To calculate the life and depreciation of an asset, you must first be classified. This technique is referred to as asset management. The Odoo Accounting module streamlines asset management for long-term business assets.

The Odoo Asset Management module allows you to define asset categories, create asset models, and calculate depreciation. This feature generates an accounting item for the relevant amortization at the end of a fiscal year.

Managing business assets and tracking depreciation is important for maintaining accurate financial records.

In this blog, we’ll look at the comprehensive features of Odoo 17 Accounting, which will help you manage assets easily while assuring exact depreciation estimates.

Steps to Manage Assets & Automate Depreciation in Odoo 17 Accounting

Setting Up Assets in Odoo 17

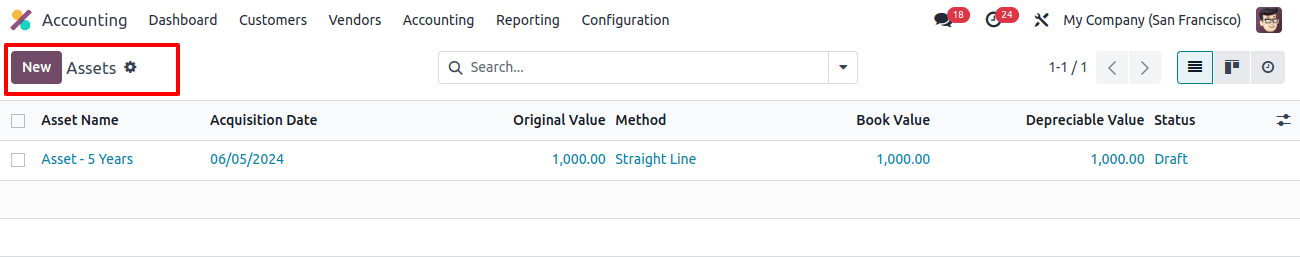

Users may easily build and manage their business assets with the Odoo 17 Accounting module. Start by selecting the Assets option from the ‘Accounting’ menu.

When you open the dashboard, you will see a list of existing asset records with their respective Asset Names, Acquisition Date, Original Value, Method, Book Value, Depreciation Value, and Status, as shown below.

You can register and categorize various assets possessed by your company by completing a new asset register form.

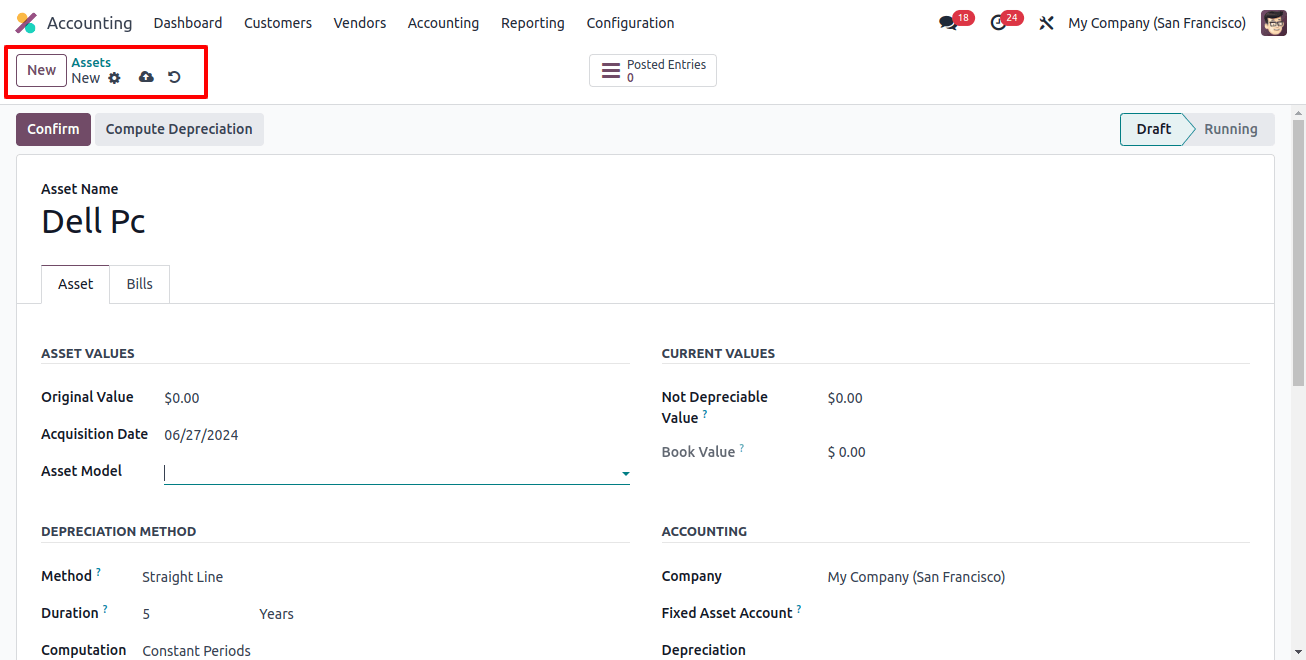

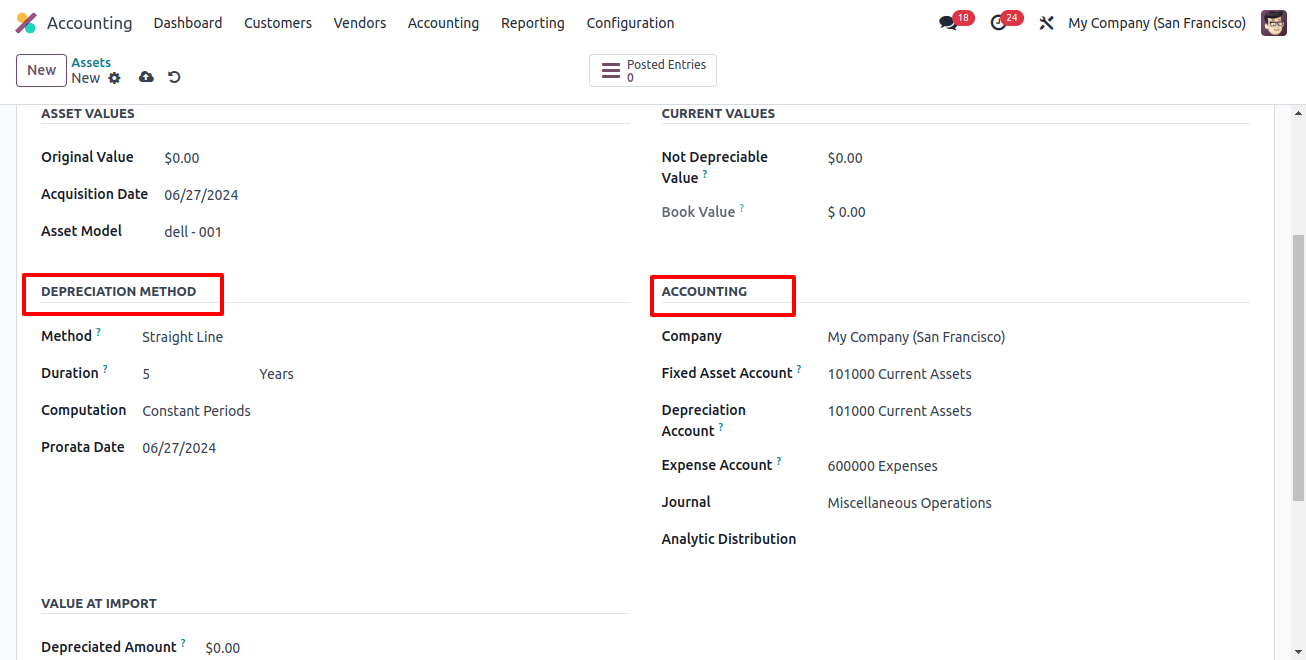

Fill out the form fields with important information, such as the asset name. The ‘Asset’ tab allows you to configure asset values, depreciation methods, current values, accounting, and other options.

In the ‘Asset Values’ field, enter the product’s original value, acquisition date, and asset model.

The Not Depreciable Value and Book Value of the asset can be under the ‘Current Values’ field.

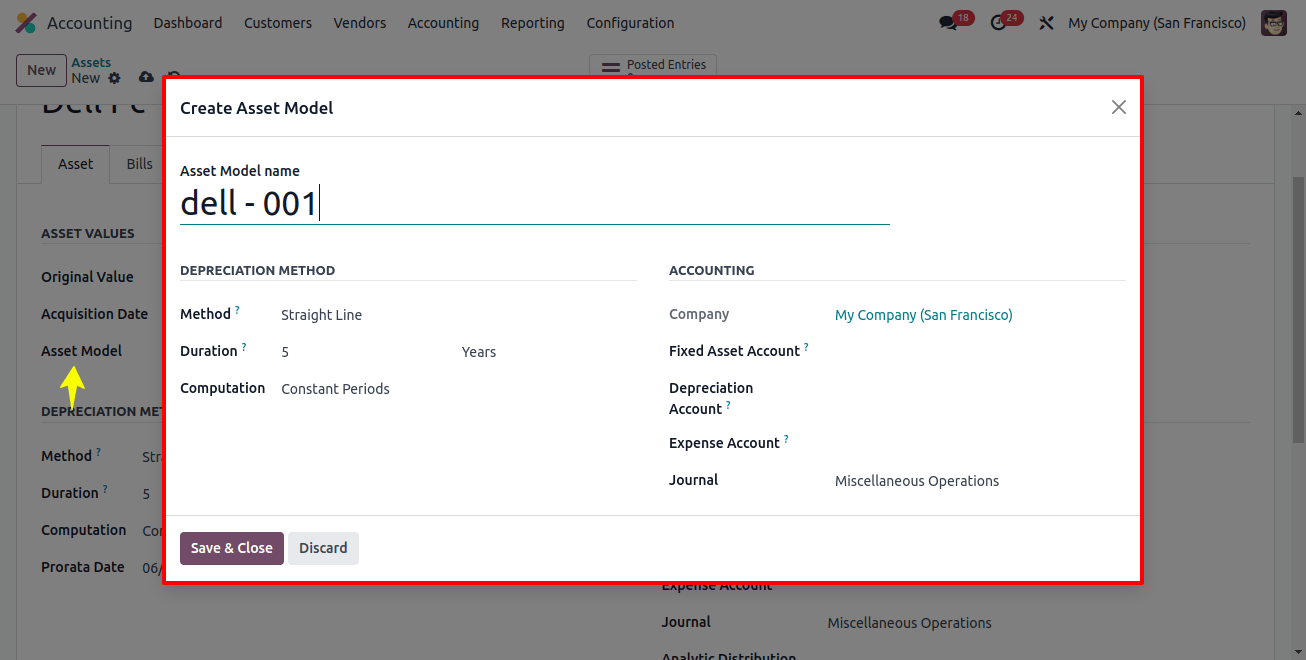

Setting Asset Model

The ‘Asset Model’ field in the asset setup form allows you to set or save multiple product model details. If model data is available, you may choose an existing model from the dropdown menu or build a new one. This field will launch another pop-up notification, where you can enter the important new product information, as seen below.

In the form view, the ‘company’ field automatically fills with the business name. It is important to select a ‘Method’ for determining the depreciation lines, and the ‘Duration’ field indicates the depreciation required for an asset.

The ‘Computation’ technique is used for No Prorata, Constant periods, and based on days per period.

The fixed asset account details the asset’s acquisition and initial cost, whereas the ‘Depreciation account’ reduces its worth.

A portion of the asset is recorded as a cost in the previously specified ‘cost account.’ Finally, include the accounting entry journal in the ‘journal’ field. Odoo 17 allows you to categorize assets for more efficient management.

Depreciation Methods

Odoo 17 allows you to select Depreciation Methods consistent with your business's accounting standards.

Choose the strategy that best meets your demands, whether straight-line or diminishing balance. To customize depreciation estimates, set factors such as the number of periods and the residual value.

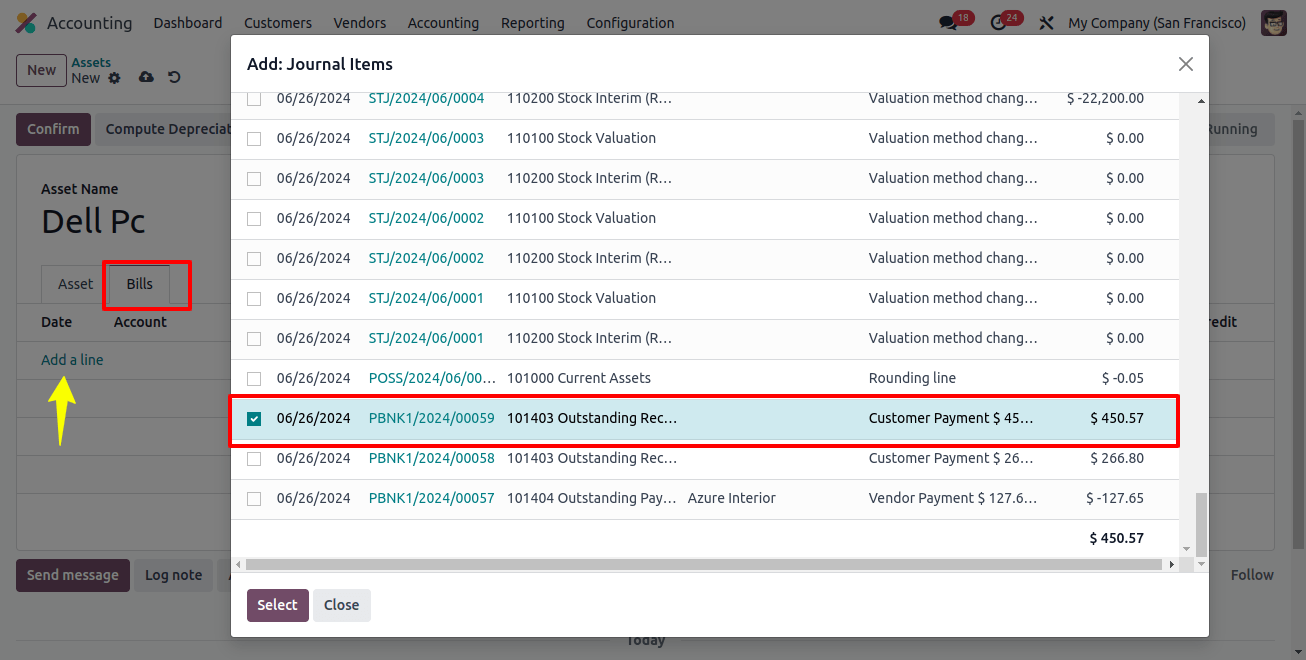

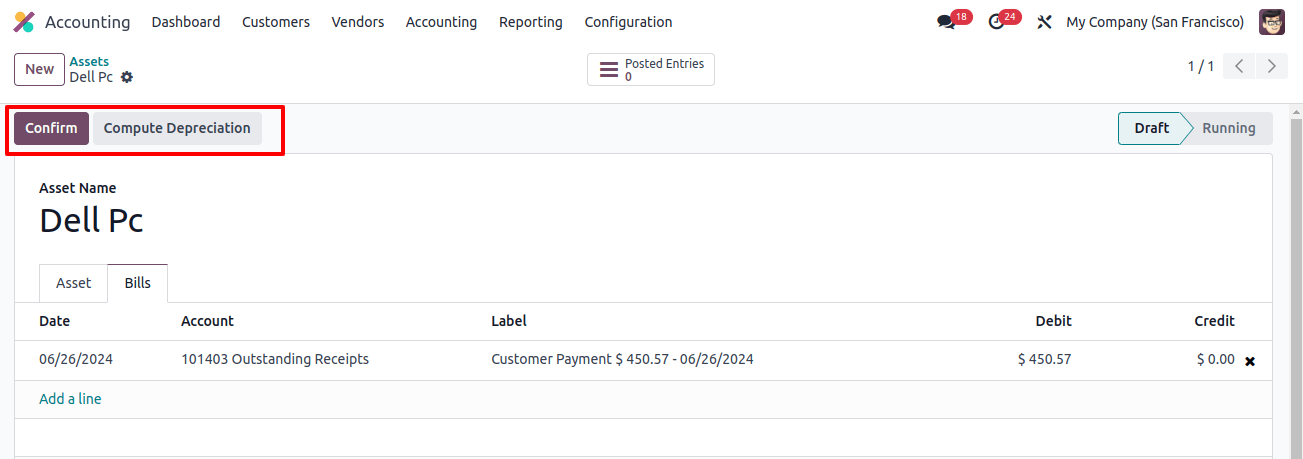

Bills Tab

We can add the asset’s bill details to the ‘Bills’ tab field, including the data, account, label, debit, and credit. Click the ‘enter a line’ button to enter bill details from the journal items dashboard, as shown below.

Choose the journal products and then click the ‘Select button. Then return to the asset configuration form.

Automating Depreciation Entries

Odoo 17 streamlines the depreciation process by automating journal entries. Once you’ve set up asset data and depreciation methods, the system will generate entries automatically.

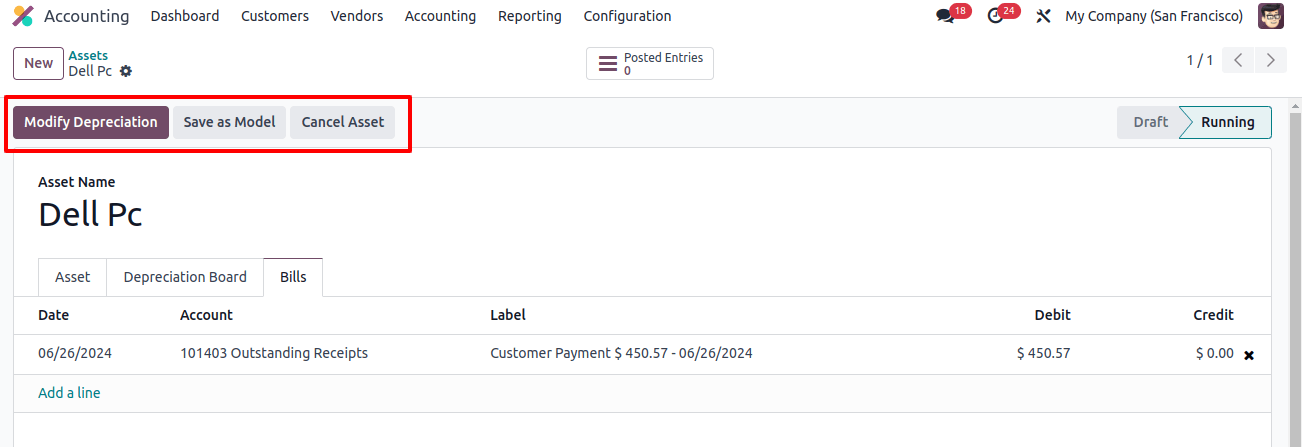

This decreases the possibility of errors related to human data entering, also saving time. After selecting the journal bills, you will see the ‘Modify Depreciation’ button, as seen below.

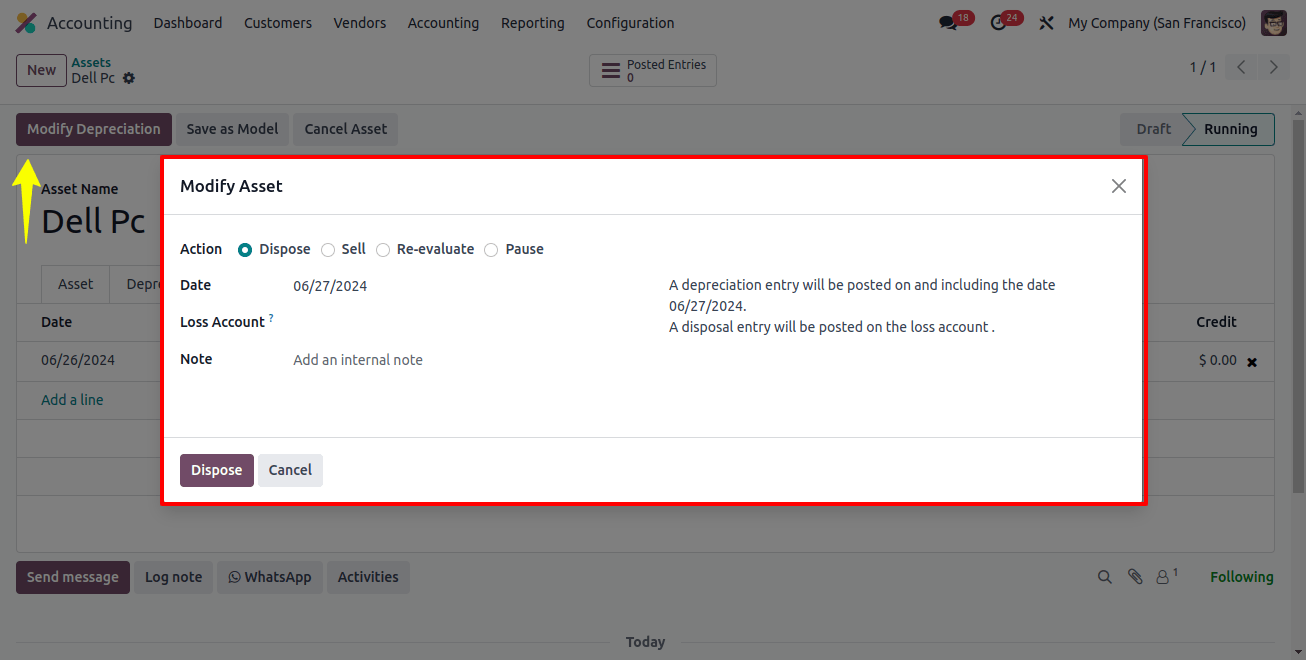

When you select the ‘modify depreciation option’, another pop-up window will appear in which you can specify the depreciation. To dispose of an asset, select the dispose action, input the date in the required field, and enter the account details for loss journal items in the Loss Account field.

Internal notes for adjusted depreciation are included in the required field. When the Pause option is selected, depreciation is suspended, and the depreciation board tab displays the changes.

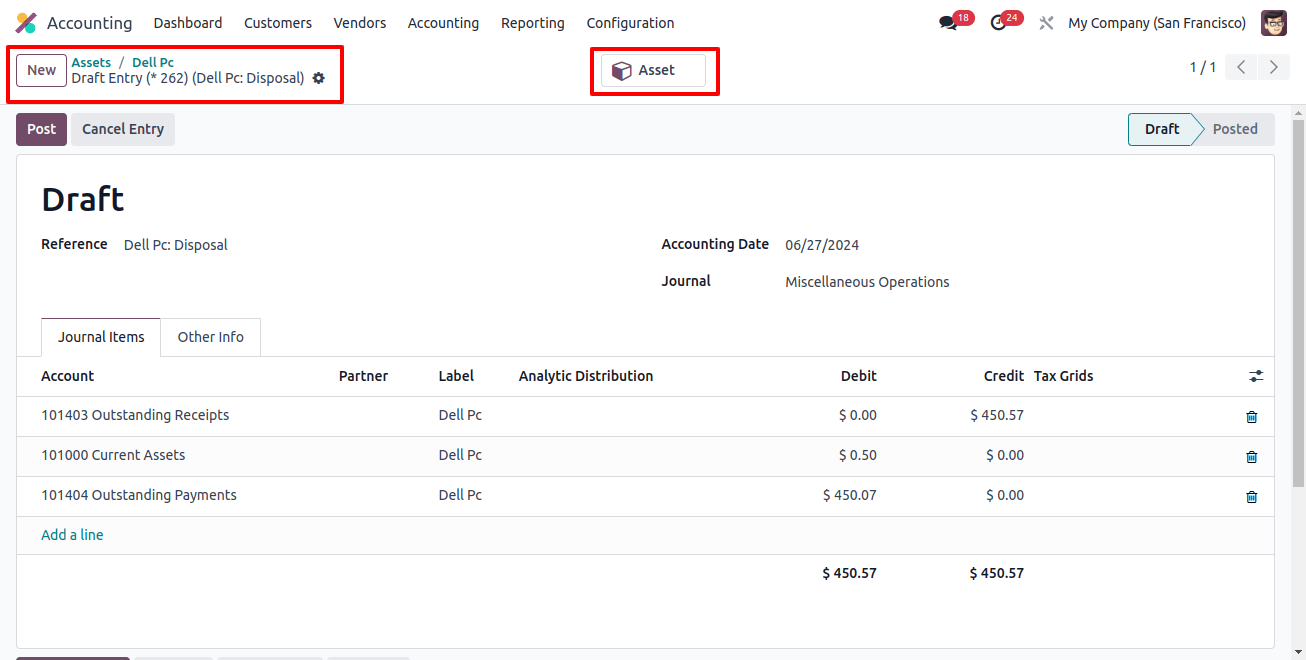

When disposing of an asset, Odoo 17 streamlines the procedure. Simply designate the asset as ‘Dispose,’ and the system will generate the right accounting entries to reflect the disposal. This ensures accurate financial reporting and conformance to accounting rules.

After disposing of the assets, you will receive an ‘Asset’ smart button that you may use to view the asset data.

Odoo 17 has amazing reporting options for tracking a business’s asset portfolio, including detailed information on asset depreciation, disposal, and current valuations.

The assets module easily interacts with accounting and inventory because of its integrated approach, which allows for smooth module collaboration and ensures a right view of a business’s financial condition.

Odoo 17 Accounting streamlines asset management and depreciation, increasing accuracy and financial efficiency for businesses.