Any company’s or business’s accounting module must include taxation and tax reporting. The following main ideas highlight their importance: Adherence to Legal Mandates: Governments create tax laws and regulations to ensure revenue collection and a fair and equitable tax system.

Companies must follow these rules, and accurate tax filing is a basic need. Noncompliance may result in penalties, fines, or legal implications.

Businesses must follow these rules, and accurate tax filing is a basic need. Noncompliance may result in penalties, fines, or legal actions.

Taxes have a huge impact on a company’s profitability and financial situation. They are making decisions and managing funds.

Proper tax planning allows businesses to reduce their tax liability, take tax benefits, and make wise important decisions. Companies can use tax data to discover trends, provide tax expenses, and develop tax-cutting strategies.

Steps to Configure & Apply Taxes in Odoo 17 Accounting

Calculating Tax Liability

Tax reporting gives a comprehensive picture of a company's financial activities, including income, expenses, credits, and deductions. Companies assess their taxable income and utilize proper tax reporting to calculate the appropriate amount of tax to pay.

It inhibits under reporting and tax evasion while ensuring the transparency of financial statements.

Communication with External Stakeholders

Tax reports are routinely shared with lenders, investors, auditors, and other external stakeholders.

These reports increase the openness and credibility of financial accounts while showing that a company complies with tax rules. Accurate tax reporting provides two benefits: maintaining stakeholder confidence and ensuring regulatory compliance.

Audit and Due Diligence

Tax reports are important in audit and due diligence scenarios for determining a company’s financial position and tax compliance.

Audits, investors, and prospective buyers can use accurate and well-documented tax reports that show financial activities, deductions, and credits to evaluate a company’s tax situation and possible risks.

Future Tax Planning

When planning for the future, tax returns from previous years are valuable tools to study. Businesses can identify areas for potential tax savings, plan for predicted tax payments, and make informed decisions to improve their tax status in the future by reviewing previous tax data.

Overall, taxes and tax reporting are important components of the accounting module because they help with decision-making, allow for future tax planning, ensure legal compliance, simplify financial planning, and set tax accounting standards.

Businesses must keep up-to-date and correct tax records to comply with tax legalization and promote good financial management.

Odoo 17 accounting additionally has extensive reporting options for tax management and analysis. Businesses can generate tax reports that provide a detailed breakdown of tax transactions, liabilities, and payments.

These reports assist businesses in tracking their compliance with tax laws, calculating their tax liabilities, and making educated financial decisions. The reporting tools in Odoo 17 allow businesses to discover patterns, understand their tax situations, and measure the impact of taxes on their financial performance.

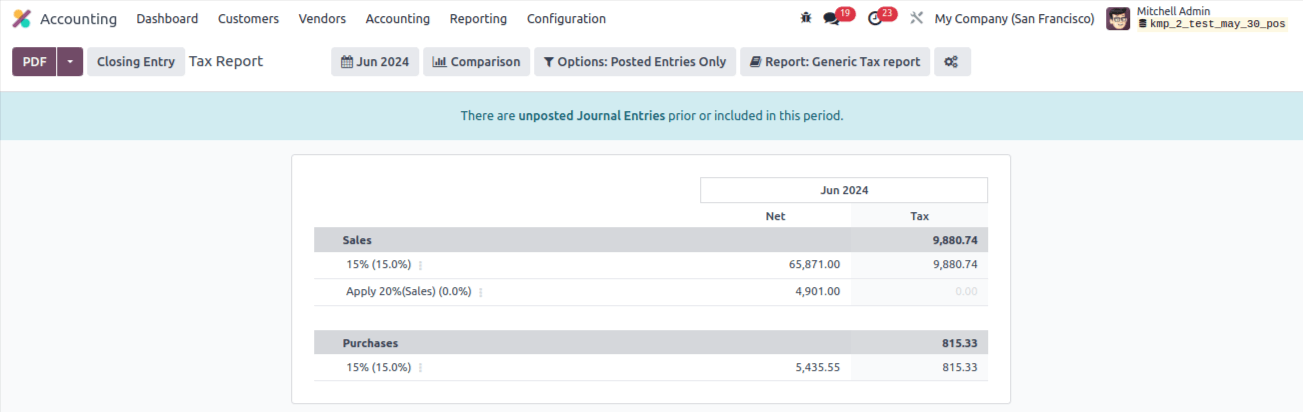

When you select the tax report option from the reporting menu, you will see the page in the image below.

The tax records platform, accessible via the reports menu, can generate comprehensive sales and purchase tax records. The closing entry option allows you to file the return tax for the specified period.

You can also download the tax report in PDF format by clicking the icon provided. Any organization’s accounting methods must include efficient tax management. Precise tax adjustments are required to comply with tax rules and keep correct financial records.

Odoo 17 accounting has powerful tools and capabilities for efficiently adjusting taxes. In this blog post, we will walk through adjusting taxes in Odoo 17 accounting. The first step in changing taxes in Odoo 17 is to set up tax settings.

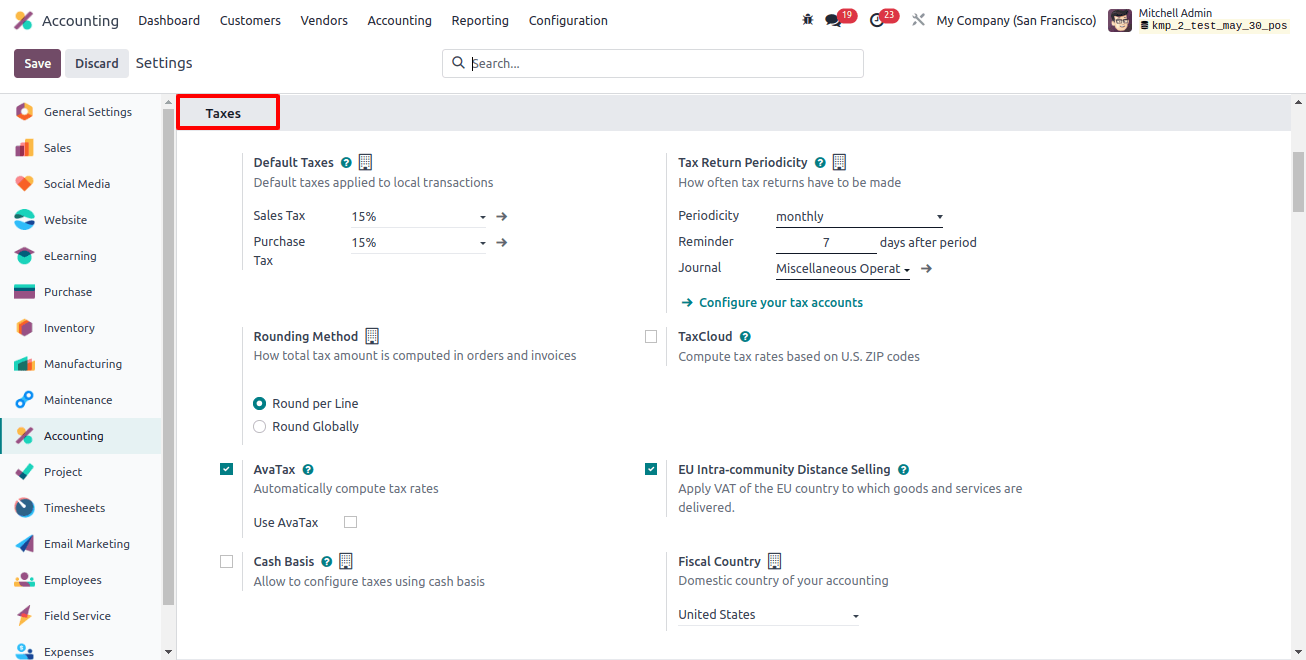

Go to Odoo’s accounting settings and select the ‘Taxes’ option. You can specify tax laws, rates and costs here based on your business's tax requirements. Odoo 17 allows you to design several tax rules and rates to support various tax jurisdictions or tax types.

Calculate taxes using the current tax rates, exemptions, and tax categories, as well as your local tax legislation.

After the tax settings have been defined, taxes are applied to items and services. In Odoo 17, each product or service can be linked to a specific tax code or tax law.

This guarantees that taxes are automatically calculated and applied when creating invoices or documenting transactions involving specific services. In Odoo 17, while setting or changing a product service, you can select the applicable tax codes or tax rules from a selection menu. This organization guarantees that the right taxes are applied when invoicing or documenting transactions.

Odoo 17 is also extremely adaptive to complex tax situations. It allows you to set tax regulations based on a variety of factors, including your clients’ locations, the types of products you offer, and unique scenarios. This allows firms to follow special tax exclusions, different tax rates, or other unique tax obligations.

Odoo 17 automatically calculates and applies taxes when creating invoices or recording transactions, thanks to the specified tax settings and product connections.

The tax amounts are calculated using the set tax legislation and rates, accounting for the goods or services being invoiced or transacted. Automation eliminates the possibility of human error while ensuring accurate and consistent tax calculations throughout the accounting process.

However, there may come a time when tax changes are required. These changes may be necessary to repay eros, request exemptions, or address unique tax issues. Odoo 17 allows for tax modifications on single invoices or transactions.

When reading an invoice or transaction in Odoo 17, you can view the tax lines and make changes to the tax amounts, tax codes, or manual tax adjustments. It is important to exercise caution and ensure that any tax modifications are properly justified and documented.

When there are frequent tax modifications or complex computations, Odoo 16 allows you to develop custom tax rules or formulae. These rules or formulae can be modified to address unique tax scenarios, such as multi-tiered taxes, compound taxes, or tax computations based on certain criteria.

Businesses may effectively manage complex tax needs thanks to the Odoo 17 accounting system's ability to create bespoke tax rules.

To maintain accurate financial records, tax accounts must be reconciled regularly. Tax accounts are used in Odoo 17 accounting to track financial transactions and tax amounts. These tax accounts indicate the company's tax liabilities and payments.

Tax accounting can be reconciled in Odoo 17. This tool allows you to link tax payments or refunds to their respective tax liabilities. Reconciling tax accounts ensures that tax liabilities are properly reflected in financial records and helps uncover issues in tax transactions.

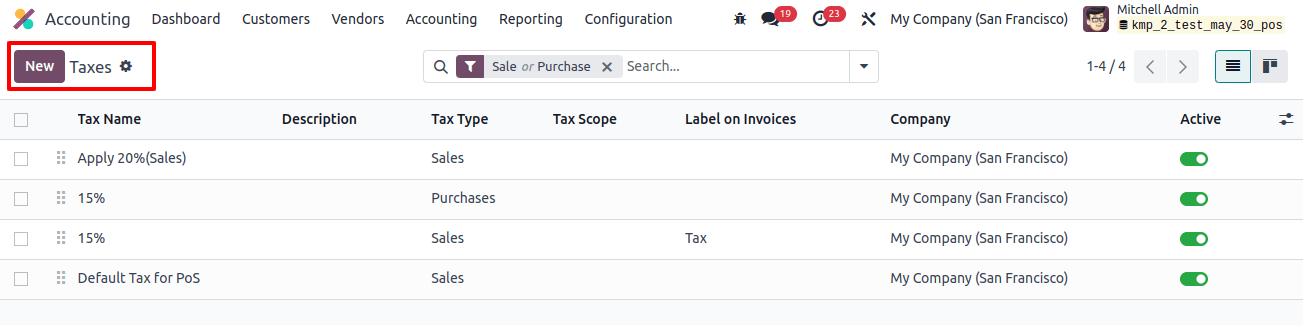

Tax calculation is one of the most difficult accounting management tasks, as it needs precise execution. Even little arithmetic eros can jeopardize your business. Since the release of the Odoo Accounting module, tax computation has been substantially easier. You may access the taxes platform, which allows you to manage sales and purchase taxes, via the module’s configuration menu.

The conveniently accessible tax list can be organized into Sales, Purchases, Services, Goods, Active, and Inactive categories. You can categorize them according to the firm, tax type, and tax scope. Users can configure the Group By and Filters options. Now, click the Create button to create a new tax.

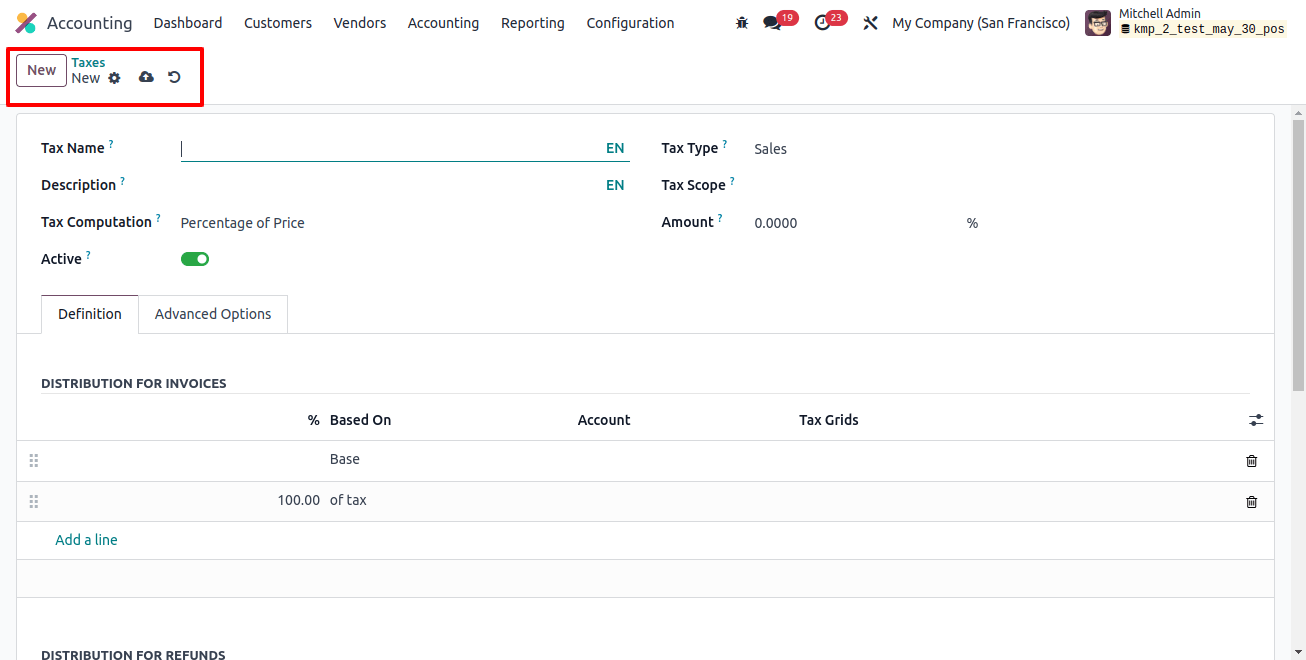

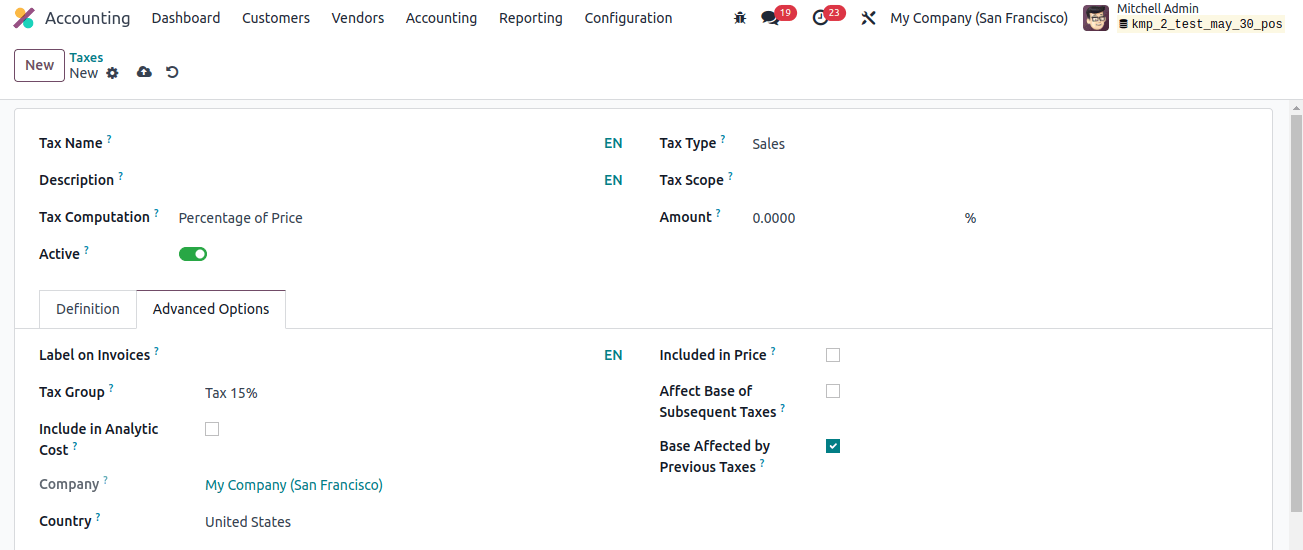

Name the new tax in the Tax Name field. There are two tax types to choose from: purchases and sales. It selects the regions where the tax is applicable. When the value is ‘none,’ the tax may be charged to a group but not an individual.

You can limit the application of taxes to a certain amount of items by selecting the proper option in the tax scope box. To hide the tax, set its active property to false without deleting it.

In the Tax Computation area, select one of the following options: Group of Taxes, Fixed, Percentage of Price, Percentage of Price Tax Included, or Python Code.

The tax in the case of the Group of Taxes is effectively a collection of sub-taxes, and the overall tax is calculated using the sub-taxes.

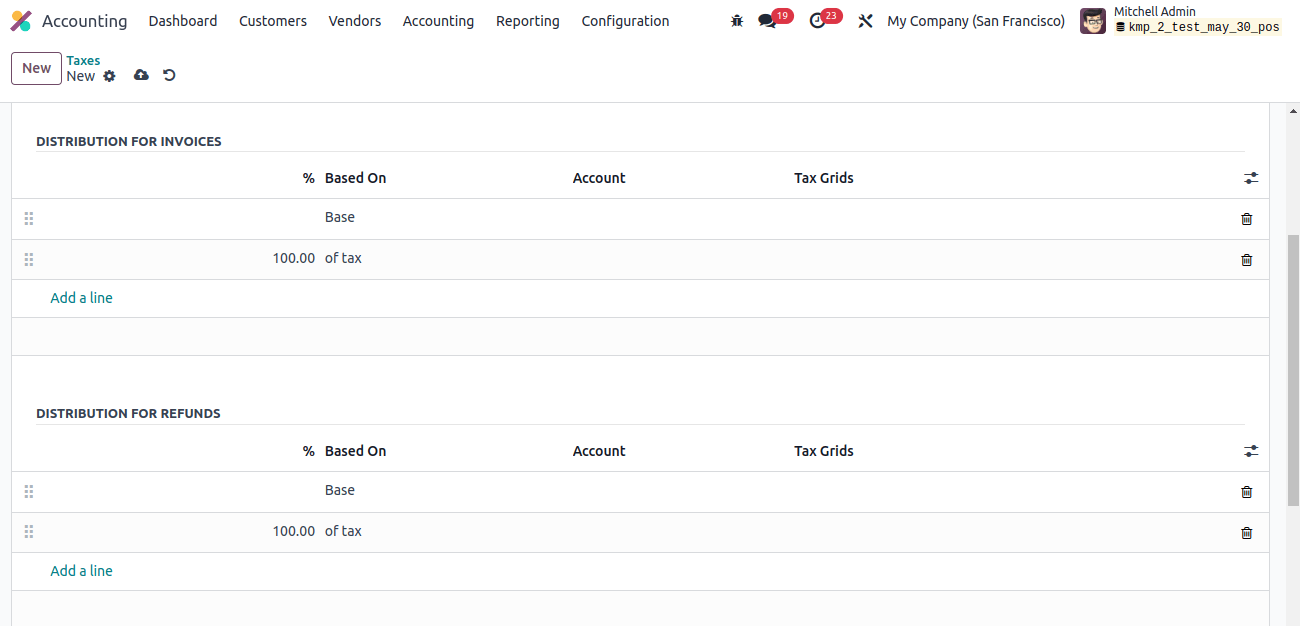

You can add the sub-taxes to the Definition tab one at a time by clicking the Add a Line button.

You can learn more about the company and the country by going to the Advanced Options tab.

When Tax Computation is set to Fixed, the tax amount remains constant regardless of cost. Selecting the Percentage of Price tax computation option allows you to specify the tax amount as a percentage of the actual price.

The tax amount will be calculated as a proportion of the actual price using the proportion of the Price Tax Included approach. The tax can also be calculated using Python code by selecting the Python Code option. The settings for each of these processes are identical.

Under the Definition tab, click the Add a Line button to pick the basis on which the factor will be applied, the account to which the tax amount will be posted, and the tax grids.

You can use the Label on Invoice option from the Advanced Options menu to incorporate them in invoices. Choose the most appropriate Tax Group from the list of options.

The Cash Basis feature allows you to set up taxes on a cash basis. You can enable this option, which will add an entry for those taxes to a specific account during reconciliation if they must be calculated in cash.

Related Post: How To Set Up Custom Fiscal Years In Odoo 17 Accounting

You can include information about the Base Tax Received Account and the Tax Cash Basis Journal in the appropriate sections.

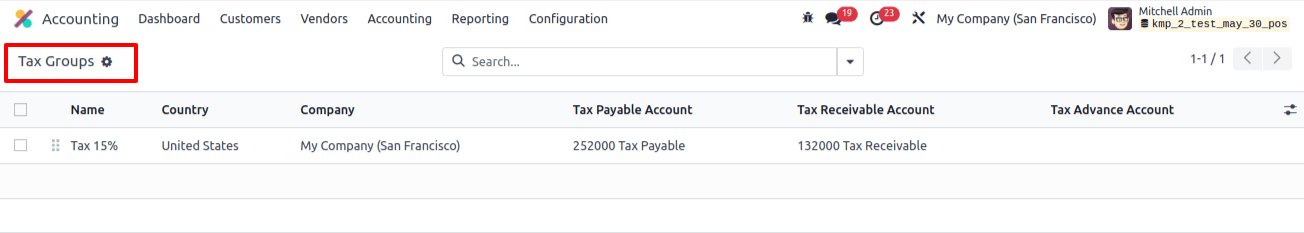

Depending on how your business operates, you may apply these taxes to products, services, suppliers, companies, and accounts. The Configuration option in the Accounting module, as shown below, allows you to view the list of Tax Groups that Odoo currently supports.

The list view includes information such as Name, Country, Tax Payable Account, Tax Received Account, and Tax Advance Account.

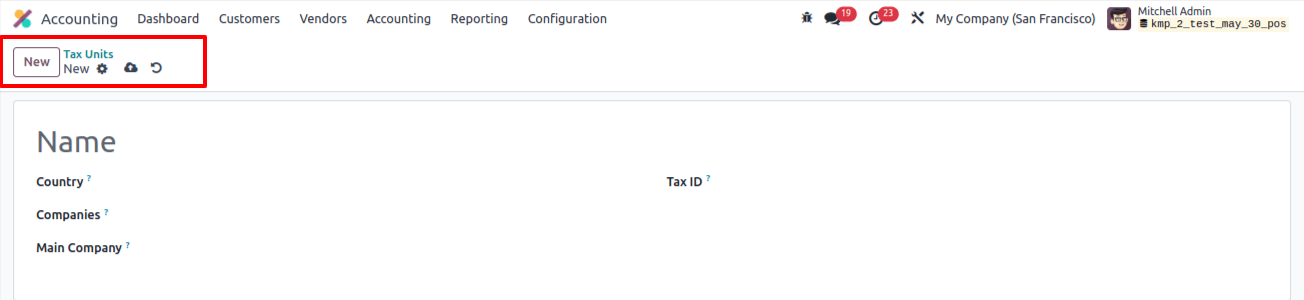

The Accounting module's Tax Report Declaration is grouped using the Tax Unit option in the Configuration menu. The new Tax Units configuration window will appear, as seen below.

After giving the taxing unit a title, you may specify the country in which it will be used to create the tax report declaration for your business. The Companies and Main Company (responsible for filing and paying taxes) can be entered in the appropriate fields. The identifier to use when filing a report for this unit can be altered and entered into the Tax ID box.

Tax Defaults

If no extra taxes are specified in financial operations, Odoo will automatically select the default taxes. These tariffs will be applied automatically during the configuration of new products. Later, the product form will allow you to modify it. This will be used in the local translation if no other taxes are available.

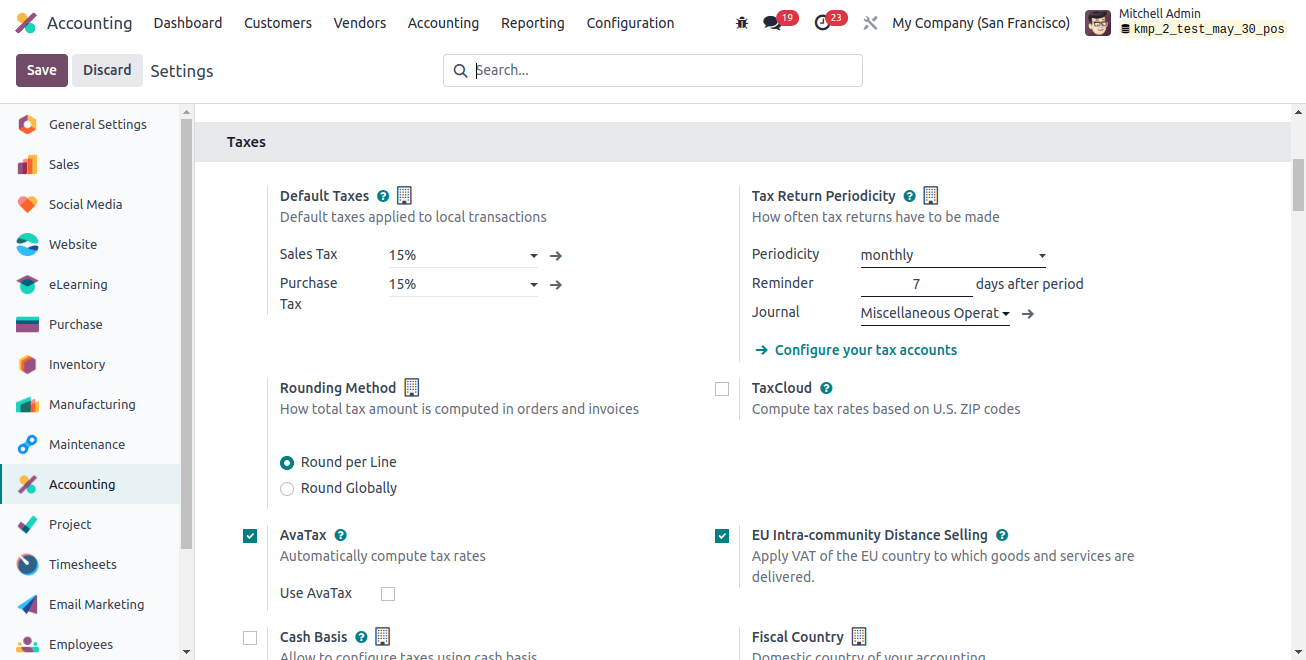

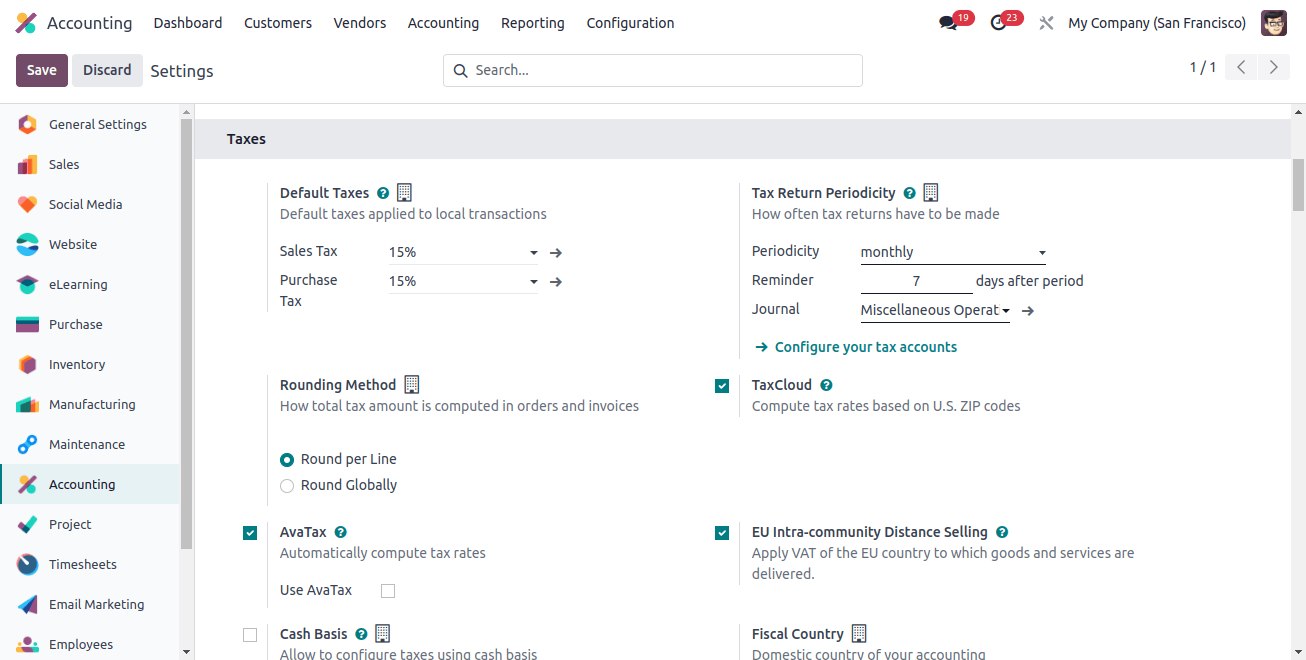

As seen in the picture above, the Accounting module's Settings menu allows you to adjust the Default Taxes for sales and purchases. You can change the sales and purchase taxes using the internal link in the default taxes area.

The Tax Return Periodicity parameter sets the frequency with which tax returns must be filed. Using Periodicity, Reminders, and Journals, enter tax returns into the appropriate fields.

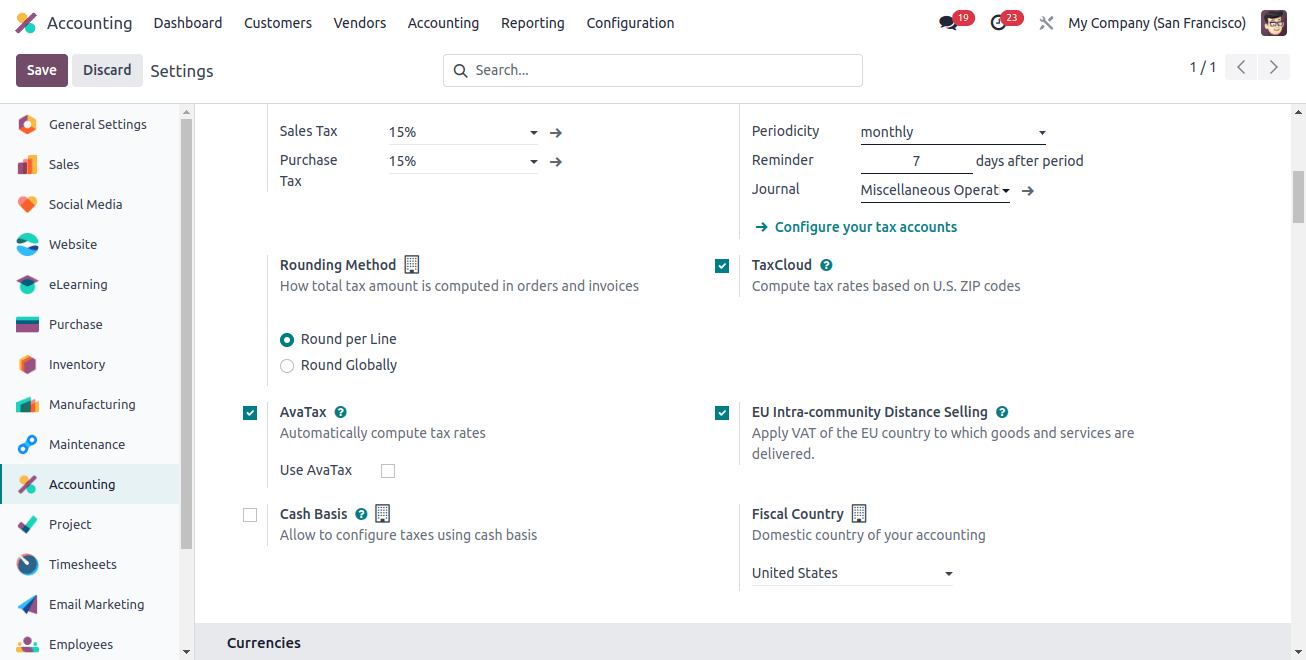

The Rounding Method section describes how orders and invoices compute the final tax amount. You can select between rounding globally or rounding per line. If you incorporate tax in your pricing, you should round each line independently. The line subtotals are combined to calculate the total with taxes.

In the Cash Discount Tax Reduction section, you can specify the terms that apply when a cash discount is granted. It can be set as Never, On Early Payment, or Always (on the invoice). With this new feature, the Odoo 17 Accounting module is now functional.

Tax Cloud

If you enable the TaxCloud option in the Accounting module's Settings menu, Odoo will calculate tax rates based on U.S. zip codes. The API ID, API KEY, and Default Category can all be entered into the designated fields.

If no tax cloud is specified for products or product categories, the default category will be utilized instead. The module's Configuration menu allows you to establish a wide range of tax cloud categories.

The TaxCloud Categories can be found on the Configuration menu's Management tab. This is where you may create a new category by entering the TIC Description and Code.

Tax computation service Avatax automatically calculates tax rates. Appropriate fields, including the Environment, API ID, API KEY, and Company Code. Use UPC, Commit Transactions, and Address Validation should all be activated if necessary.

Once you've entered enough information, you can set up Avatax categories for your items and categories. It is useful to have the option to automatically calculate taxes on orders and invoices.

VAT must be collected when selling products and services to customers in another European Union country, depending on the delivery address.

To enable this capability, navigate to the Accounting module's Settings menu and select the EU Intra-community Distance Selling option, as shown below. This policy applies regardless of where you are.

Odoo will automatically calculate the appropriate tax and fiscal positions for each EU member state based on your country. And here is how we handle taxes in Odoo 17 Accounting.

Related Post:

- Step-by-Step Guide: Configuring Taxes in Odoo 17 POS

- What Are the Steps to Import a Chart of Accounts, Journals, and Taxes In Odoo 17

- Guide to Manage Product Tax Prices In Odoo 17 POS

- How to Customize Tax & Finance Reports in Odoo 17

- How Does Odoo 17 Support Accounting Localization for Chile

- Odoo Accounting Software: The Next-Gen Accounting Software