In the world of business software, adhering to local tax laws is critical for businesses to operate smoothly. Odoo 17 has capabilities that enable firms in Spain to comply with local tax rules.

Managing finances and managing tax requirements in Spain can be complex, but the correct tools, such as Odoo, make it much easier.

Odoo is specifically intended to manage Spanish tax requirements, automating VAT and income tax calculations. This automation saves firms from the difficulties of manual calculations while also ensuring correctness.

One of Odoo's merits is its compatibility with Spanish accounting practices. It employs the same chart of accounts as Spanish accountants, allowing firms to better analyze and arrange their financial data.

This alignment makes the entire accounting process more efficient, from expense categorization to financial statement preparation.

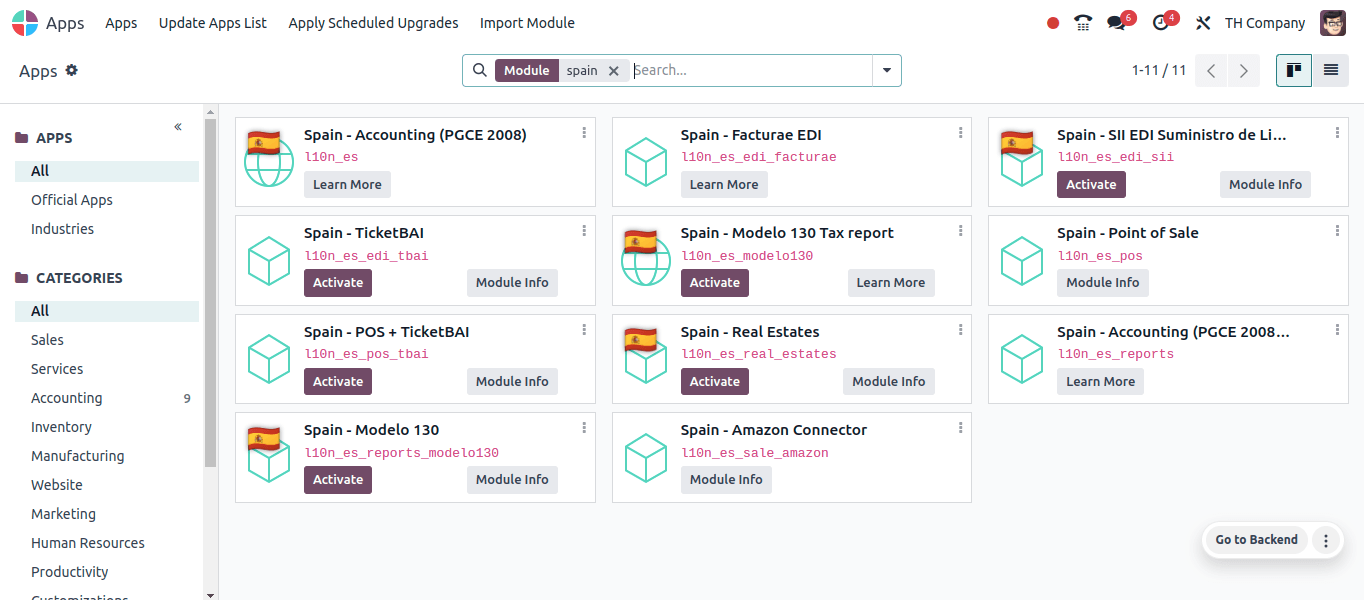

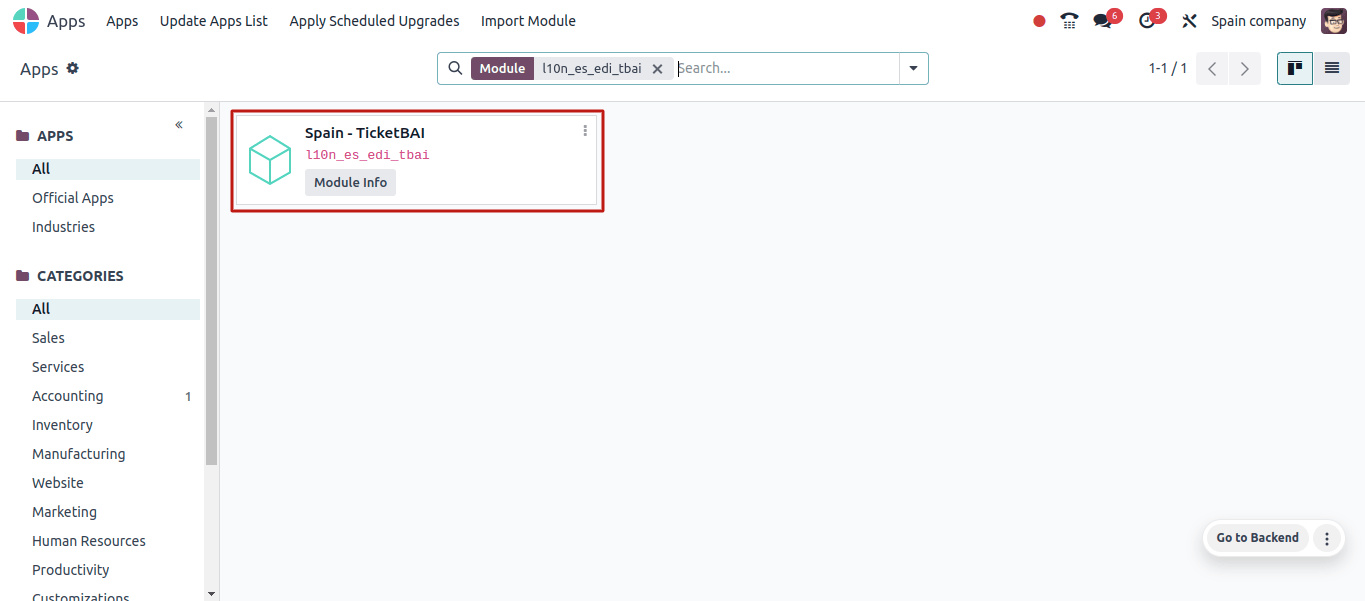

To enable Spanish accounting localization in Odoo, you must first install some special modules. These modules can be found in Odoo's "Apps" section. Navigate to Apps and install the relevant modules.

There are three distinct Spanish localizations, each with a pre-configured PGCE chart of accounts:

* Spain - SMEs (2008);

* Spain - Complete (2008);

* Spain - Non-profit entities (2008).

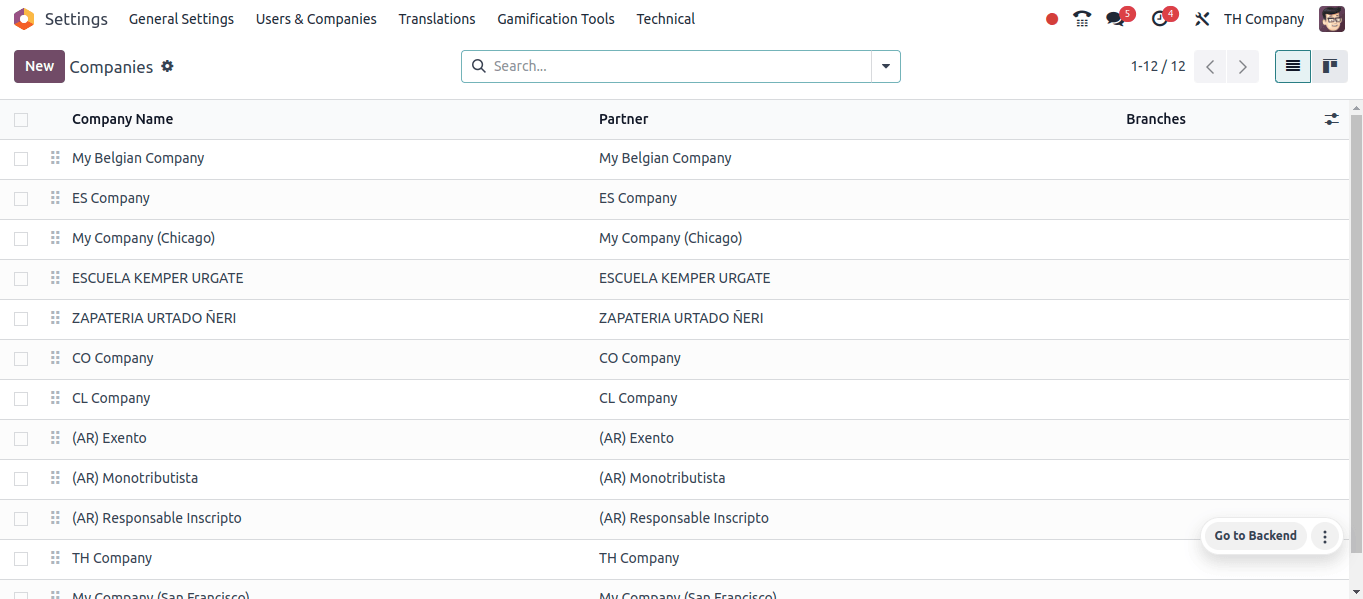

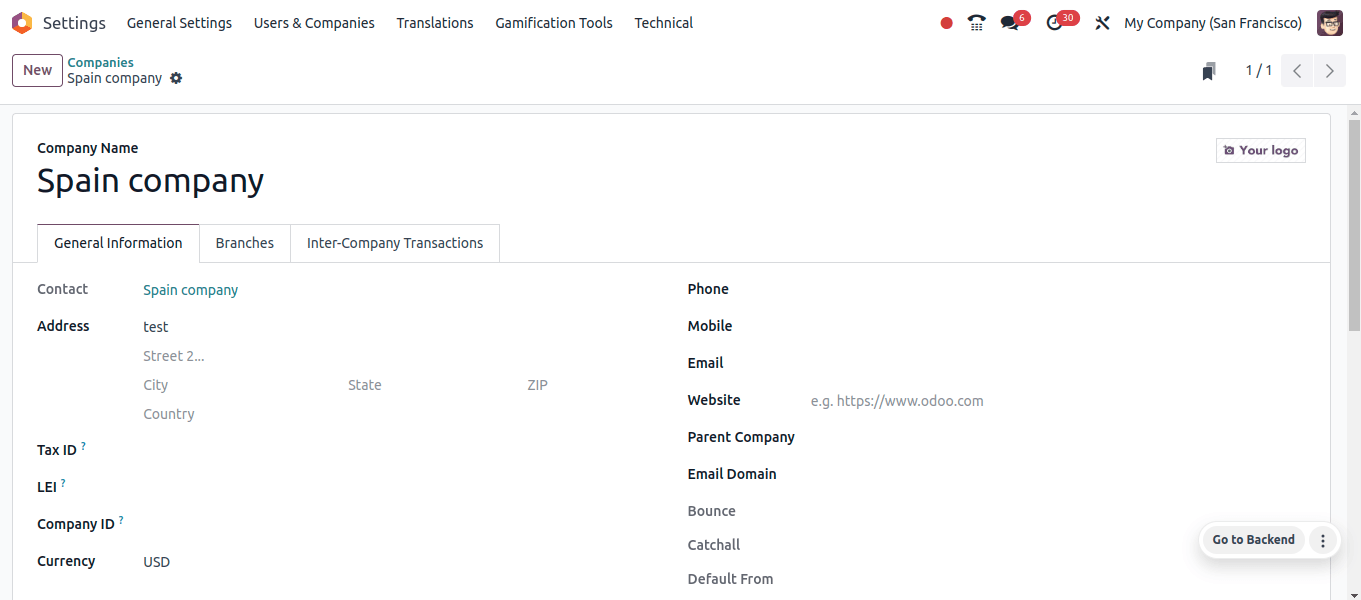

Next, ensure that your company information is right in Odoo. This allows Odoo to appropriately apply Spain's accounting regulations.

You can review your current company details or establish a new company profile if necessary. To do this, go to Odoo's "Settings" menu, then "Users and Companies" and "Companies."

This will display a list of the firms you have set up in Odoo. You can then select a firm and review its details, or create a new company with the necessary nation information for Spain's accounting features.

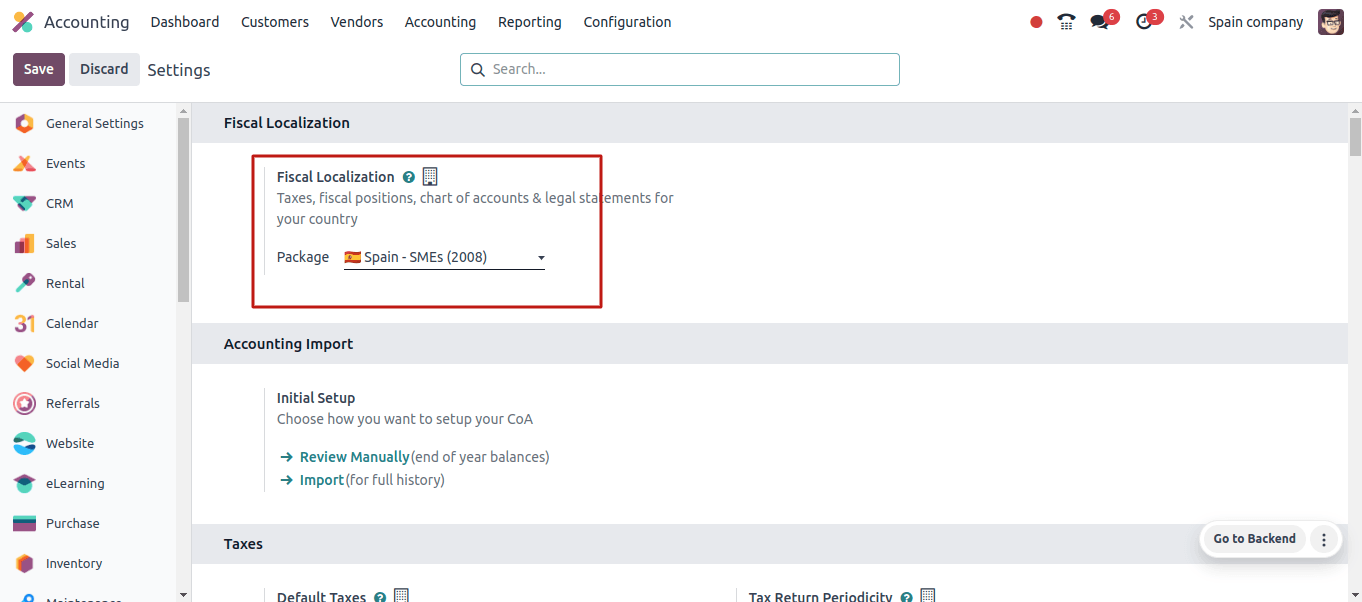

Finally, validate that Singapore is selected as the fiscal localization option in the Accounting module's settings.

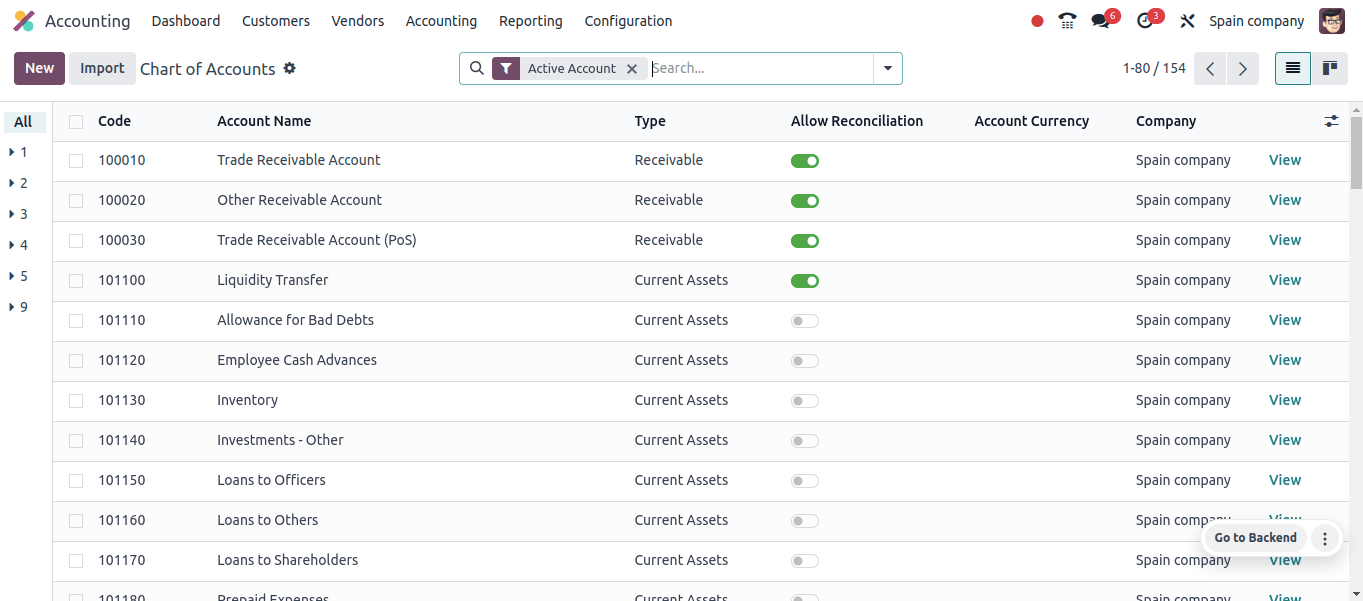

Charts of Accounts

Odoo offers a ready-to-use Spanish chart of accounts and tax options that comply with local reporting requirements. This core arrangement provides precise financial tracking and simple tax compliance.

It offers ready-made solutions like charts of accounts and tax arrangements that comply with Spanish reporting rules. This allows firms to precisely track their finances and comply with tax laws.

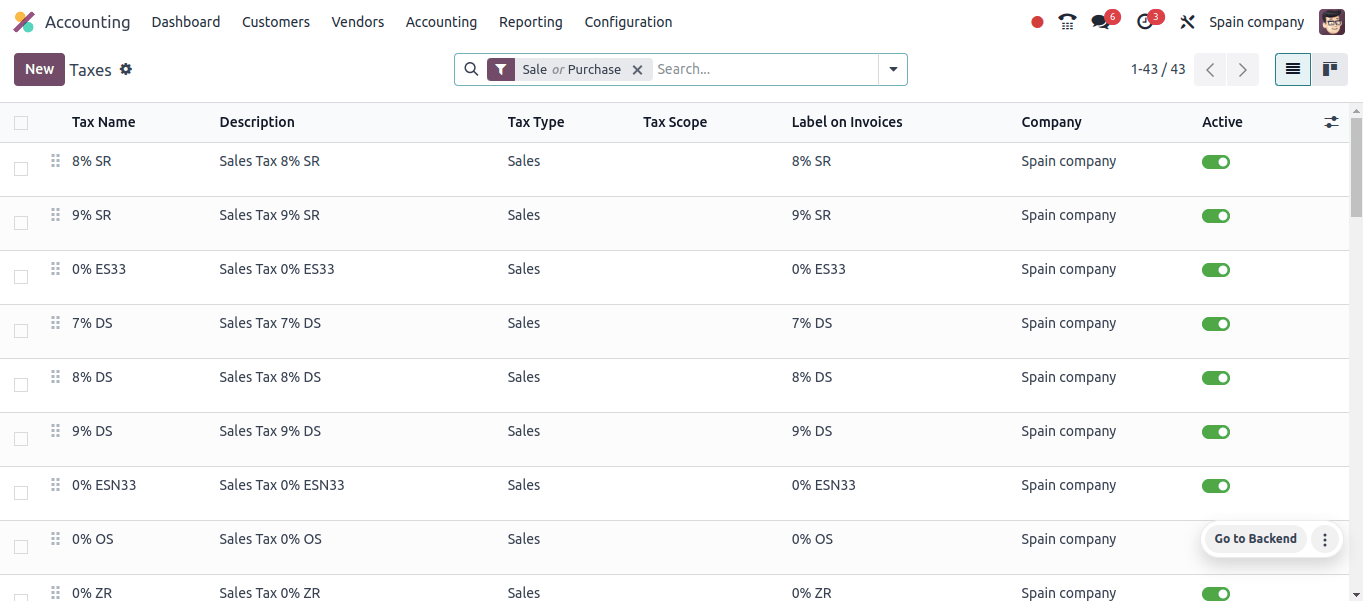

Taxes

Upon installation of the Spanish - Accounting (PGCE 2008) (l10n_es) module, default Spain-specific taxes are created automatically.

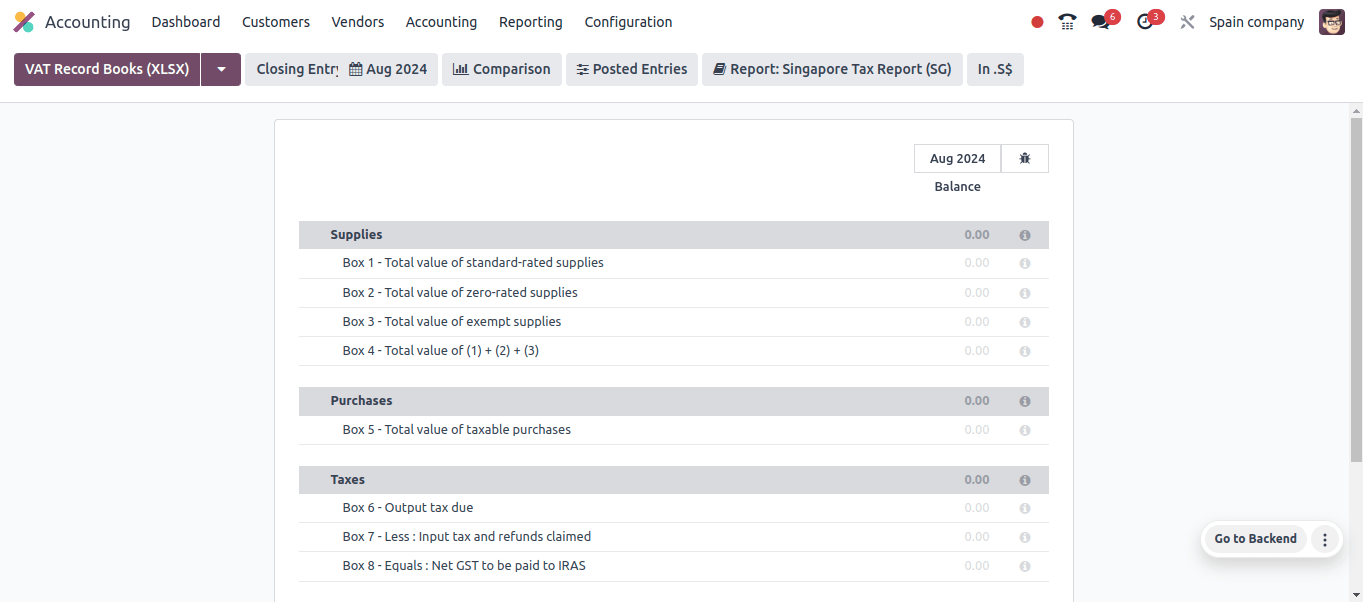

The platform contains templates for generating important legal reports including Modelo 303 (VAT returns), Modelo 349 (Intrastat statements), and others required by Spanish authorities.

These reports are critical for compliance and are created straight from the system using the transactions logged.

Furthermore, by installing the Spain - Accounting (PGCE 2008) (l10n_es_reports) module, tax reports customized to Spanish requirements are available.

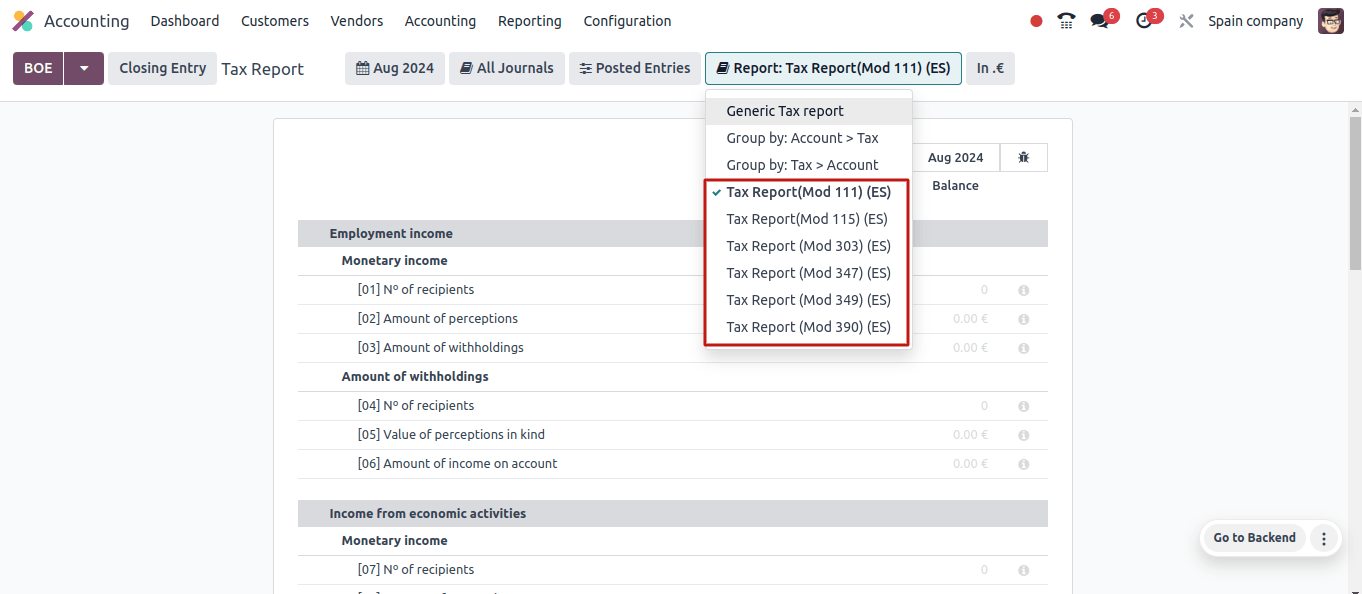

These taxes have a direct impact on Spain-specific tax reports (Modelo), which may be viewed under Accounting --> Reporting --> Statements Reports: Tax Report.

The accessible Spanish-specific statement reports are as follows:

* Balance Sheet;

* Profit & Loss;

* EC Sales List;

* Tax Report (Modelo 111);

* Tax Report (Modelo 115);

* Tax Report (Modelo 303);

* Tax Report (Modelo 347);

* Tax Report (Modelo 349);

* Tax Report (Modelo 390).

When viewing a report, click the book icon and select the Spain-specific edition (ES) to see tax reports specific to Spain.

Invoice

Odoo offers electronic invoicing in accordance with Spanish rules (facturae). This feature makes sure that invoices created in Odoo follow the right format and guidelines set forth by the Spanish tax authorities.

TicketBAI

The Basque government and three provincial councils in Álava, Biscay, and Gipuzkoa use the Ticket BAI or TBAI e-invoicing system.

Odoo supports all three Basque Country regions' electronic invoicing formats, including TicketBAI (TBAI). To activate TicketBAI, enter your company's Country and Tax ID in the Companies area of General Settings.

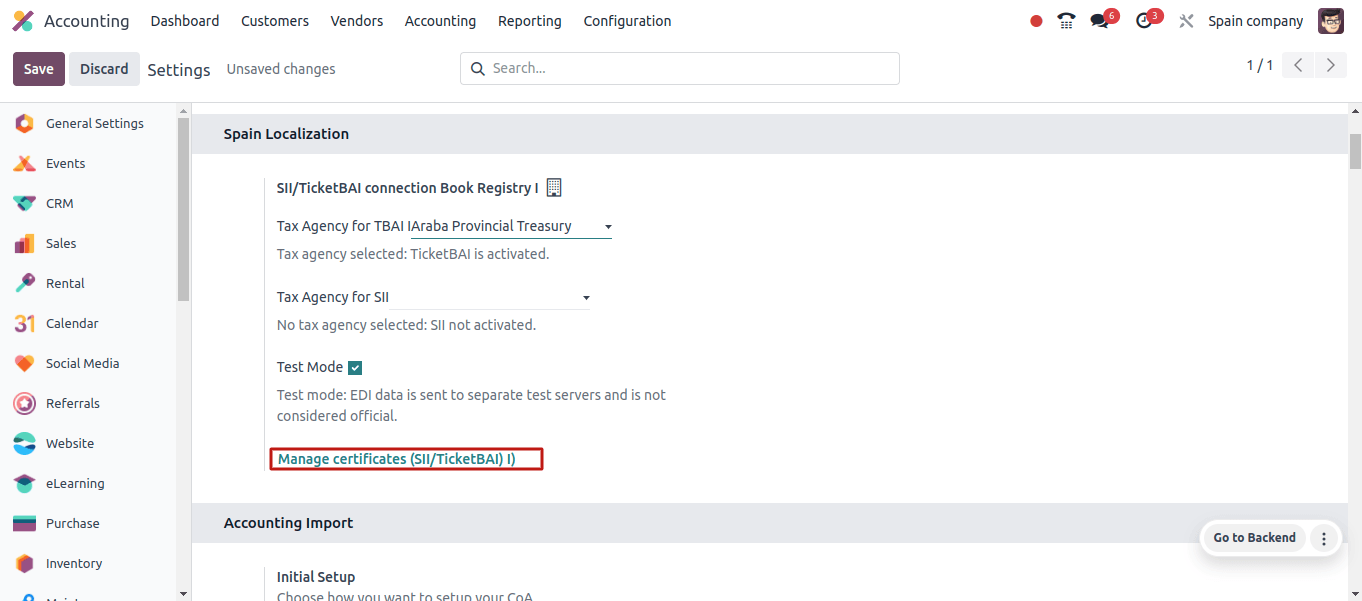

Next, install the Spain-TicketBAI (l10n_es_edi_TBAI) module. Next, go to Accounting? Configuration? Settings. In the Tax Agency for TBAI section, select an area.

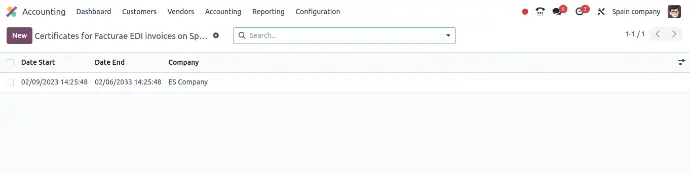

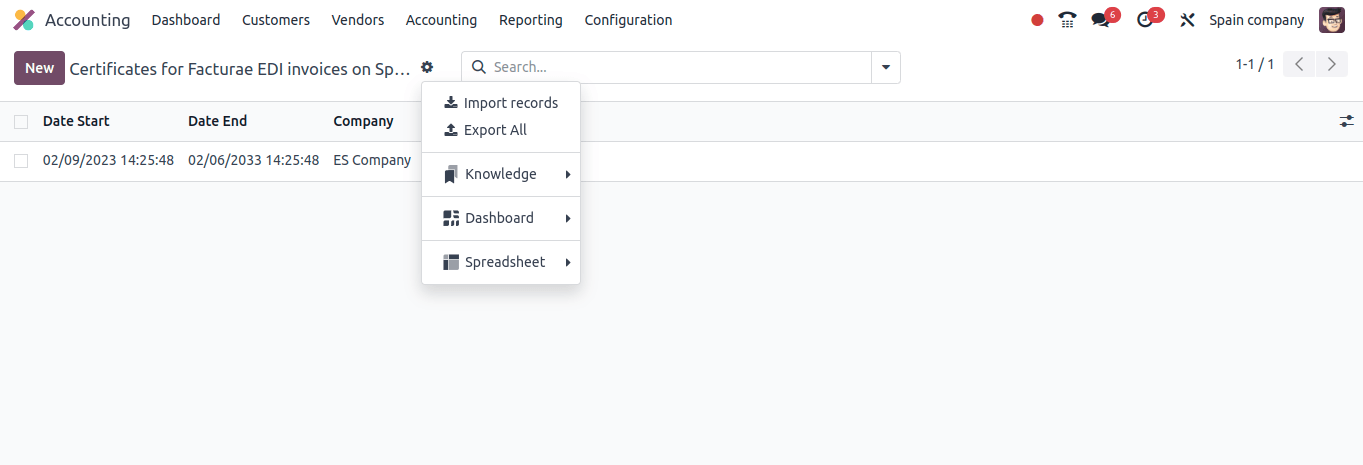

Choose a region, then click Manage certificates (SII/TicketBAI).

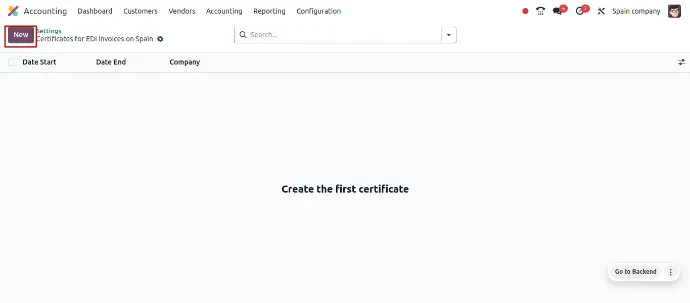

Next, click New, upload the certificate, and enter the tax agency-supplied password. Next, select the New.

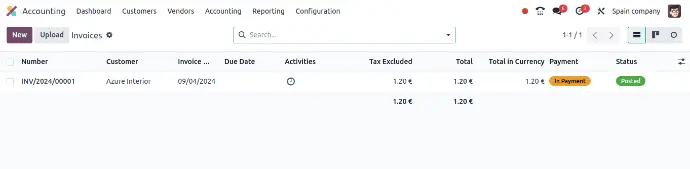

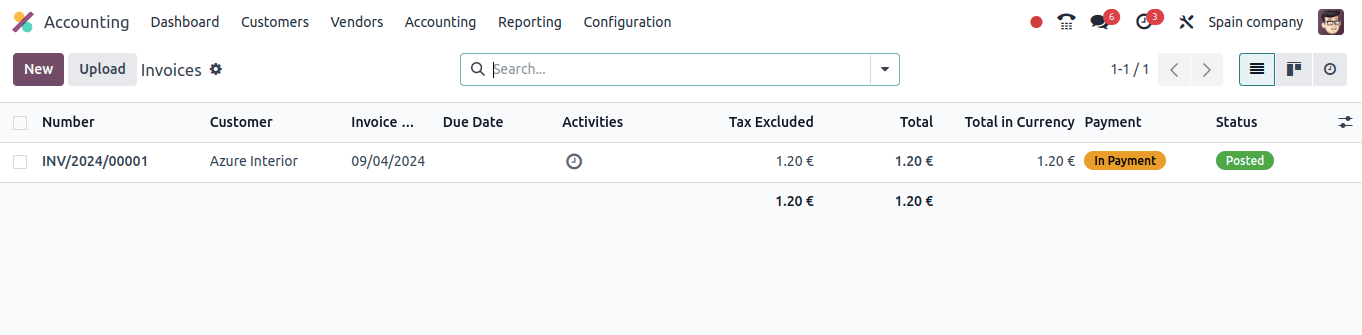

After an invoice has been prepared and confirmed, a TicketBAI banner appears at the top of it.

Odoo automatically sends bills via TicketBAI once every day. However, if you want to send the invoice straight immediately, select Process now. The XML file is located in the discussion, and the Electronic Invoice field changes to Sent once the invoice is sent.

Under the EDI Documents tab, you may view the traceability of other produced documents associated with the invoice (for example, if the invoice needs to be delivered by SII).

FACe

The Spanish public authorities employ an electronic invoicing technology called FACe.

Before setting the FACe system, install the Spain - Facturae EDI (l10n_es_edi_facturae) module as well as any other Facturae EDI modules.

To activate FACe, go to Settings. In General Settings, under the Companies section, click Update Info, and then change your company's Country and Tax ID.

Next, select Add a line, upload the tax agency certificate, and enter the password to add the Facturae signature certificate.

Once the invoice has been prepared and confirmed, click Send & Print.

After confirming that the Generate Facturae edit file option is enabled, click Send & Print again.

After delivering the invoice, the generated XML file is available within the discussion.

To work with FACe, the invoice must include specific information on the administrative centers. Create a new contact and add it to the partner firm to include administrative centers.

After selecting FACe Centre as the type and assigning that contact one or more roles, save the changes. Typically, three roles are required, which include:

* Organismo gestor: Receiver/receptor;

* Traitor Unit: Payer (Pagador);

* Fiscal (Fiscal) is the office contable.

In this article, we have seen Accounting Localisation for Spain. Odoo's fiscal localization for Spain stands out as a comprehensive solution for organizations seeking to optimize their financial processes while adhering to local tax requirements.

Companies that use Odoo’s integrated strategy may focus on growth rather than managing onerous financial regulations.