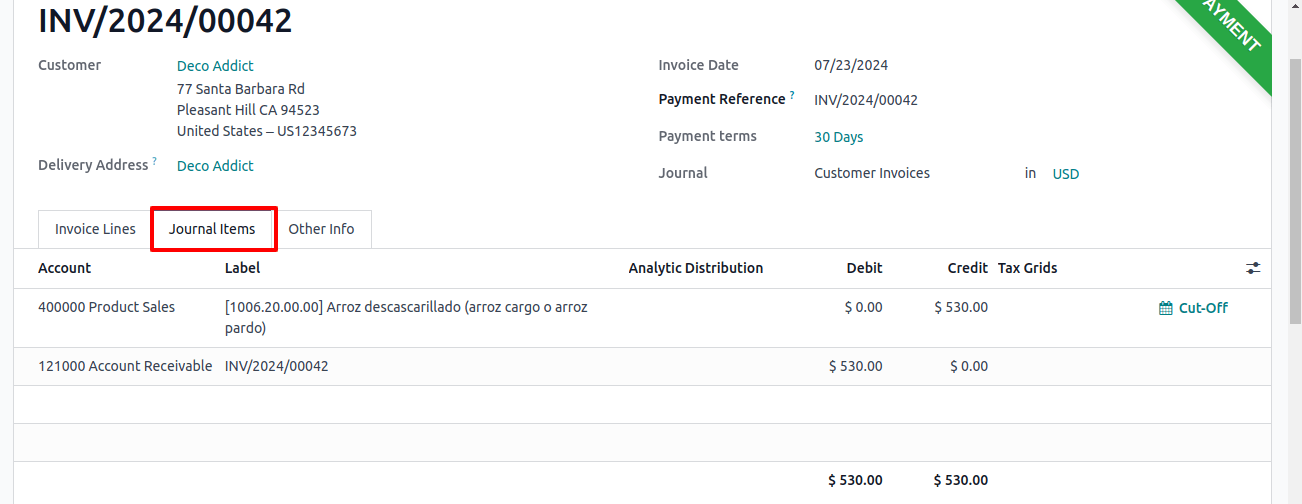

Close to being paid we can find an icon on the date. The indicator indicated that the invoice had been automatically reconciled.

We can now click the un-reconciled button to cancel the reconciliation. Example of bank statement reconciliation. This is another route to reconciliation.

Since we’ve already discussed invoice reconciliation, a bank statement can be used to confirm reconciliation. We must create a fresh bank statement to accomplish reconciliation. Bank statements can also be imported to do this.

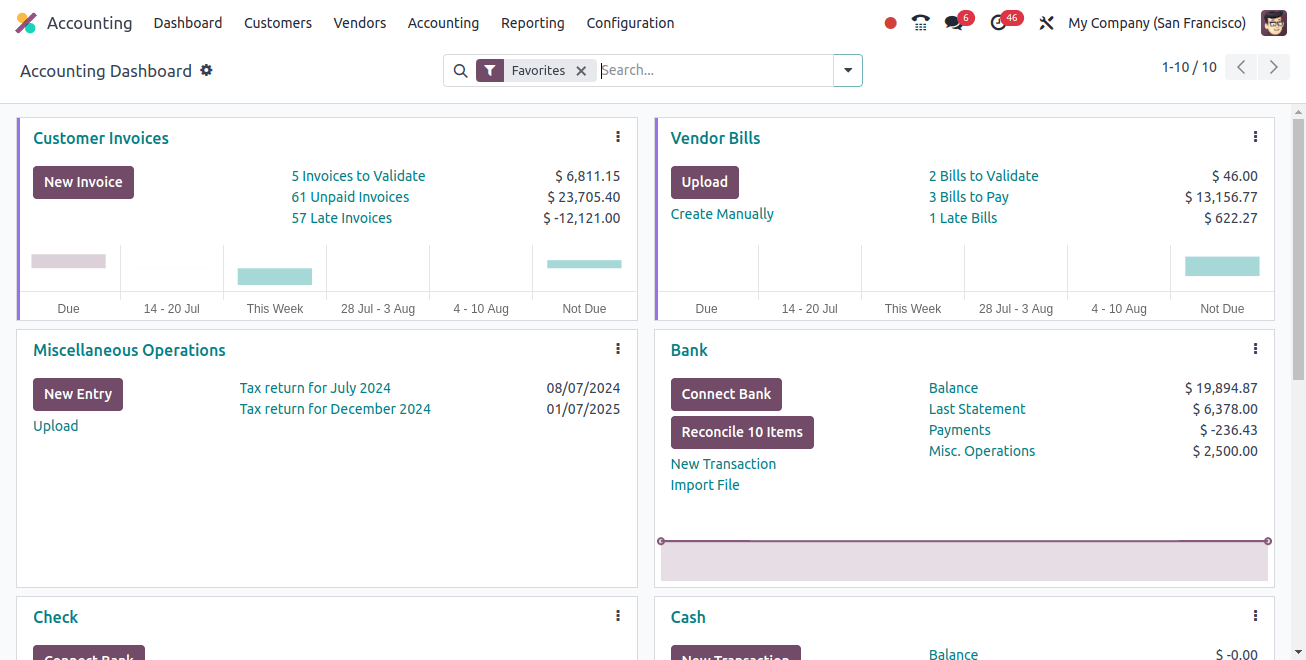

To achieve this, go to the Accounting dashboard’s bank feed section. Click on Bank Reconciliation to analyze the statements that are awaiting reconciliation.

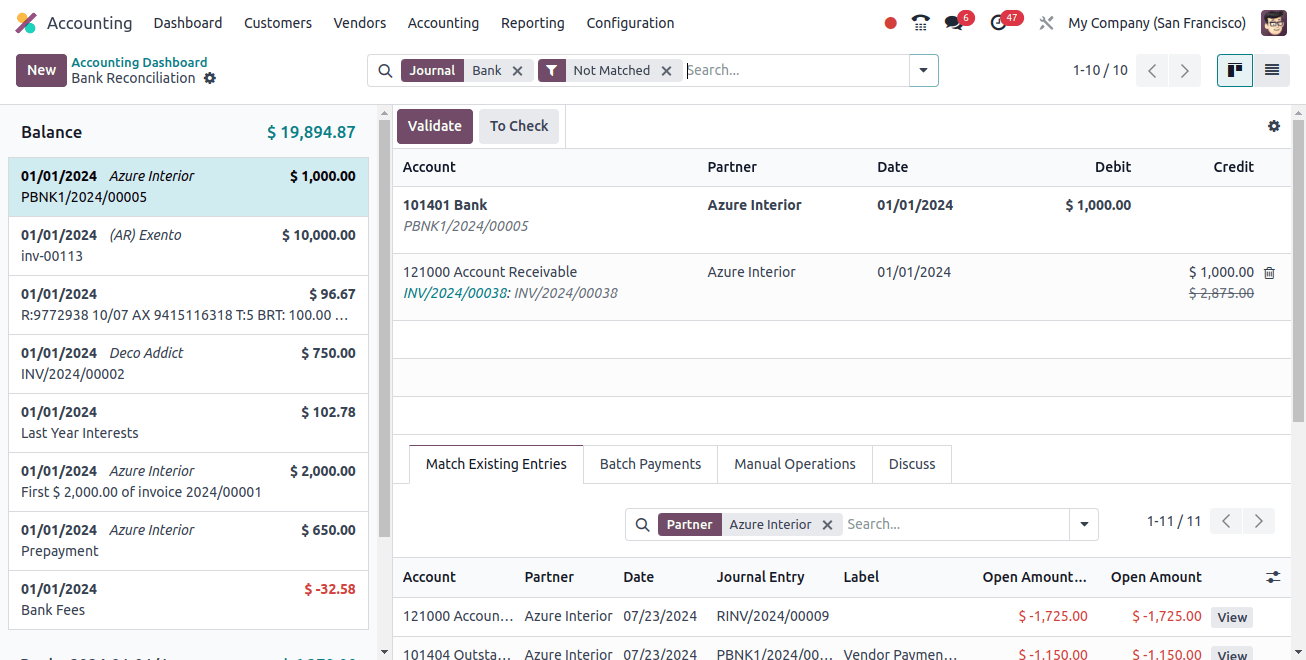

Use the existing statement or create a new one. All statements awaiting reconciliation are listed here. We can check such statements.

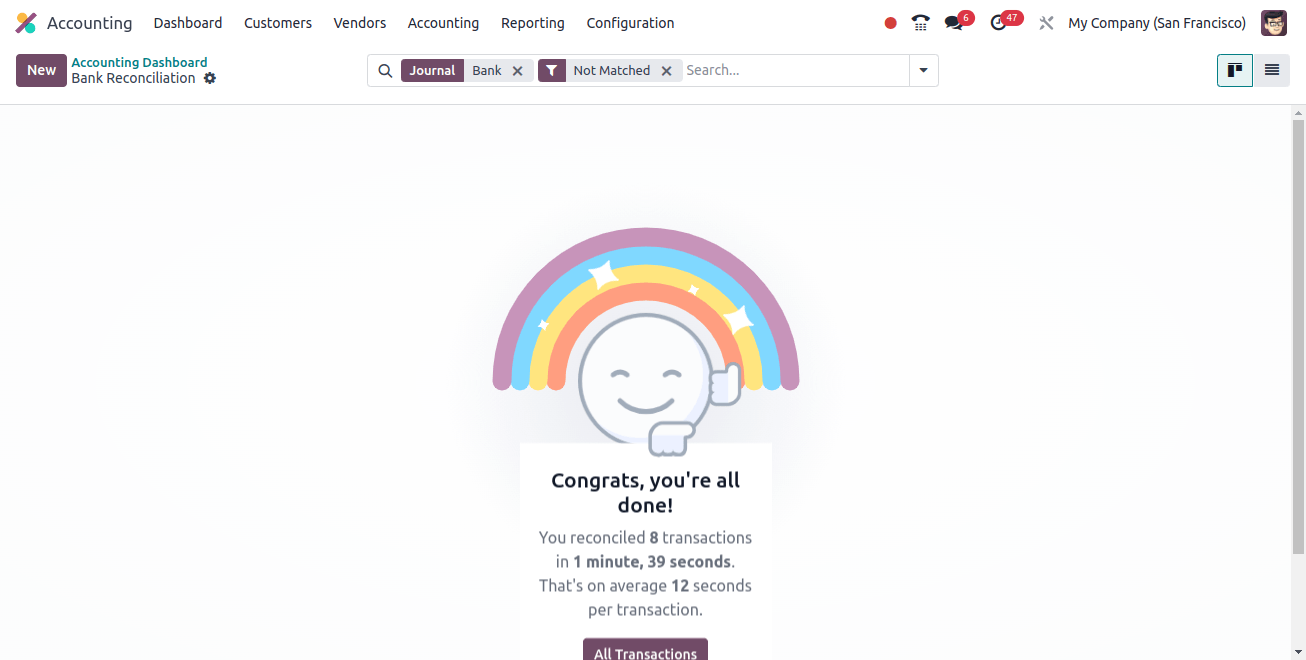

Following validation, we can observe that each transaction has been reconciled.

After that, clicking on this reveals that all transactions have been reconciled.

If we pick ‘go to the bank statement,’ we may view the bank statement. Odoo 17 Accounting uses the following methods for reconciliation. This approach will ensure that our bank statements are transparent and devoid of statistical differences.