The Intrastat system is used to collect data on items traded between EU member states. This statistics tool’s objective is to track and collect data on goods trade between EU member states.

The system collects data on what is known as external—trade with third-world countries outside of the EU. Intrastat, which generates trade data, focuses on internal trade among EU countries.

All member states must follow the very secret data collection approach. The collected data is used for statistical research and accounting, as well as for researchers, decision-makers, and planners in the public and private sectors.

Intrastat is an important component that allows and guarantees the smooth movement of goods inside the European Union.

Features & Benefits of Odoo Intrastat

Intrastat Data Entry and Recording: User input for intra-community trading transactions.

Data Validation: Validation ensures data conformity with Intrastat regulations.

Automatic Generation: Odoo automated Intrastat reporting to reduce errors and save time.

Classification Codes: The Odoo 17 Accounting module has a robust product classification system that allows you to easily give particular classification codes.

Submission to Authorities: Once generated, data can be electronically sent to authorities to ensure legal compliance.

Reporting and Analytics: Businesses can provide detailed reports and analytics to help them make informed decisions.

Advantages of Intrastat Utilization in Odoo

Compliance: Reduces the possibility of fines or other penalties for noncompliance.

Efficiency: Reduces the need for manual data entry, which saves time and money.

Data Accuracy: Built-in validation tests guarantee data accuracy.

Analytics: Provides significant insights on trade activities, allowing for better decision-making.

Configuring Intrastat in the Accounting Platform

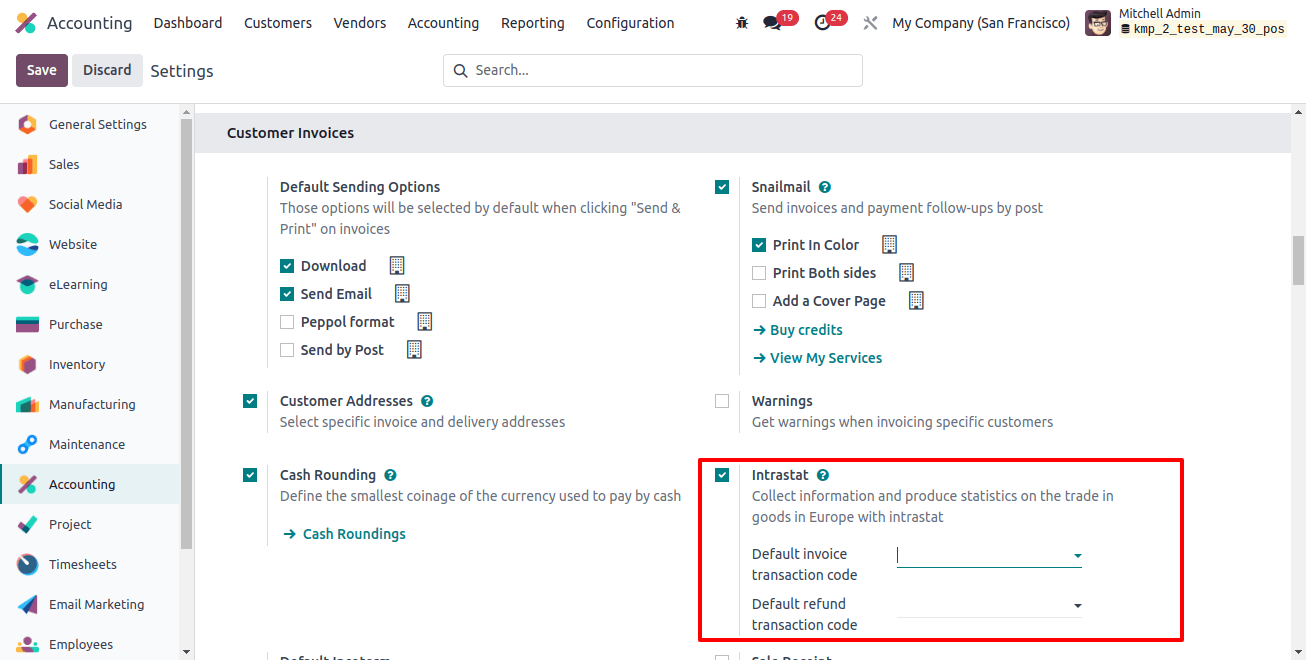

The Intrastat reporting option can be activated using the Accounting module’s ‘Settings’ list. There is a setting under the ‘customer invoices’ page to allow ‘Intrastat.’

You will notice particular areas where you can enter a ‘Default invoice transaction code’ for each created invoice and a ‘Default refund transaction code.’ When you do this, the code is immediately applied to all matching invoice lines in your database.

After enabling the option, save your modifications by clicking the ‘save’ button, and then proceed to the remaining features.

By filling in this column, you may automatically set the default transaction code for all connected invoice lines in your database for invoice and refund transactions. For Belgian enterprises, a field called ‘Region Code’ will appear.

The correct product configuration is critical for Intrastat reports. You can enter a default transaction code in this field, which will be applied automatically to all matching invoice lines in your database for invoice and refund transactions. For Belgian enterprises, a "Region Code" field will show. Intrastat reports are dependent on an accurate product configuration.

The commodity code is a standard numerical code used in customs and international trade that must be mentioned. These codes help identify and classify objects based on their features, materials, and intended function.

They are important for determining import and export duties, processing customs declarations, and providing cross-border goods movements. Intrastat uses the combined nomenclature to classify commodities as per EU internal trade statistics requirements.

When creating product data in the Accounting Module, you can specify the Intrastat specifications for each product.

Intrastat Settings in a Product Configuration form

To set the commodity code for a product, go to the ‘products’ dashboard and open or create a product configuration. The intrastate parameters can be viewed on the ‘Accounting’ page of the product setup under the ‘intrastate’ section, as shown below.

In the ‘commodity code’ field, select a commodity code from the dropdown menu. Depending on the nature of the items, you may also enter the product’s weight or an additional unit in the ‘supplementary units’ section.

You can indicate the country of origin of the goods in the ‘country of origins’ field. Then you can enter more product information and save the data. Then we can generate an invoice to verify the feature.

Creating Invoice

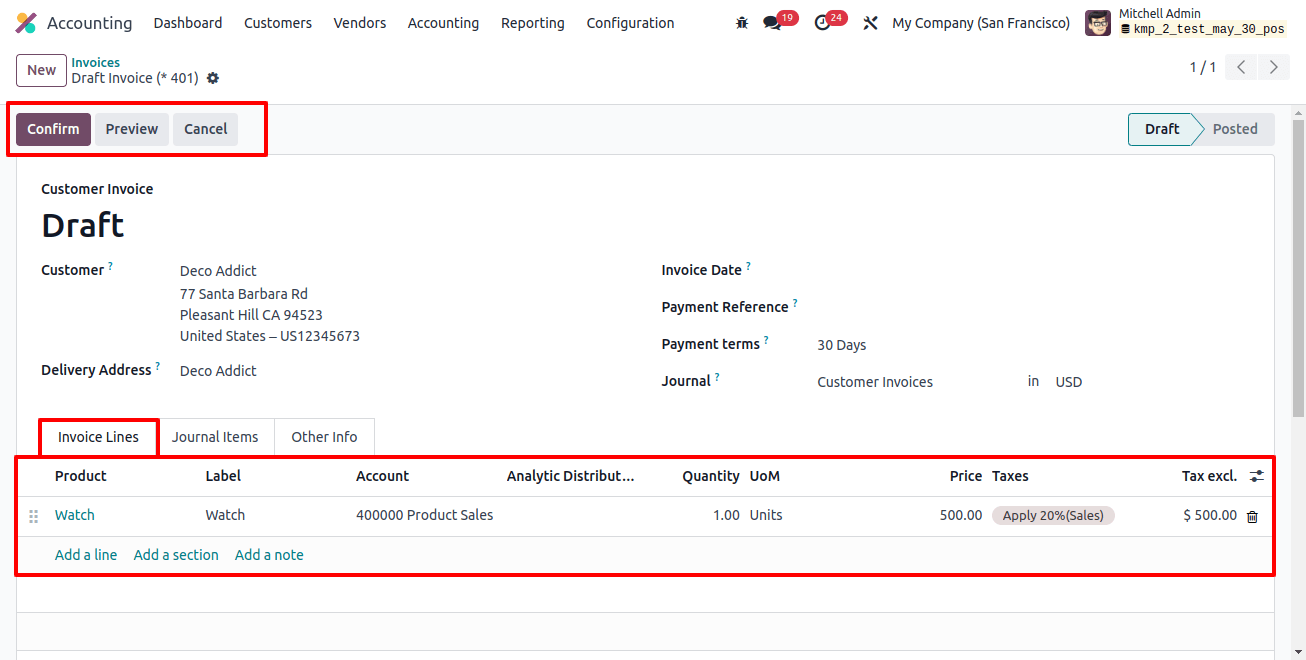

To create an invoice using the previous product, go to the ‘invoices’ section in the Accounting module’s ‘customers’ menu.

Fill up the configuration form with the necessary invoice information, such as the customer’s name, delivery address, payment reference, due date, journal, etc. Then, as shown below, add the product to the ‘invoice lines’ tab while also filling out the other tab sections.

When the product configuration is complete, you will need to make a few changes to the bills and invoices you create. Setting default transaction codes is something we’ve already discussed.

In Odoo, these codes are used to identify the type of transaction. An invoice line might also include a transaction code.

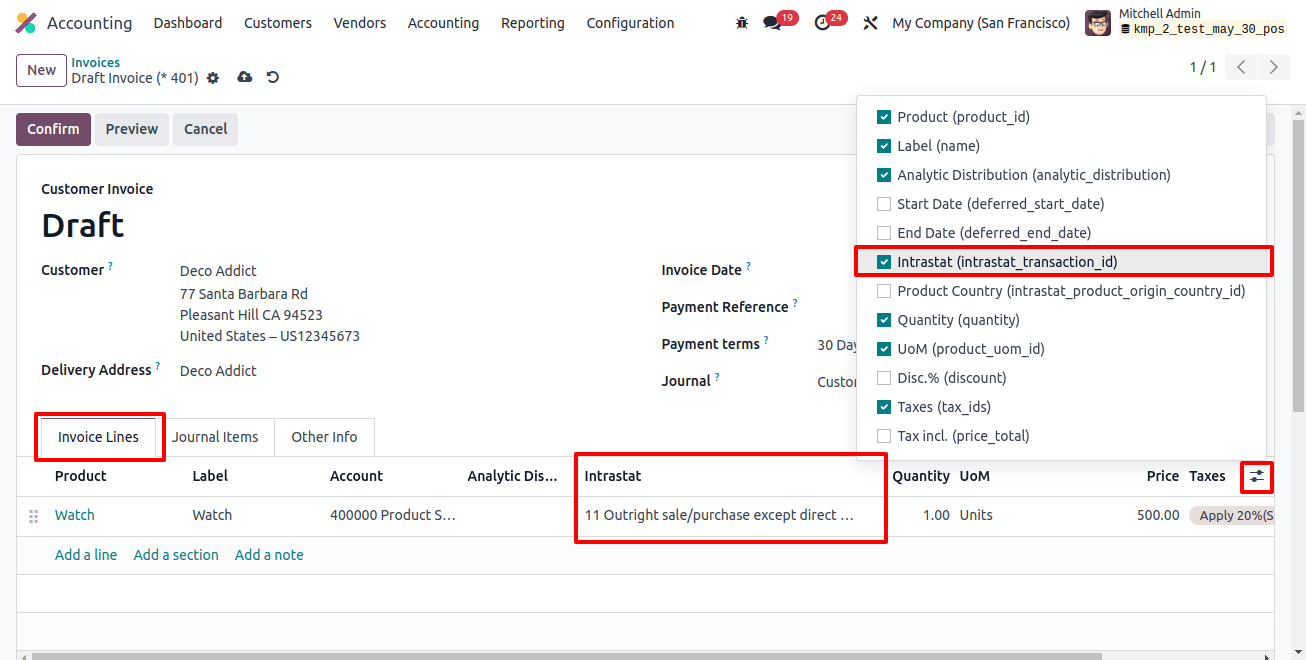

To select an invoice, use the toggle list menu at the bottom of the ‘invoice lines’ section. As shown below, the invoice pane displays a list of invoices stored in your Odoo accounting database.

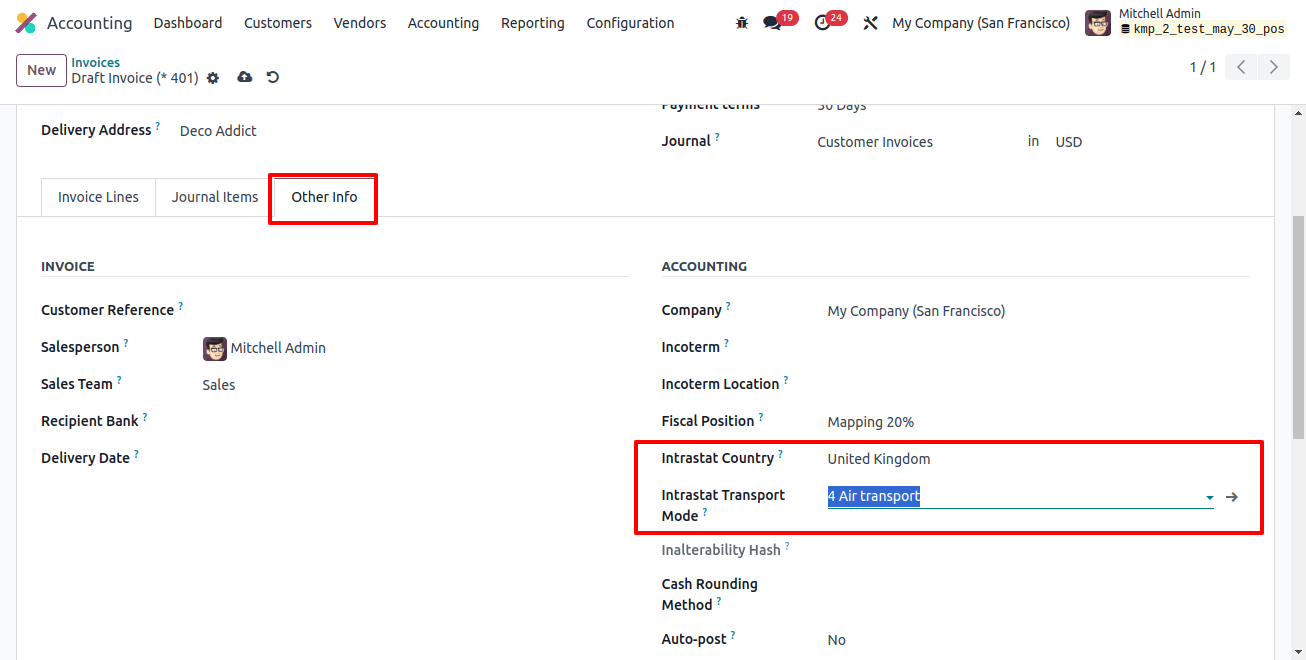

By enabling the ‘Intrastat’ feature in the invoice line, you can select a transaction code and partner nation from the other information tab’s intrastate country field.

This field also contains the Intrastat conveyance mode, which specifies the preferred mode of conveyance for transferring products.

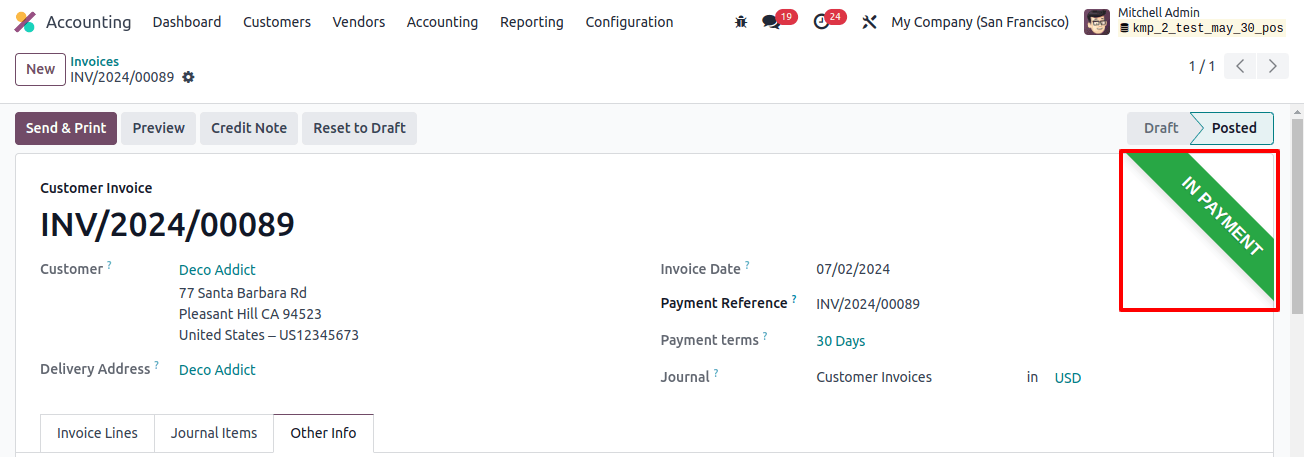

Then, using the save icon, you can store the invoice data and proceed with the bill invoicing by clicking the ‘confirm button.’

I’ve confirmed the bill invoicing and registered the bill payment. The above image shows the ‘in payment’ ribbon inside the form view. Then, go to the Accounting ‘Reporting’ menu and select the ‘Intrastat Reports’ window.

Intrastat Reporting

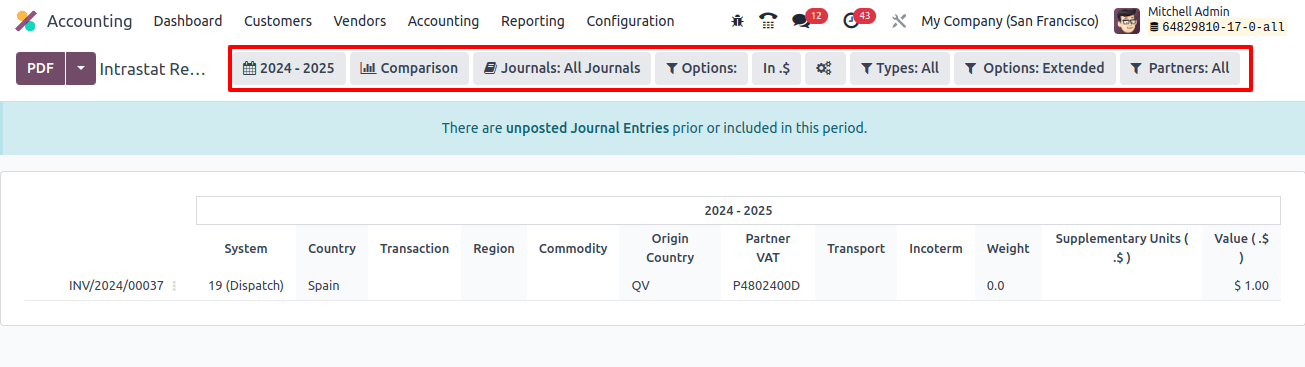

To create an Intrastat report, navigate to the Audit Reports area of the Accounting module's Reporting menu and select the 'Intrastat' page.

The report includes product, invoice/bill, and partner information, as well as reference numbers, system, nation, transaction codes, region codes, commodity codes, origin country, partner VAT, transportation codes, Incoterm codes, weight, additional units, and value information.

Intrastat Codes

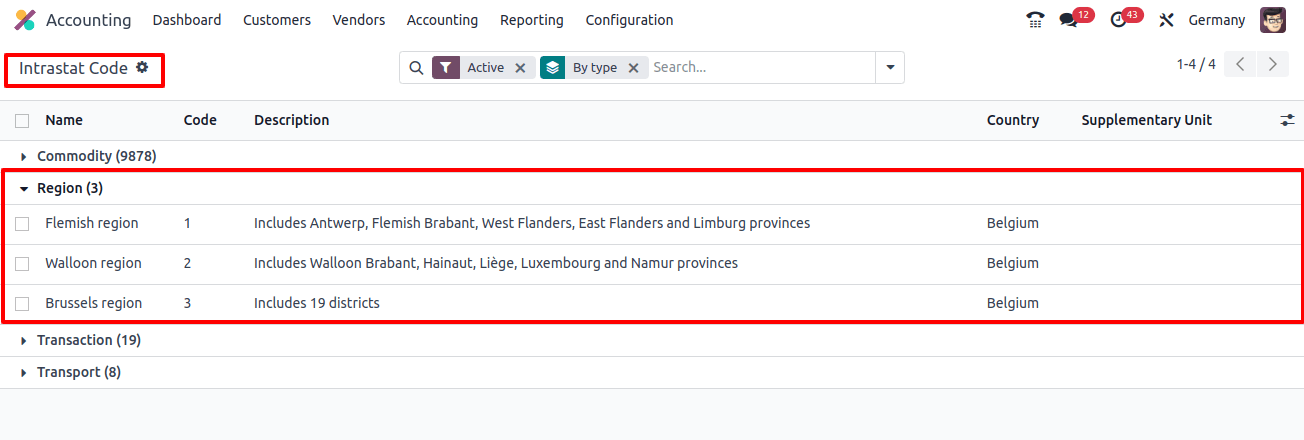

The Accounting module’s configuration menu has the Intrastat code option, which records goods traded between EU member nations, including name, code, description, country, and supplementary unit.

This Odoo 17 feature allows intra-community trade reporting across the EU by providing a user-friendly solution for data entry, validation, automation, and reporting. This enables businesses to efficiently manage Intrastat responsibilities while focusing on core EU market operations.