Flexibility and adaptability are important to success in today’s fast-paced business world. With the release of odoo 17 Accounting, businesses have more flexibility over their financial reports.

This updated version has strong options for customizing financial and tax reports, giving customers specific information to guide strategic decision-making. In this post, we’ll look at how Odoo 17 Accounting allows businesses to modify their financial and tax reports to meet their specific needs.

Every business is unique, as are its financial needs. Standard reports may not always include the exact metrics and details required for strategic decision-making.

Customization allows businesses to modify their financial and tax reports to meet their objectives, industry regulations, and internal management requirements.

Important Customization Features in Odoo Accounting 17

Flexible Report Templates

Odoo 17 Accounting comes with several customizable report templates. Whether you need a thorough income statement, balance sheet, or specific tax report, these templates can help you customize reports as per your specific requirements.

Drag-and-Drop Report Builder

Odoo 17 Accounting provides a new drag-and-drop report builder that offers users an easy way to customize their reports. Simply rearrange and change report items to highlight important information or build a visual representation that matches your reporting requirements.

User-Defined Formulas

Businesses frequently use unique calculations that are specific to their industry or business model. Odoo 17 Accounting allows customers to create custom formulas, ensuring that reports represent the precise financial measures required for their decision-making processes.

Multi-Currency Support

Support for many currencies is important for multinational businesses. Odoo 17 Accounting allows for the customization of reports in different currencies, making accurate financial reporting possible for businesses with a wide range of foreign operations.

Tax Report Customization

Meeting tax responsibilities is an important part of financial management. Odoo 17 Accounting allows customers to tailor tax reports to comply with local legislation and requirements. This ensures accurate tax reporting while also expediting the reporting process.

Steps to Customize Tax & Finance Reports in Odoo 17

Odoo’s financial reports and preset, customizable documents provide a comprehensive picture of the business's financial status and transactions as a result of accounting entries generated using the Odoo Accounting module.

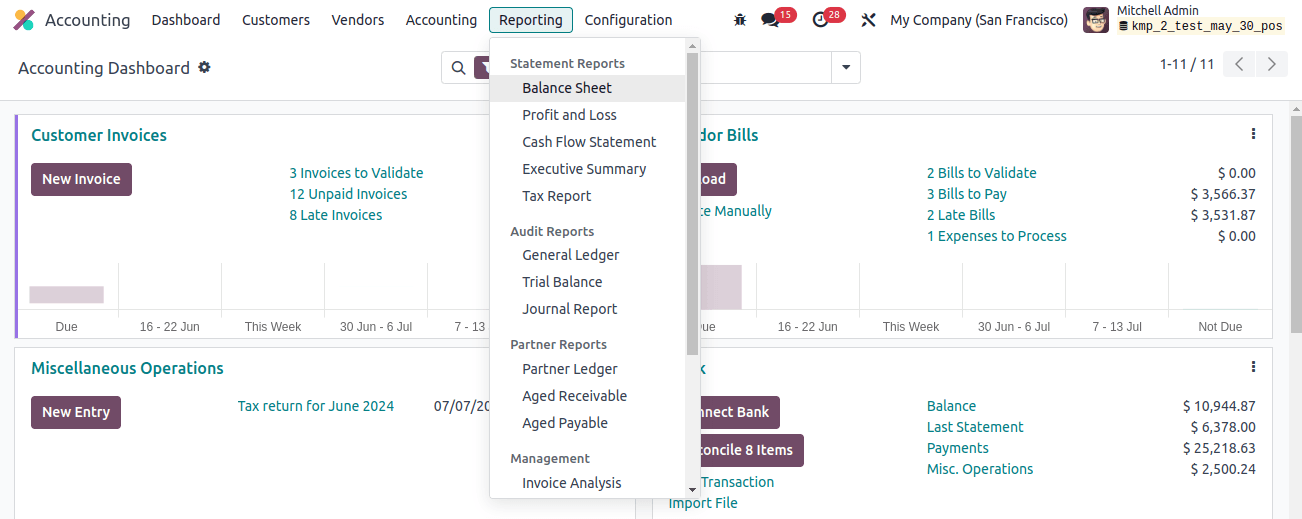

Log in to your Odoo instance and go to the Accounting module. Select the report type that you want to change from the "Reporting" section. The report includes several reports, such as Profit and Loss, Balance Sheet, Trial Balance, Aged Receivable, and Tax Report. Each option offers a detailed examination of accounting entries.

Balance Sheet

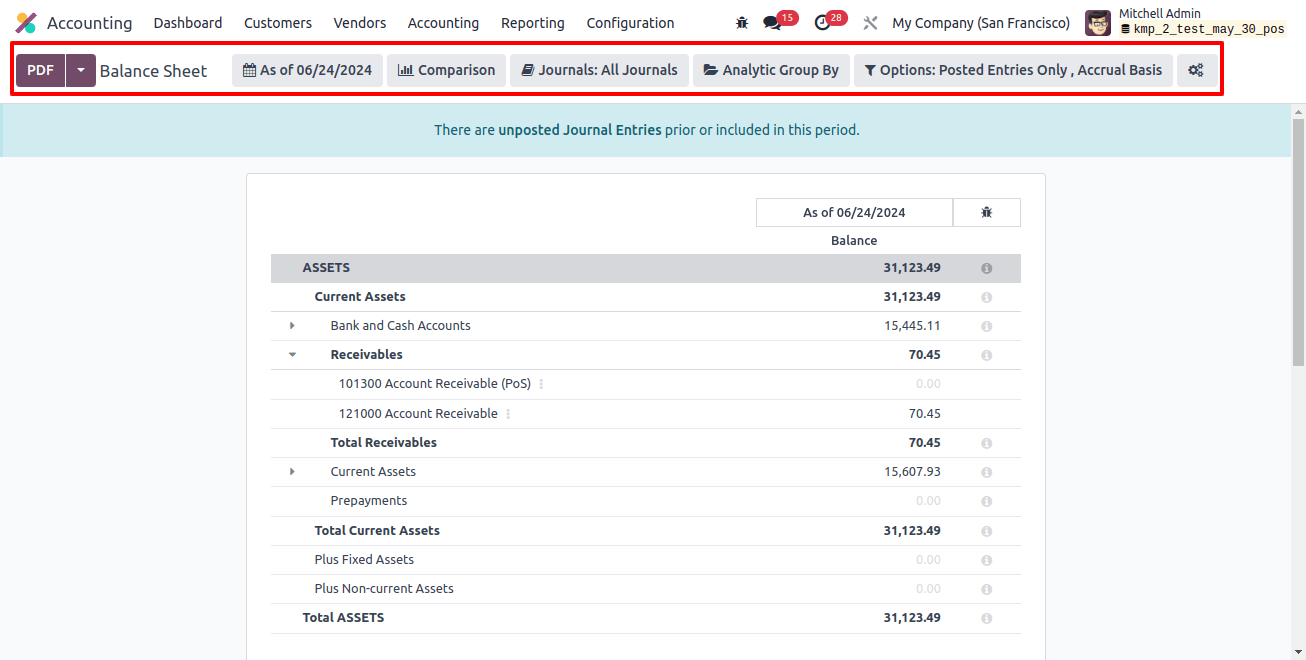

The Balance Sheet is an important report that determines a business's present financial status by summarizing assets and liabilities, thereby assessing its overall financial position.

Begin using a pre-existing template that closely suits your needs. Odoo provides several templates for income statements, balance sheets, and tax reports.

The user-friendly drag-and-drop interface allows you to rearrange and personalize report components. Depending on your company’s needs, add or remove components.

To ensure a thorough knowledge of financial data, users can use the 'Comparison' tool to compare reports to previous periods, select a specific journal from the ‘Journals’ option, and apply advanced filters to arrange data based on needs.

Use the user-defined formulas functionality to do customized calculations. This allows you to include financial metrics particular to your business.

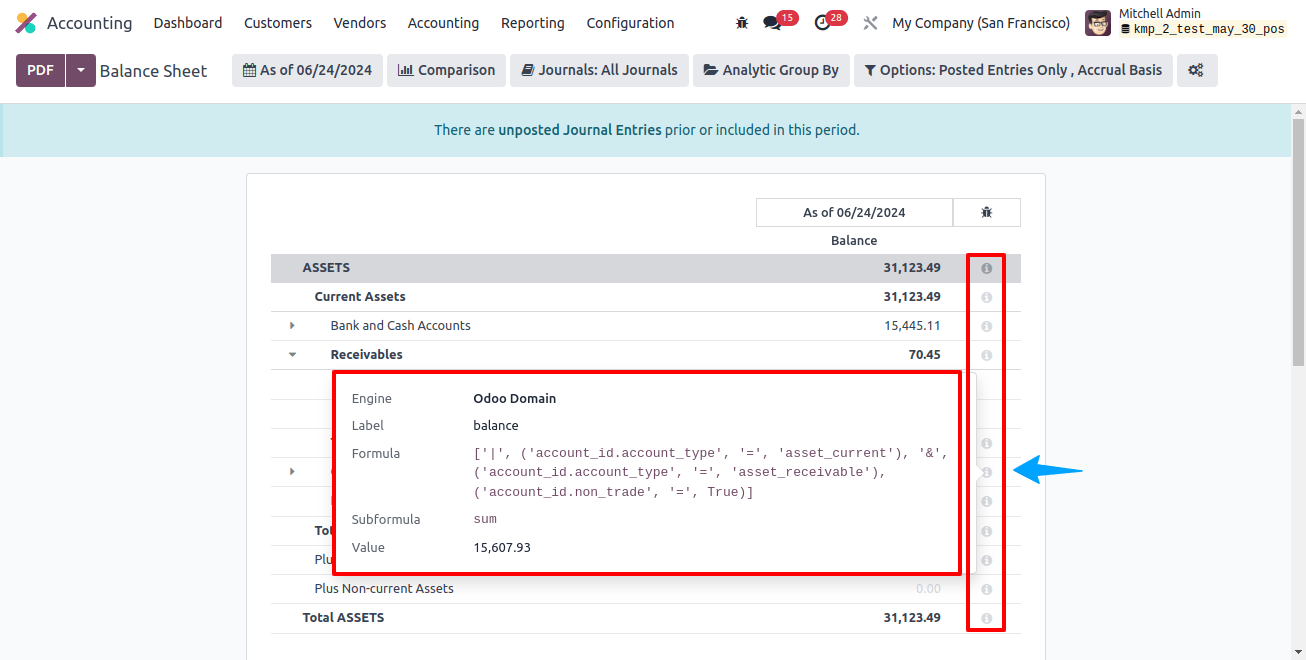

Understanding the Formula for Account Calculation

Add a little ‘i’ to the end of each reporting line to activate the developer mode and see the calculation formula displayed for each reporting line as seen in the image below.

The specific accounting journal’s Engine, Label, Formula, subformula, and Value are visible. Once you’ve adjusted the report view with personalized filters, save your modified report template and check to make sure it directly displays the financial information and insights you require.

Creating Custom Reports

The user-friendly reporting framework in Odoo allows you to develop additional reports such as income statements, balance sheets, and tax reports.

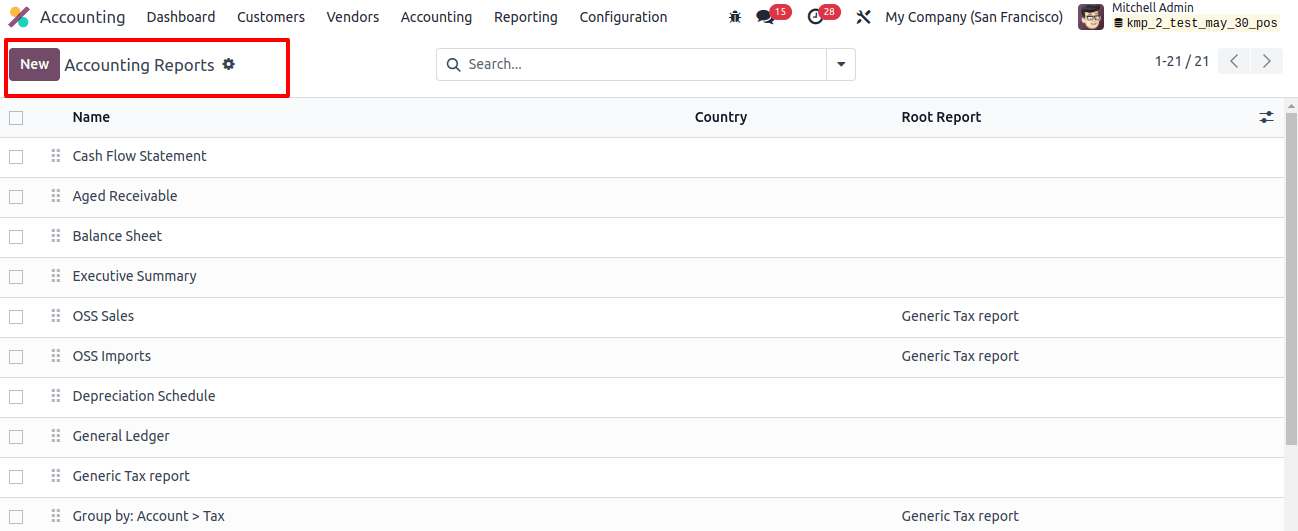

To create custom reports, engage developer mode in the Odoo 'Settings’ window and start a new report from the ‘Configuration’ menu. You can create a root report or a version using the ‘Accounting Reports’ window in the ‘Management’ section.

The report’s Name, Country, and Root Reports will be displayed in a list format. To begin producing a new accounting report, select the ‘New’ button.

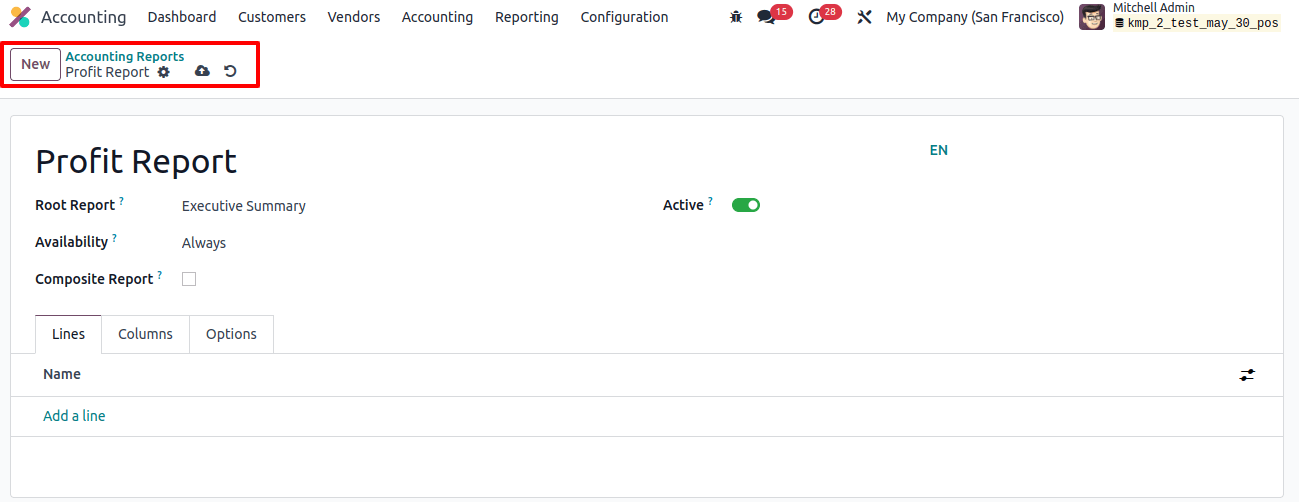

Enter a suitable name for the accounting report in the blank space. Then, select ‘Root Report’ and Availability from the dropdown menu.

Root Reports:

Root reports are neutral accounting models that are used to create local versions; if a report does not have a root report, it is termed a root report.

Composite Report:

This option allows you to create more organized reports with multiple sections, simple navigation, and quick printing.

Lines Tab

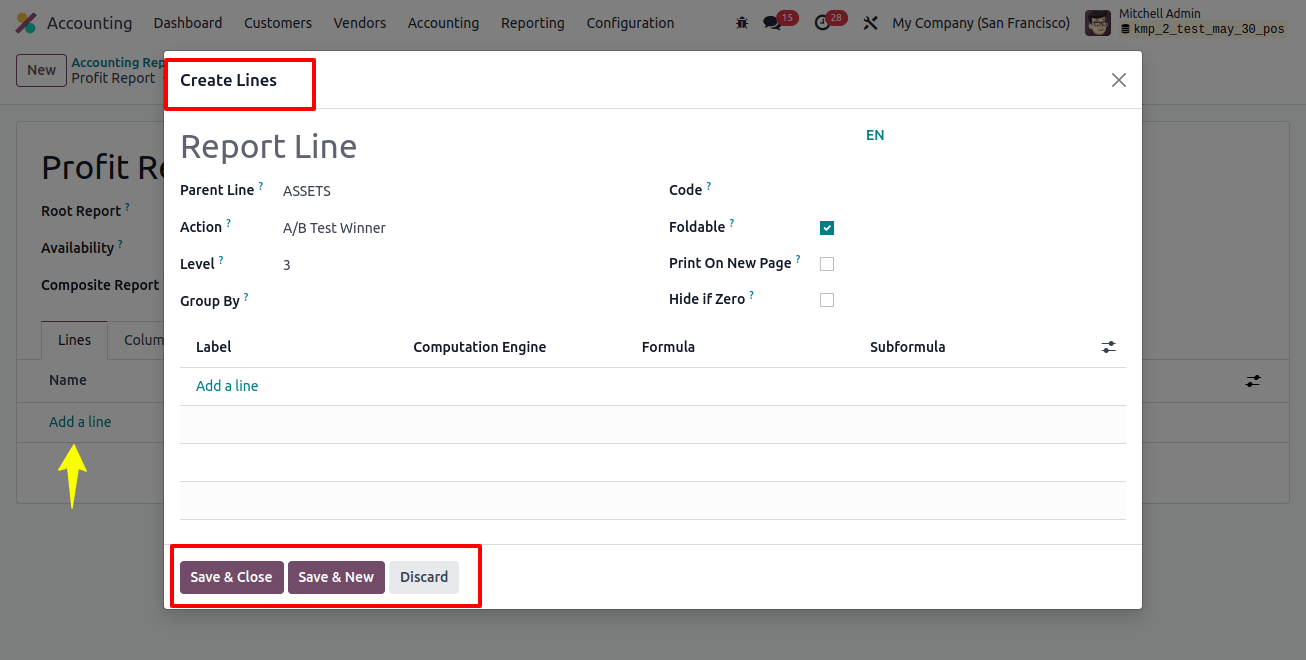

Selecting the "Add a line" option under this tab allows us to create detailed reporting lines. This action will create a new window in which you may adjust important report details such as Parent Line, Action, Level, Group By, Code, Foldable, Print on New Page, and so on, as shown below.

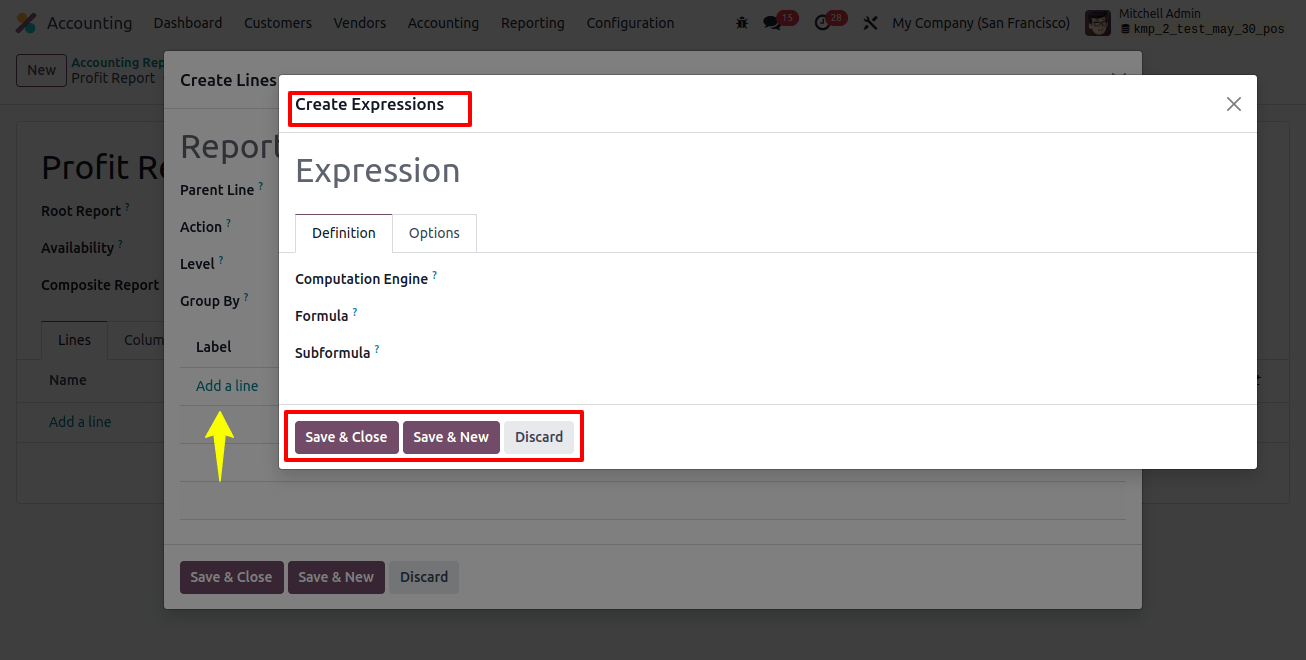

Inside the column, click the ‘Add a line’ button under the ‘Label’ field to add new expressions for calculating accounting journals in the displayed window. You can change the calculating expression or formula in the empty field.

Modify the Formula, subformula, and computation engine information for the report data computations in the "Definition" box. Finally, save your data and return to the accounting report configuration form.

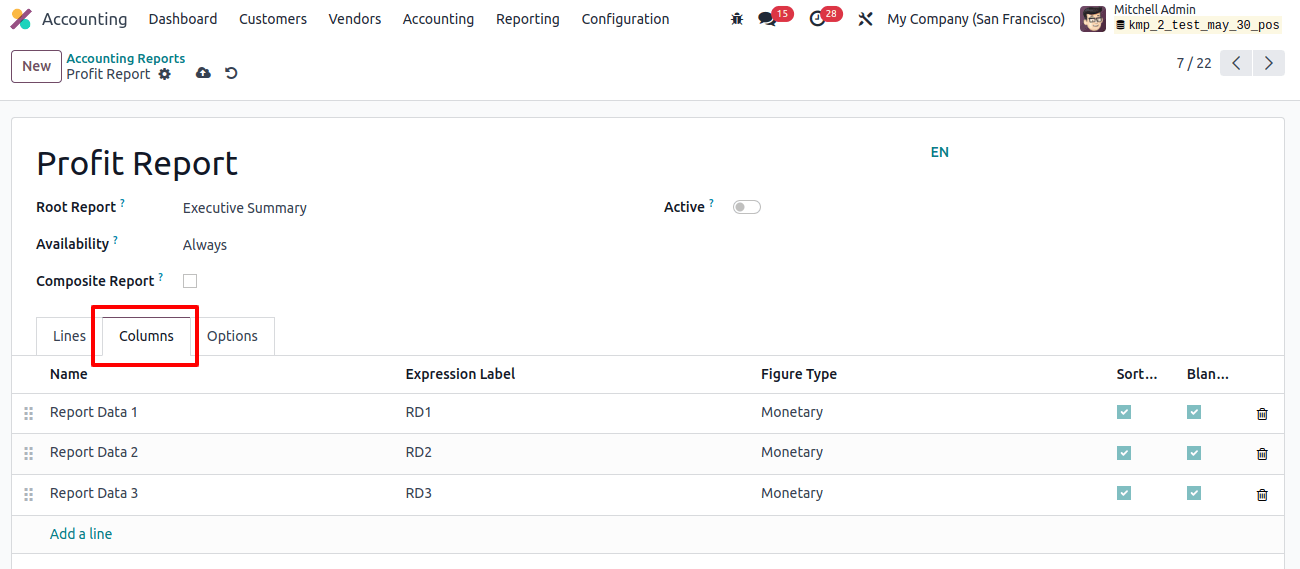

Columns Tab

The columns required to present the report data can be added by selecting the ‘Add a line’ option inside this tab field.

If there are zero alternatives, you must enter the name, expression label, figure type, sortable, and blank values for the report column, as seen in the image above.

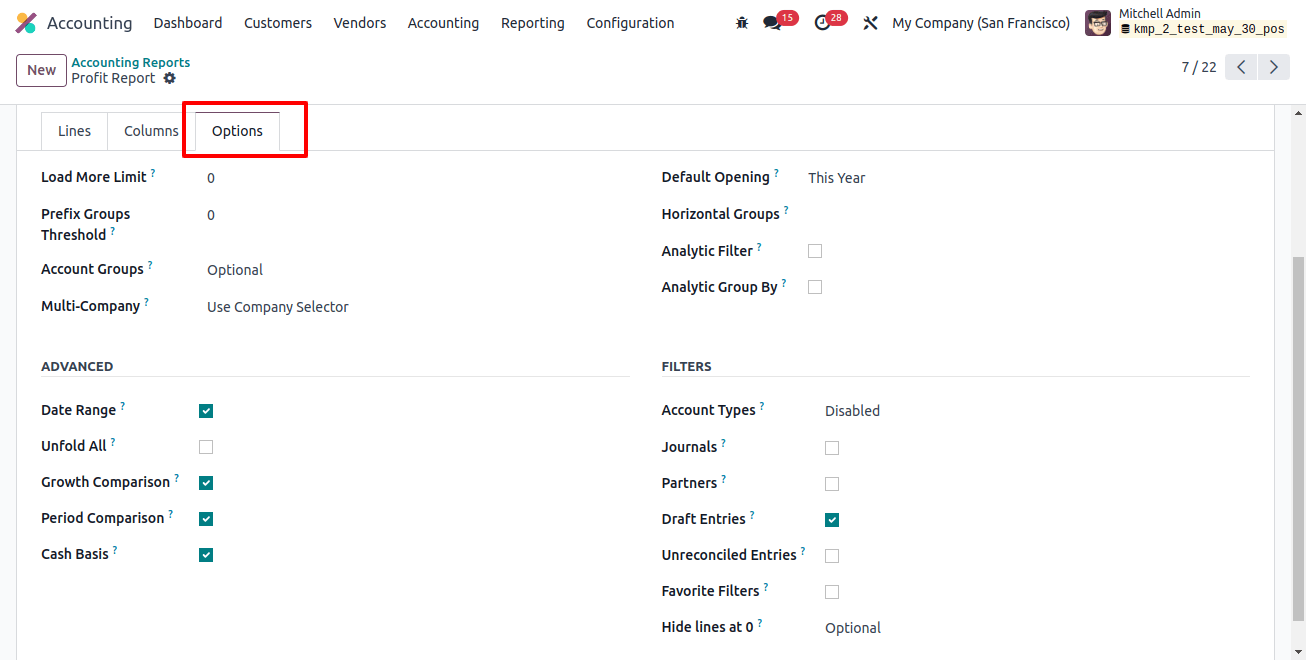

Options Tab

This tab field allows you to configure the basic and important reporting window features, such as Account groups, Multi-Company, Date Ranges, Growth Comparison, period Comparison, Cash basis, Default Opening, Analytic Filters, Account types, Analytic Group By, Journals, Partners, Default Entries, Reconciled Entries, and many more by simply checking the corresponding checkboxes, as shown in the image below.

After activating the relevant data, click the save button to save the new accounting report. Then, in the reporting box, you can view the report data.

The ability to customize tax and financial reporting is innovative in today’s ever-changing business environment. Odoo 17 Accounting provides businesses with a comprehensive collection of customization features, ensuring that financial reporting is more than simply a compliance need, but a strategic advantage.

Odoo 17 Accounting is a valuable asset for businesses looking to stay ahead in the competitive world of finance because it offers flexibility, user-friendly interfaces, and support for multi-currency reporting.

Customizing your financial and tax reports with Odoo 17 Accounting is more than a feature; it’s a strategic advantage for making informed decisions and achieving long-term success.